Shareholders Should Be Pleased With Cronos Group Inc.'s (TSE:CRON) Price

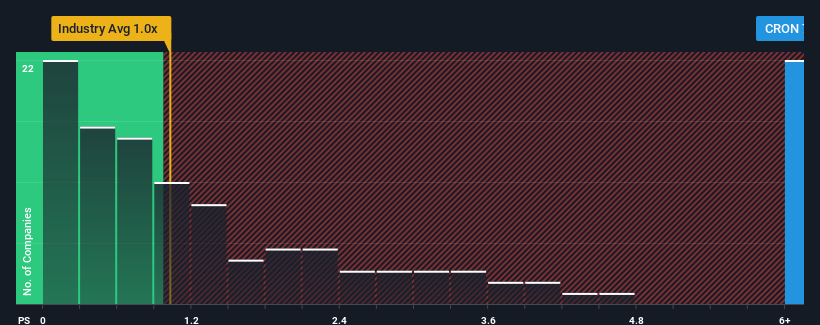

When you see that almost half of the companies in the Pharmaceuticals industry in Canada have price-to-sales ratios (or "P/S") below 1x, Cronos Group Inc. (TSE:CRON) looks to be giving off strong sell signals with its 7.7x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Cronos Group

How Has Cronos Group Performed Recently?

With revenue growth that's inferior to most other companies of late, Cronos Group has been relatively sluggish. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. However, if this isn't the case, investors might get caught out paying to much for the stock.

Keen to find out how analysts think Cronos Group's future stacks up against the industry? In that case, our free report is a great place to start.

How Is Cronos Group's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Cronos Group's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 23% last year. Pleasingly, revenue has also lifted 287% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the ten analysts covering the company suggest revenue should grow by 19% per year over the next three years. With the industry only predicted to deliver 16% per year, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Cronos Group's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Cronos Group's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Cronos Group with six simple checks on some of these key factors.

If you're unsure about the strength of Cronos Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance