Shaky end to IPO performance in 2018 may delay Uber, Lyft IPOs

After a strong showing for most of 2018, companies issuing shares through initial public offerings are limping across the finish line.

From the beginning of the year through the first week of December, companies completing IPOs have seen shares pop 13% on average from its IPO price to opening trade on public markets, according to Dealogic. But companies listing since November 1 have only seen a 0.2% pop — which marks the weakest market reception of IPOs since November 2016, when new offerings were met with an average decline of 2%.

But that apparent waning of demand for private companies taking the plunge recently doesn’t necessarily mean other companies will be thinking twice about going public in 2019, according to David Ethridge, U.S. IPO services leader at PwC.

“I don’t think it’s going to substantially impact the decision of companies that have come to the point to say this makes sense for us to diversify our capital structure that are seeking liquidity to change their mind,” he said. “I think the ones that have come have carefully chosen to move forward in the evolution of those companies’ business models and I don’t think a little volatility is going to take them off that path.”

Of the more notable companies to already signal for 2019 IPOs are ridesharing giants Uber and Lyft, which both filed initial paperwork with the Securities and Exchange Commission last week to set up IPOs that could come as early as the first quarter of 2019. But if market jitters, which caused the S&P 500 to shed nearly 10% over the past two months, spill over into next year, it’s plausible Uber or Lyft could delay their offerings until the second quarter.

“A Wall Street aphorism which I adore which is, ‘Don’t catch a falling knife,’” Duncan Davidson, co-founder and general partner at venture firm Bullpen Capital, told Yahoo Finance. “It would be a smart move to delay. You don’t want to sell into a volatile market.”

Tencent Music, which raised nearly $1.1 billion in its IPO, priced shares at the bottom of its range at $13 a share. When Tencent Music debuted Wednesday morning, it bucked the trend, its shares popped about 10% and opened for trading at $14.10 on the New York Stock Exchange. Tencent-backed Chinese fashion app Mogu also priced shares at the low end of its range last week at $14 a share, only to see shares open 14% lower in their trading debut at $12 a share. Mogu has since rebounded, however, trading above $14 a share.

Racing to an IPO

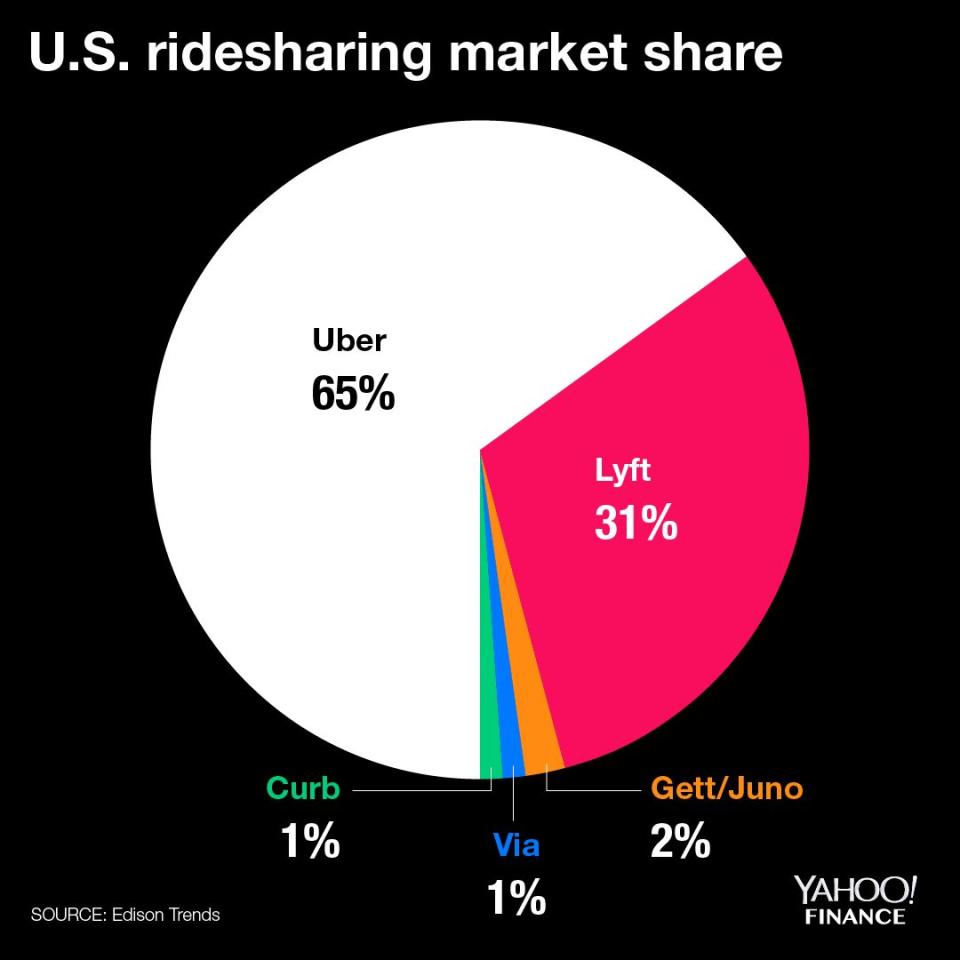

However, considering the SEC filings from the two ridesharing companies came so close in time to each other, it does raise the question if each is feeling pressure to reach the public market first, despite concerns about launching in a volatile market. For Lyft, which last raised money at a $15 billion valuation, the threat of following in the shadows of a much larger Uber IPO might be too much of a risk.

“Lyft really needs to go out ahead of Uber because I think Lyft will price up and Uber will price down,” Davidson said, hypothesizing that preferred shares in Uber’s cap table might likely result in its public valuation taking more of a hit relative to its private valuation than Lyft might see. Following in that might mean less enthusiasm for Lyft.

That said, Uber might not want to see Lyft upstage it in the public market, especially if investors don’t seem willing to wait for a second ridesharing investment opportunity.

However, both companies at least enjoy a higher level of notoriety being high-profile, consumer-facing companies that investors are familiar with. That fact certainly helps compared to smaller, lesser-known companies that might be more threatened by continued volatility in 2019.

“For those names, I think we might have some 2019 expected IPOs push back into 2020,” said Davidson.

Zack Guzman is a senior writer and on-air reporter covering entrepreneurship, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read more:

Where SoftBank’s Vision Fund is deploying its $100 billion

Why 2019's IPO outlook is bleaker than it should be

Juul surpasses Facebook as fastest startup to reach decacorn status

Yahoo Finance

Yahoo Finance