Shareholders in Danimer Scientific (NYSE:DNMR) are in the red if they invested a year ago

It's not a secret that every investor will make bad investments, from time to time. But it's not unreasonable to try to avoid truly shocking capital losses. We wouldn't blame Danimer Scientific, Inc. (NYSE:DNMR) shareholders if they were still in shock after the stock dropped like a lead balloon, down 83% in just one year. That'd be a striking reminder about the importance of diversification. Danimer Scientific hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Furthermore, it's down 14% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 7.7% decline in the broader market, throughout the period. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for Danimer Scientific

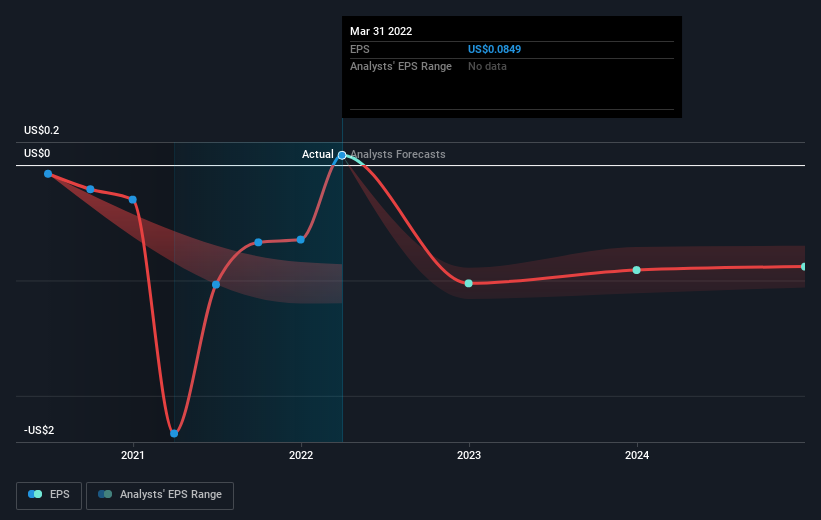

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Danimer Scientific managed to increase earnings per share from a loss to a profit, over the last 12 months.

The result looks like a strong improvement to us, so we're surprised the market has sold down the shares. If the company can sustain the earnings growth, this might be an inflection point for the business, which would make right now a really interesting time to study it more closely.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. It might be well worthwhile taking a look at our free report on Danimer Scientific's earnings, revenue and cash flow.

A Different Perspective

Danimer Scientific shareholders are down 83% for the year, even worse than the market loss of 12%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. With the stock down 14% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 3 warning signs we've spotted with Danimer Scientific (including 1 which can't be ignored) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance