Scotts Miracle-Gro (SMG) Q1 Earnings & Sales Beat Estimates

The Scotts Miracle-Gro Company SMG posted net loss from continuing operations of $71.3 million or $1.28 per share in first-quarter fiscal 2020 (ended Dec 28, 2019). The figure is narrower than a loss of $82.6 million or $1.49 per share in the year-ago quarter.

Barring one-time items, adjusted loss per share was $1.12, narrower than a loss of $1.39 in the year-ago quarter. The figure was also narrower than the Zacks Consensus Estimate of a loss of $1.24.

Net sales rose 23% year over year to $365.8 million. The figure surpassed the consensus mark of $347.7 million.

Company-wide gross margin rate (as reported) rose to 14.8% from 11.6% in the year-ago quarter.

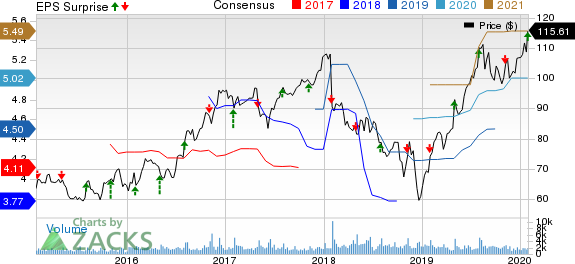

The Scotts Miracle-Gro Company Price, Consensus and EPS Surprise

The Scotts Miracle-Gro Company price-consensus-eps-surprise-chart | The Scotts Miracle-Gro Company Quote

Segment Details

In fiscal first quarter, net sales in the U.S. Consumer division rose 8% year over year to $147.4 million. The segment reported a loss of $41.5 million, which is narrower than a loss of $43.1 million in the year-ago quarter.

Net sales in the Hawthorne segment rose 41% year over year to $198.8 million in the reported quarter, which was primarily driven by strong demand in almost all categories of indoor growing equipment and supplies. The segment’s profit surged 216% year over year to $13.9 million.

Net sales in the Other segment fell 4% year over year to $19.6 million. The segment incurred a net loss of $3.5 million in the reported quarter, which is lower than a loss of $4 million in the year-ago quarter.

Balance Sheet

In fiscal first quarter, the company had cash and cash equivalents of $27.4 million, up 21.2% year over year. Long-term debt was $1,969.9 million, down 9.9% year over year.

Outlook

The company witnessed strong momentum in the U.S. Consumer unit in fiscal 2019, which also continued into fiscal 2020. Moreover, it continues to see outstanding performance across all product categories in the Hawthorne business in the United States.

Going forward, the company is upbeat on achieving its fiscal 2020 guidance. Scotts Miracle-Gro expects company-wide sales growth in the range of 4-6% for fiscal 2020. It continues to expect adjusted earnings per share in the band of $4.95-$5.15 for fiscal 2020.

Free cash flow is projected to be around $300 million.

Price Performance

Shares of Scotts Miracle-Gro have surged 61.8% in the past year against the industry’s 18.2% decline.

Zacks Rank & Key Picks

Scotts Miracle-Gro currently carries a Zacks Rank #3 (Hold).

Few better-ranked stocks in the basic materials space are Daqo New Energy Corp DQ, Royal Gold, Inc RGLD and Sibanye Gold Limited SBGL, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Daqo New Energy has projected earnings growth rate of 326.3% for 2020. The company’s shares have rallied 44.3% in the past year.

Royal Gold has an estimated earnings growth rate of 83.5% for fiscal 2020. Its shares have returned 32.5% in the past year.

Sibanye Gold has an expected earnings growth rate of 587.5% for 2020. The company’s shares surged 213.8% in the past year.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DAQO New Energy Corp. (DQ) : Free Stock Analysis Report

Sibanye Gold Limited (SBGL) : Free Stock Analysis Report

Royal Gold, Inc. (RGLD) : Free Stock Analysis Report

The Scotts Miracle-Gro Company (SMG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance