Scalping GBPAUD Pullback- Targets in View Ahead of Aussie Data, BoE

DailyFX.com -

Talking Points

GBPAUD pullback in focus ahead of key event risk

Updated targets & invalidation levels

GBPAUD Daily

Chart Created Using FXCM Marketscope 2.0

Technical Outlook

GBPAUD holds confluence resistance at yearly high-day close 2.2037

Breach targets resistance objectives at 2.2217 & 2.2676

Interim support 2.1670/80 backed by key support at 2.1420-2.1527- bullish invalidation

Momentum divergence into the highs leaves the pair vulnerable for a pullback

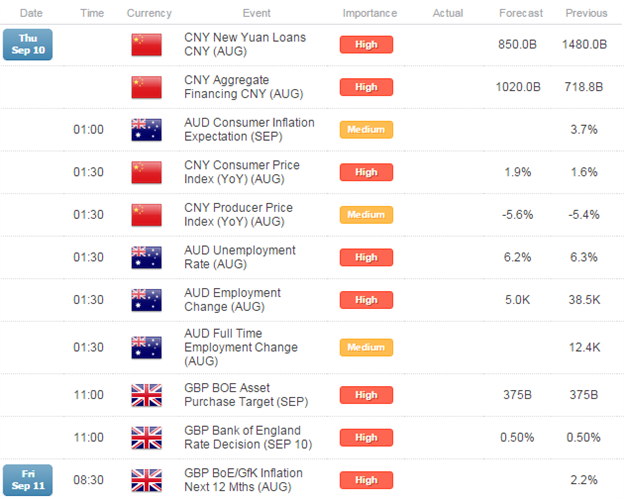

Key Event Risk Ahead: Australian Employment, China CPI tonight & Bank of England Rate Decisiontomorrow

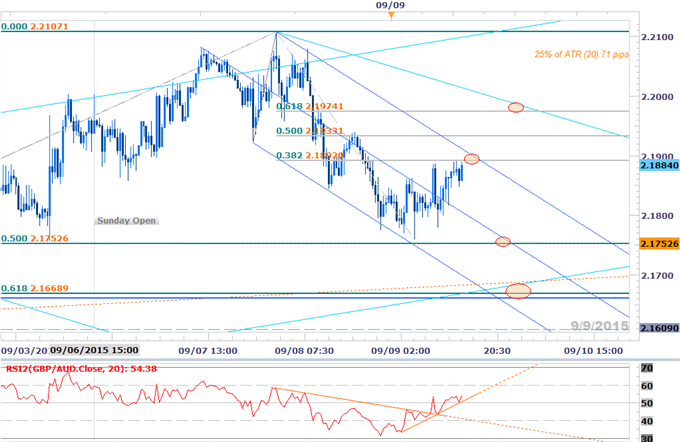

GBPAUD 30min

Notes: GBPAUD is trading within the confines of a descending median-line formation off the weekly highs with the risk for a deeper pullback before resumption of the broader up-trend. The pair is now testing confluence resistance into the 2.19-handle with subsequent resistance seen at 2.1933. We’ll reserve the 2.1975/90 region as our bearish invalidation level (looking for short triggers while below this region) with a breach above targeting the weekly highs and beyond.

Interim support targets are eyed at 2.1753 backed by key near-term confluence support at 2.1668/80. A break below this level keeps the immediate short-bias in play targeting 2.1609 & our broader bullish invalidation level down at 2.1420-2.1527. Note that this is a wide-range scalp with a quarter of the daily average true range (ATR) yielding profit targets of 68-71 pips per scalp. Caution is warranted over the next 48 hours with employment data out of Australian, inflation data out of China and the BoE interest rate decision likely to fuel added volatility in the Sterling & Aussie crosses.

For updates on this scalp and more setups throughout the week subscribe to SB Trade Desk

Relevant Data Releases

Other Setups in Play:

USDCAD Levels to Know Ahead of BoC - 1.3335 Marks Critical Resistance

USDJPY Battle Lines Drawn Ahead of NFPs- Short Scalps Favored Sub 120.80

AUDNZD: Rinse & Repeat- Reversal Scalp Back in Play Ahead of GDP

Webinar: ECB, NFP Report to Carve Opening Range for Euro Crosses

EURJPY Rebound to Offer Short Entries Ahead of ECB- 137.50 Critical

---Written by Michael Boutros, Currency Strategist with DailyFX

Follow Michaelon Twitter @MBForex, contact him at mboutros@dailyfx.com or Click Here to be added to his email distribution list

Join Michael for Live Scalping Webinars on Mondays on DailyFXat 12:30 GMT (8:30ET)

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance