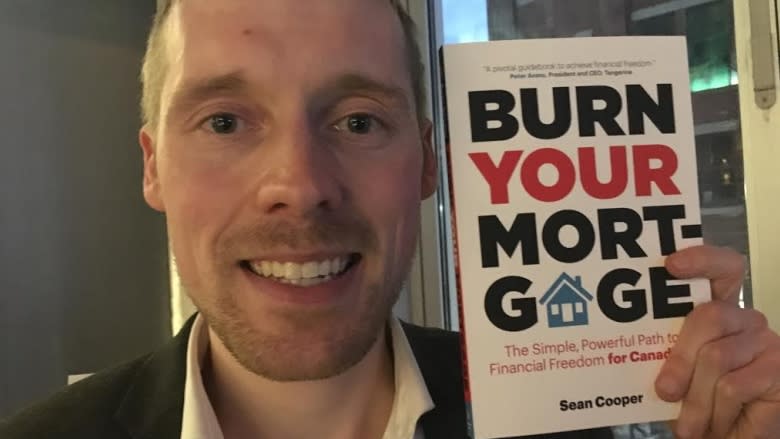

Sean Cooper wiped out his mortgage in 3 years — and now he offers advice in new book

In 2015, Sean Cooper did what many of us can only dream: he wiped out his mortgage in just three years — at age 30.

It wasn't easy and once he achieved his goal, he took a break.

It didn't last for long.

"I pretty much took it easy for six weeks and then I'm like, better start writing a book," says Cooper.

After obliterating a $255,000 mortgage on his Toronto house, Cooper got lots of media attention. He also garnered interest from people wrestling with their own large debts.

So he says he decided to write an advice book to help other homeowners free themselves of a mortgage faster.

Canadian household debt has risen to record levels, thanks largely to fat mortgages fuelled by pricey homes.

"I'm just trying to hammer home the point that debt does have a cost," says Cooper. "If you pay it off a lot quicker, you can save thousands of dollars, tens of thousands of dollars, in interest and be financially free years sooner."

His self-published book, Burn Your Mortgage, officially launches on March 1, but is available now at some Indigo bookstores.

It's full of practical advice for average homeowners — people unable or unwilling to go to extremes like Cooper did.

Extreme mortgage burning

When Cooper bought his house for $425,000 in 2012, he moved into the basement and rented out the rest of the house. He also lived super frugally, including making all his own meals.

"Kraft Dinner's probably been my best friend [for] the last three years," Cooper admitted at his mortgage-burning party in 2015.

The pension analyst by day also took on two extra jobs: as a financial writer and a clerk in the meat department at a grocery store. Between his work and rental income, Cooper says he netted about $100,000 a year.

He worked up to 100 hours a week, which meant little time for friends and no time for travelling.

"Sadly, my most exciting trip to date was a 24-hour bus ride to rural Wisconsin," he said at the time.

Not everyone was inspired by Cooper's methods. After CBC News reported his story, reader comments flooded the internet, some mocking the 30-year-old's financial achievement.

"What is he going to do next, buy a car and sell one of his kidneys to pay for it?" snarled one reader.

"What a load of horse patty," posted another, adding, "Work yourself to an early grave!"

"I definitely found it unfortunate that people felt that way," says Cooper about the naysayers. But he emphasizes that while his book is peppered with his own experiences, he offers less extreme tips for readers.

"You don't necessarily need to pay down your mortgage in three years like me. You don't need to eat Kraft dinner. That was just my path to financial freedom," he says.

The book covers all stages of the mortgage process — from how to save for a down payment, to how to find a suitable property, to how to chip away at your home loan faster.

So what are Cooper's top tips? He claims the biggest mistake people make is buying too much home.

"A lot of people think, 'Oh I'm spending only a bit more on a house, it's only a one-time expense.' But it's going to be eating up your monthly cash flow for years to come."

Along with that bigger house, comes bigger bills for utilities, property tax and home insurance, Cooper explains. Plus, you'll need to spend more money to furnish it.

When it comes to getting a mortgage, Cooper cautions not to be satisfied with only a low interest rate. He stresses that it also pays to land one with generous pre-payment privileges that can be key to wiping out a mortgage quickly.

Once a year, people typically can increase their mortgage payments and make a lump-sum contribution up to a specified limit. That lump-sum goes directly toward the principal amount you owe — rather than your added interest charges.

"That's where you can really knock off a huge balance from your mortgage and get it down really quickly," says Cooper.

He also recommends putting in some legwork at mortgage renewal time, instead of just accepting your bank's initial offer.

Customers should shop around and check out mortgage rate comparison websites, says Cooper. That way, they can start their renewal negotiations by showing their bank what competitors are offering.

"If they can even save 0.1 or 0.2 per cent off their mortgage rate, that can add up to thousands of dollars of savings in interest," he says.

No time out

If people commit to wiping out their mortgage faster, it will remove some of the stresses in their life, says Cooper.

"You don't have to stay at a job that you hate. Or you might be able to leave the rat race altogether and travel."

Cooper, however, has no current plans to flee his career. He has been promoted to senior pension analyst, still works as a financial writer and has added a new gig: freelancing as a money coach for people seeking financial help.

Cooper did take one vacation recently: he went to a financial conference in San Diego. And yes, he's still living in his basement. But he promises he'll move upstairs and slow down — eventually.

"I don't want to necessarily work 80 to 90 hours a week. I'd like to settle down and maybe get married one day," he says.

In the meantime, Cooper is working on his next big goal — investing his money that no longer goes toward mortgage payments. He aims to become a millionaire by the age of 35.

And then perhaps he'll take some time out … or maybe not.

Here's an excerpt from our Facebook Live Q&A with Cooper:

Q. You started with a pretty significant down payment for that home — $170,000. How did you get your down payment together in the first place?

A. It certainly wasn't the Bank of Mom and Dad. My parents weren't wealthy by any means. I saved all the money myself. While I was in university I was working three jobs … so I was able to graduate debt free and actually save some of my down payment when I was in university. I was definitely fortunate because I was able to live at home and save on the costs of living and all of that. Then I saved for a bit over two years after that working full time and working some additional jobs.

Q. Day to day, how did you save?

A. I packed my lunch, cycled to work. I didn't have a car. The two highest costs after mortgage or rent are food and transportation, so I was able to cut those expenses back considerably and save money.

Q. One of the questions that comes up is, why rush to pay off a mortgage right now when interest rates are so low? Why put all of this energy into paying off that debt when it's not costing you that much to hold onto it?

A. My own personal circumstances growing up … my mom was a single mom raising my sister and me. She lost her job a couple of times and it was stressful and she almost lost the house. She was out of work for almost six months. Being a single person myself paying a mortgage, I didn't want to be in that situation. It was about risk management.

To the point of low interest rates, a lot of people use low interest rates as an excuse to borrow as much money as possible, but I see that as an opportunity to pay down the biggest debt of your lifetime, your mortgage. Today the average mortgage that you take out, about 50 cents on the dollar goes toward principal, but a decade earlier only about 25 per cent went to principal and the rest toward interest.

Q. Where do you live? One viewer said that it seems like a cheap mortgage for Ontario.

A. I bought east of the Beach area and back then that price was reasonable. This was in August 2012.… They're always talking about in the media about the million-dollar average-priced detached house in Toronto or Vancouver, but there are still lots of affordable options. You have to choose between location and property type. If location is important to you, you probably can't afford a detached house.

Q. You got a lot of negative reaction online, people saying it's not realistic with kids, that you have to live a little too. Is that fair? Did you feel like you weren't living?

I was definitely laser focused while I was paying down my mortgage, but … you don't necessarily need to eat Kraft dinner or bike or anything like that. It's not a realistic scenario for someone who has a spouse and children. But there are still ways to save money. For example, instead of having two cars maybe you can have one car. Or maybe instead of having a brand-new shiny car and drive it off the lot and have it lose half its value, buy a two- or three-year-old car from a registered car dealer. It's kind of looking at the big picture of your finances and finding ways you can save money without hurting your lifestyle by a lot.

Yahoo Finance

Yahoo Finance