scPharmaceuticals (SCPH) Plunges Despite Furoscix's FDA Approval

scPharmaceuticals SCPH recently announced that the FDA approved its proprietary formulation of furosemide in 80 mg dosage delivered via an on-body infusor, marketed under the trade name Furoscix (furosemide injection) for treating congestion due to fluid overload in adults with New York Heart Association (NYHA) Class II and Class III heart failure.

This was scPharmaceuticals’ third attempt to secure FDA approval for Furoscix. The company had previously received a complete response letter (CRL) from the FDA twice, first in June 2018 and then in December 2020.

Post the approval, Furoscix becomes the first and only FDA-approved subcutaneous loop diuretic that delivers IV equivalent diuresis at home.

The company is working toward optimizing the commercialization of Furoscix to make the therapy available to patients in the first quarter of 2023 and meet the global demand in the addressable market.

However, Furoscix has not been approved for use in emergencies or patients with acute pulmonary edema.

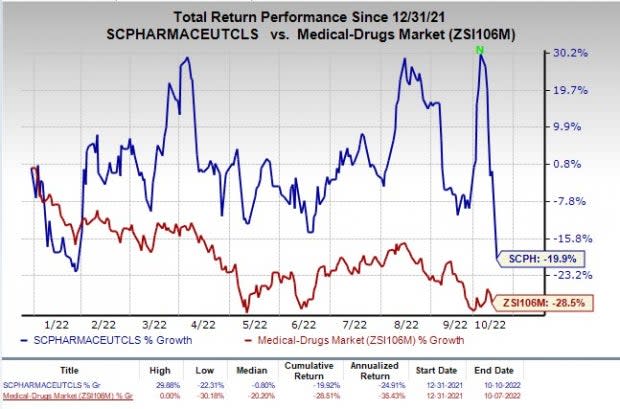

In spite of a regulatory win, scPharmaceuticals shares dropped 19.28% on Oct 10. Shares of scPharmaceuticals have declined 19.9% in the year-to-date period compared with the industry’s fall of 28.5%.

Image Source: Zacks Investment Research

Along with the FDA approval, scPharmaceuticals also announced that it has agreed to receive financing of $100 million from Oaktree Capital Management, L.P. The company intends to use the funding to execute the launch of Furoscix and repay its debt under its existing loan and security agreement.

Pursuant to the agreement, to be signed mid-October, Oaktree will pay scPharmaceuticals $50 million instantly, while the remaining $50 million will be paid in two tranches of $25 million, upon achievement of specified commercial milestones.

Though it seems like a great deal at a glance, the loan terms say otherwise. The debt is expected to carry an interest rate equal to the three-month secured overnight financing rate (SOFR) plus 8.75%, with the interest rate capped at 11.75% per annum. If a $100 million net sale of Furoscix is achieved in the trailing 12-month period, the interest rate will be lowered to 8.25%.

Even with the interest capping, a rate of 11.75% might push the company towards a massive debt load. As of June 30, 2022, scPharmaceuticals had cash, cash equivalents, restricted cash and investments of $56 million.

This might be yet another reason for the downfall of SCPH’s stock price on Monday.

scPharmaceuticals, Inc. Price

scPharmaceuticals, Inc. price | scPharmaceuticals, Inc. Quote

Zacks Rank and Stocks to Consider

scPharmaceuticals currently holds a Zacks Rank #4 (Sell).

Some better-ranked stocks in the same sector include Acadia Pharmaceuticals ACAD, Aridis Pharmaceuticals ARDS, and Immunocore IMCR, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Acadia’s loss per share estimates for 2022 have narrowed from $1.30 to $1.29 in the past 30 days. The loss per share for 2023 has narrowed from 67 cents to 60 cents in the same time frame.

Earnings of Acadia beat estimates in two of the trailing four quarters, while missing the same in the remaining two occasions. The average negative earnings surprise for STSA is 6.83%.

Aridis Pharmaceuticals' loss estimates for 2022 have remained steady at 23 cents over the past 30 days. The loss estimates for 2023 also remained steady at 53 cents per share in the same time frame.

ARDS surpassed earnings in three of the trailing four quarters, missing the same in one. The average negative earnings surprise for Aridis is 238.54%.

Immunocore’s loss per share estimates for 2022 widened from $1.34 to $1.46 in the past 30 days. The same for 2023 has narrowed from $1.78 to $1.65 in the same time frame.

Earnings of Immunocore missed estimates in three of the trailing four quarters, while beating the same in the reaming occasion. The average earnings surprise for IMCR is 33.28%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report

scPharmaceuticals, Inc. (SCPH) : Free Stock Analysis Report

Aridis Pharmaceuticals (ARDS) : Free Stock Analysis Report

Immunocore Holdings PLC Sponsored ADR (IMCR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance