Shareholders in Lion Electric (TSE:LEV) are in the red if they invested a year ago

The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But it should be a priority to avoid stomach churning catastrophes, wherever possible. We wouldn't blame The Lion Electric Company (TSE:LEV) shareholders if they were still in shock after the stock dropped like a lead balloon, down 78% in just one year. A loss like this is a stark reminder that portfolio diversification is important. Because Lion Electric hasn't been listed for many years, the market is still learning about how the business performs. Furthermore, it's down 31% in about a quarter. That's not much fun for holders.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

See our latest analysis for Lion Electric

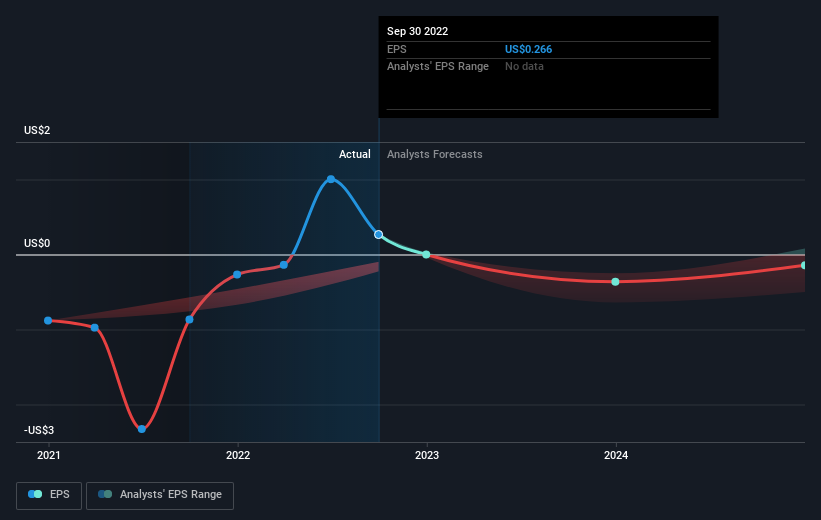

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the last year Lion Electric grew its earnings per share, moving from a loss to a profit.

We're surprised that the share price is lower given that improvement. If the improved profitability is a sign of things to come, then right now may prove the perfect time to pop this stock on your watchlist.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. This free interactive report on Lion Electric's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

We doubt Lion Electric shareholders are happy with the loss of 78% over twelve months. That falls short of the market, which lost 3.0%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 31% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand Lion Electric better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Lion Electric (of which 1 shouldn't be ignored!) you should know about.

Lion Electric is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance