Severe housing downturn in Canada is unlikely: RBC

Canada’s biggest bank says a widespread real estate downturn is unlikely.

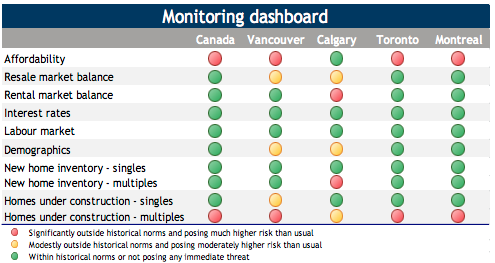

In its latest Canada Housing Health Check — Royal Bank says the probability is “still low but has increased somewhat in recent months.” RBC says mortgage stress tests and rising rates are making it harder for buyers to get a foot in the door.

RBC says higher interest rates put high-priced areas like Vancouver and Toronto at risk. Homeowners in Alberta could also be in trouble because of high household debt. The bank sees mortgage stress tests as a short-term headwind.

“Longer term, the tightening of mortgage and housing policy rules will reduce risks,” says RBC.

Affordability is a major concern in Toronto and Vancouver. RBC says Vancouver’s affordability is at a crisis level. Earlier this week Vancouver was ranked the second most unaffordable city behind only Hong Kong. The situation in Toronto isn’t quite as dire.

“Regulatory changes made the market healthier— it is now balanced, well supported by

economic and demographic fundamentals, and while condo building activity is elevated we see few signs of overbuilding,” says RBC.

Falling oil prices and pipeline politics are creating uncertainty in Calgary. RBC says demand is soft and prices are expected to trend lower in the near-term. There are also too many condos compared to its slow population growth.

RBC expects Montreal’s real estate market to do well.

“This remains one of Canada’s stronger markets at present with a generally positive risk/vulnerability profile,” says RBC.

“Buyer interest has been quite resilient in the face of the stress test and rising interest rates.”

Elevated levels of apartment construction in Montreal, Vancouver, and Toronto is a potential long-term concern, but RBC notes unsold inventories are low.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance