Scalping the GBPAUD Recovery- 1.8050 Key Resistance

Talking Points

GBPAUD breaks above bearish technical formation

Momentum divergence warns of possible exhaustion

Weekly opening range breaks shifts near-term bias higher

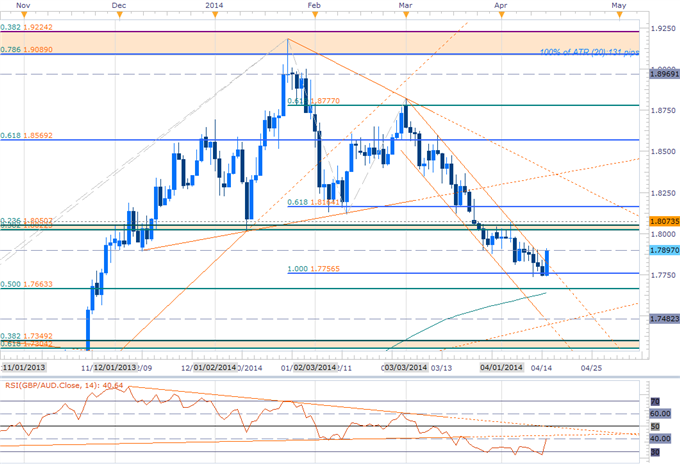

GBPAUD Daily Chart

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

GBPAUD breaks channel resistance dating March high- correction?

Daily RSI divergence on the rebound off 100% extension- bullish

Broader outlook weighted to the downside Sub 1.8020/50- key resistance

Support at 1.7738/56 (April ORL / 100% extension)- bullish invalidation

Break targets 1.7663, 1.7483, 1.7304/49

Multiple topside RSI triggers pending

Event Risk Ahead: UK employment data tomorrow

GBPAUD Scalp Chart

Notes: The GBPAUD looks to have broken trendline resistance dating back to the March high with today’s advance also breaching the weekly opening range high at 1.7842. Although our broader bias remains weighted to the downside below the April high, a near-term recovery is now in focus. Looking for a high to possibly sell into heading into Thursday/Friday with only a break/close above the April high invalidation the broader bearish outlook.

Bottom line: nimble longs are in play here on the back of the weekly opening range break with the rally likely to offer more favorable short entries higher up. A move back below 1.7840 puts us neutral with only a break sub-1.7738 putting the broader bearish trend / head and shoulders objectives into view. Use caution heading into tomorrow’s UK employment report with sterling crosses likely to see increased volatility on the release. Follow the progress of this trade setup and more throughout the trading week with DailyFX on Demand.

* It’s extremely important to give added consideration regarding the timing of intra-day scalps with the opening ranges on a session & hourly basis offering further clarity on intra-day biases.

Key Threshold Grid

Entry/Exit Targets | Timeframe | Level | Significance |

Resistance Target 1 | 30min | 1.7916 | 50% Retracement (Oct Low) |

Resistance Target 2 | 30min | 1.7954 | Last Week’s High / Soft Resistance |

Resistance Target 3 | 30min | 1.7993 | 23.6% Retracement |

Bearish Invalidation | Daily / 30min | 1.8022/50 | 23.6% & 38.2% Retracements |

Break Target 1 | 30min | 1.8073/78 | April ORH / 23.6% Retracement (Jan High) |

Break Target 2 | Daily / 30min | 1.8151/64 | 61.8% Extension / 38.2% Retracement |

Support Target 1 | 30min | 1.7842 | Weekly ORH / Soft Support |

Bullish Invalidation | Daily / 30min | 1.7738/56 | 100% Extension (2014 High) / April ORL |

Break Target 1 | Daily / 30min | 1.7665 | 50% Retracement |

Break Target 2 | 30min | 1.7618 | 61.8% Retracement |

Break Target 3 | 30min | 1.7564 | Soft Support / Nov Swing Low |

Break Target 4 | Daily / 30min | 1.7482 | August High |

Daily (20) | 131 | Profit Targets 30-33pips | |

*ORH: Opening Range High

*ORL: Opening Range Low

Other Setups in Play:

AUDNZD Approaches Key Inflection Point- 1.0825 Make or Break

GBPJPY Long Scalps Favored into April Opening Range- 172.60 in Focus

Scalps Favor Selling Rallies in EURAUD Post Head and Shoulders Break

---Written by Michael Boutros, Currency Strategist with DailyFX

For updates on this scalp and more setups follow him on Twitter @MBForex

To contact Michael email mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars Tuesday-Thursday this week on DailyFX Plus (Exclusive of Live Clients) at 12:30 GMT (8:30ET)

Interested in learning about Fibonacci? Watch this Video

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance