Sea Limited (SE) to Report Q4 Earnings: What's in Store?

Sea Limited SE is set to release fourth-quarter 2019 results on Mar 3.

The Zacks Consensus Estimate for revenues is currently pegged at $889.5 million, indicating 128.5% growth from the year-ago quarter’s reported figure.

Moreover, the Zacks Consensus Estimate for loss has remained unchanged at 62 cents per share over the past 30 days.

The company’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters, the average positive surprise being 23.9%.

Let’s see how things have shaped up prior to this announcement.

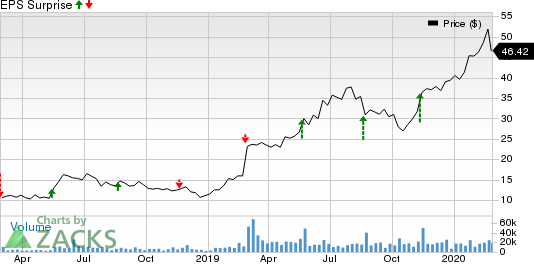

Sea Limited Sponsored ADR Price and EPS Surprise

Sea Limited Sponsored ADR price-eps-surprise | Sea Limited Sponsored ADR Quote

Factors to Consider

Sea Limited’s fourth-quarter results are expected to benefit from continued popularity of its self-developed game, Free Fire.

Notably, per App Annie data, the game was among the top five most downloaded games globally and the highest grossing mobile game in Latin America and Southeast Asia in the third-quarter, and the company expects this momentum to have continued in the fourth quarter.

Moreover, the game’s growing popularity in India is expected to have contributed to the company’s top line in the to-be-reported quarter.

Further, Sea Limited partnered with Activision ATVI and Tencent TCEHY to launch the hugely popular Call of Duty: Mobile in Southeast Asia and Taiwan, which received strong positive reaction from gamers. This is likely to impact the company’s fourth-quarter results.

Notably, Sea Limited stated that Call of Duty: Mobile was the most downloaded mobile game on both Google Play and iOS App Store’s in October in each of the company’s markets.

The company’s e-commerce segment is likely to have benefited from the strong growth of Shopee, its online shopping platform.

Total orders on the platform increased 103% year over year to reach 321.4 million in the third quarter. The upside is likely to have continued in the to-be-reported quarter.

However, increasing operational expenses, namely general & administrative and research & development expenses, are expected to have kept margins under pressure.

What Our Model Says

According to the Zacks model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Sea Limited carries a Zacks Rank #4 (Sell) and has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

A Stock That Warrants a Look

Here is a stock that you may want to consider, as our model shows that it has the right combination of elements to deliver an earnings beat this season.

Guidewire Software, Inc. GWRE has an Earnings ESP of +15.38% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2019, while the S&P 500 gained an impressive +53.6%, five of our strategies returned +65.8%, +97.1%, +118.0%, +175.7% and even +186.7%.

This outperformance has not just been a recent phenomenon. From 2000 – 2019, while the S&P averaged +6.0% per year, our top strategies averaged up to +54.7% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Activision Blizzard, Inc (ATVI) : Free Stock Analysis Report

Sea Limited Sponsored ADR (SE) : Free Stock Analysis Report

Tencent Holding Ltd. (TCEHY) : Free Stock Analysis Report

Guidewire Software, Inc. (GWRE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance