ON Semiconductor's (ON) IGBT Devices Adopted by Danfoss

ON Semiconductor Corporation ON recently announced that the company’s high-power insulated-gate bipolar transistors (IGBTs) and diodes have been selected by Danfoss to power their inverter traction modules for the electric vehicles market.

Denmark-based Danfoss manufactures customized power modules for automotive, industrial and renewable applications. ON Semiconductor’s IGBT chips will aid Danfoss meet the growing demand for high-performance power modules needed by electric vehicles.

ON Semiconductor will manufacture the high power components in New York, East Fishkill and Bucheon, while the power modules will be developed Danfoss in Flensburg and Utica.

The Danfoss deal is a major win for ON Semiconductor as it is likely to help the company strengthen its foothold in the highly lucrative vehicle electrifications market. This, in turn, will drive the company’s top-line growth in the days ahead.

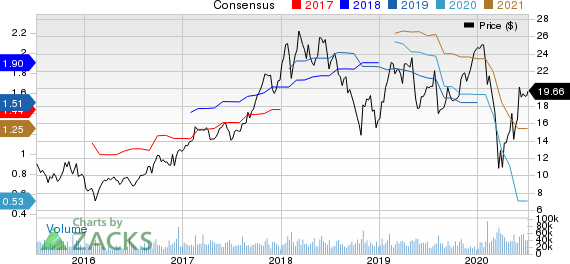

ON Semiconductor Corporation Price and Consensus

ON Semiconductor Corporation price-consensus-chart | ON Semiconductor Corporation Quote

Electric Vehicles Space Holds Growth Prospects

Rising awareness about greenhouse gases and their effect on global climate is driving people to move away from traditional automotive solutions. As a result, electric vehicles have witnessed solid traction in recent times.

Elon Musk’s Tesla TSLA witnessed its highest ever revenue in first-quarter 2020, as the company’s automotive revenues increased 38% year over year to $5.1 billion, driven by the strong performance of electric vehicles. Moreover, global electric vehicle sales amounted to around 576K units in the first-quarter, despite COVID-19 induced headwinds.

Electric vehicles are expected to witness continued popularity due to increasing fossil fuel prices and declining costs as more number of automobile manufacturers start investing in the space. Per Market Watch data, the global electric vehicle market is expected to witness a CAGR of 18.4% between 2020 and 2025.

With strong growth prospects in the electric vehicles space, ON Semiconductor’s robust capabilities in areas like smart power management, high-voltage interfacing, in-vehicle networking, sensor interfaces and system level integration are likely to boost adoption of the company’s automotive high-power components.

Moreover, the company’s 12 inch Fab in East Fishkill has well positioned it to address the rapidly growing demand for high-power devices in the vehicle electrification market over the long haul.

Wrapping Up

Nevertheless, increased expenditure on product development amid intense competition from Infineon Technologies, Microsemi and STMicroelectronics in the semiconductor solutions space is likely to exert pressure on the company’s margins.

Additionally, the company’s broader markets have been witnessing weaker demand trends. Further, supply chain disruptions and fall in demand due to COVID-19 induced lockdowns is expected to dampen revenues in the near term.

Zacks Rank & Key Picks

Currently, ON Semiconductor carries a Zacks Rank #3 (Hold).

Silicon Motion Technology Corporation SIMO and Nice Ltd. NICE are some better-ranked stocks worth considering in the broader computer and technology sector, both flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth rate for Silicon Motion and Nice is pegged at 7% and 10%, respectively.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This young company’s gigantic growth was hidden by low-volume trading, then cut short by the coronavirus. But its digital products stand out in a region where the internet economy has tripled since 2015 and looks to triple again by 2025.

Its stock price is already starting to resume its upward arc. The sky’s the limit! And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

Silicon Motion Technology Corporation (SIMO) : Free Stock Analysis Report

ON Semiconductor Corporation (ON) : Free Stock Analysis Report

Nice Ltd. (NICE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance