Sentiment Still Eluding Bombardier Inc. (TSE:BBD.B)

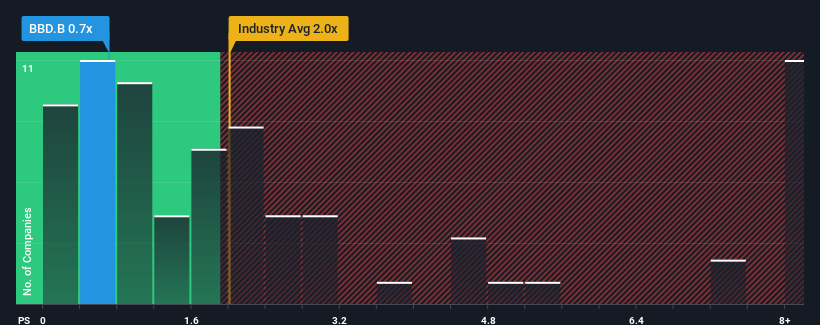

You may think that with a price-to-sales (or "P/S") ratio of 0.7x Bombardier Inc. (TSE:BBD.B) is a stock worth checking out, seeing as almost half of all the Aerospace & Defense companies in Canada have P/S ratios greater than 2.6x and even P/S higher than 12x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Bombardier

What Does Bombardier's Recent Performance Look Like?

Bombardier could be doing better as it's been growing revenue less than most other companies lately. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Bombardier will help you uncover what's on the horizon.

Is There Any Revenue Growth Forecasted For Bombardier?

The only time you'd be truly comfortable seeing a P/S as low as Bombardier's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 14%. Still, lamentably revenue has fallen 7.7% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 8.6% per annum as estimated by the twelve analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 9.0% per year, which is not materially different.

With this information, we find it odd that Bombardier is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that Bombardier currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about these 2 warning signs we've spotted with Bombardier (including 1 which is significant).

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here

Yahoo Finance

Yahoo Finance