ON Semiconductor Closes Buyout of Quantenna in All Cash Deal

ON Semiconductor Corporation ON has completed the acquisition of Quantenna Communications, Inc. The deal was announced on Mar 27, 2019, for a cash consideration of $24.50 per share. The transaction is anticipated to strengthen the acquirer’s connectivity portfolio.

Post-acquisition, Quantenna will be incorporated into ON Semiconductor’s Analog Solutions Group and will be led by Vince Hopkin. We believe the buyout will be accretive to the company and will add to its growth.

Details of Acquisition

The company expects the acquisition to be accretive to non-GAAP earnings, free cash flow, book value per share and amortization of acquired intangibles.

From the standpoint of Keith Jackson, president and CEO of ON Semiconductor, the buyout is expected to add substantial value to the company’s operations and build a platform for low-power connectivity in industrial and automotive applications. With Quantenna’s Wi-Fi technologies and software expertise, ON Semiconductor will strengthen its foothold further in industrial and automotive markets.

From Quantenna’s point of view, “As part of ON Semiconductor, Quantenna will benefit from a world-class organization in our commitment to providing the best end user experience for our customers.”

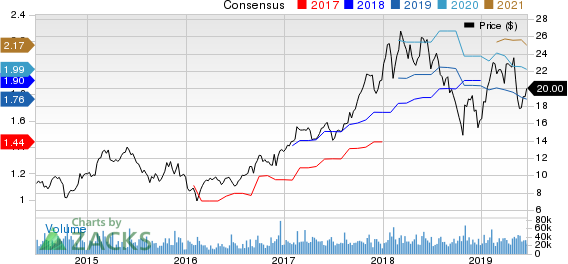

ON Semiconductor Corporation Price and Consensus

ON Semiconductor Corporation price-consensus-chart | ON Semiconductor Corporation Quote

Acquisitions: A Key Catalyst

ON Semiconductor has always been active on the acquisition front. In the recent past, the company acquired Cypress Semiconductor’s CMOS Image Sensor Business Unit, SANYO Semiconductor, AMI Semiconductor, Analog Devices’ power PC controller business, CMD, Catalyst and SoundDesign.

Further, the company’s acquisition of Fairchild Semiconductor International makes it a leader in the power semiconductor space. The deal will help the company diversify across many markets, with a planned focus on smartphone, automotive and industrial end markets.

Balance Sheet Details

As on Mar 29, 2019, ON Semiconductor had cash and cash equivalents of approximately $939.6 million, down from $1.070 billion reported in the previous quarter.

During the last reported quarter, cash from operations came in at $138.2 million compared with the previous quarter’s figure of $421 million.

To Conclude

During the last reported quarter, the automotive (34% of revenues) end-market revenues were approximately $465 million, up 4% year over year.

Further, the company is focused on investing in growth areas such as ADAS and wireless charging in the automotive business to broaden exposure. This will further enhance performance and help the company deliver strong results.

The product launches in the automotive end market for next generation automobile designs along with the existing product portfolio will increase revenues for the business quarter over quarter.

Zacks Rank and Stocks to Consider

Currently, ON Semiconductor carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector are Match Group, Inc. MTCH, Silicon Motion Technology Corporation SIMO and Autohome Inc. ATHM, all flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Match Group, Silicon Motion and Autohome have a long-term earnings growth rate of 15.2%, 5% and 20.9%, respectively.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Match Group, Inc. (MTCH) : Free Stock Analysis Report

Autohome Inc. (ATHM) : Free Stock Analysis Report

Silicon Motion Technology Corporation (SIMO) : Free Stock Analysis Report

ON Semiconductor Corporation (ON) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance