Savanna Capital Corp. Signs Definitive Agreement With San Luis and Announce Concurrent Financing

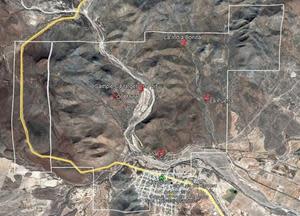

Figure 1

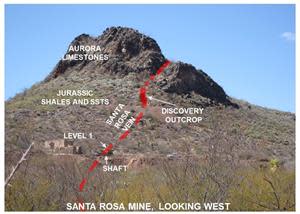

Figure 2

Not for distribution to United States newswire services or for release publication, distribution or dissemination directly, or indirectly, in whole or in part, in or into the United States.

TORONTO, March 04, 2022 (GLOBE NEWSWIRE) -- SAVANNA CAPITAL CORP. (“Savanna”) (TSX-V: SAC.P) is pleased to announce that, further to its press release dated January 27, 2022, it has entered into a definitive agreement dated March 1, 2022 (the “Definitive Agreement”) with 1000090242 Ontario Inc., a privately held corporation existing under the laws of the Province of Ontario (“San Luis ON”), relating to the proposed business combination (the “Proposed Transaction”) with Exploranciones de SL Cordero, S.A. de C.V. (“San Luis MX”), a wholly-owned subsidiary of San Luis ON (San Luis MX and San Luis ON are collectively referred to hereinafter as “San Luis”).

San Luis holds the mineral claims covering approximately 1,216.99 ha in the Municipality of San Luis del Cordero in the State of Durango, Mexico (the “San Luis Property”). The San Luis Property features three different mineralisation styles, high-grade silver-copper veins, which have been mined in the 70's, a silver, copper, zinc-bearing skarn deposit and manto-style mineralisation. The skarn has been drill tested for a strike-length of 750 metres, but has a potential of 3.5 kilometres of total strike length with known mineralisation zones.

Figures accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/965079fa-4e25-4940-8b7f-0c7241de717d

https://www.globenewswire.com/NewsRoom/AttachmentNg/77b3bdff-dc91-4481-8707-eebbd5dfc11c

Definitive Agreement and Proposed Transaction

The Proposed Transaction is to be completed pursuant to a three-cornered amalgamation among Savanna, a wholly-owned subsidiary of Savanna (“Subco”), and San Luis ON, whereby Subco and San Luis ON will amalgamate and continue as one corporation (the “Amalgamation”), and the shareholders of San Luis ON will receive shares of Savanna (referred to on a post-closing basis as the “Resulting Issuer”).

Pursuant to the Definitive Agreement, and upon the satisfaction or waiver of the conditions set out therein, in connection with the closing of the Proposed Transaction, among other things:

Savanna will change its name to “Plata Corp.” or such other name requested by San Luis and acceptable to Savanna and the applicable regulatory authorities (the “Name Change”);

following completion of the foregoing, the Amalgamation will be completed, and the San Luis ON shareholders will exchange each San Luis ON common share (the “San Luis Shares”) for one common share of the Resulting Issuer (the “Resulting Issuer Shares”); and

the board of directors and management of the Resulting Issuer will be replaced with nominees of San Luis.

The Resulting Issuer will hold, on a consolidated basis, all of the assets and will be subject to all of the liabilities of Savanna and San Luis, and will continue the business of San Luis.

Completion of the Proposed Transaction is subject to a number of conditions, including, but not limited to, San Luis ON completing a non-brokered private placement of subscription receipts for minimum gross proceeds of $1,500,000 (the “Concurrent Financing”), as discussed in greater detail below; Savanna completing the Name Change; TSX Venture Exchange (“TSXV”) acceptance of the Proposed Transaction; and receipt of the necessary approvals of the shareholders of Savanna and San Luis ON.

The Definitive Agreement will be posted to Savanna’s SEDAR profile at www.sedar.com and contains additional details regarding the Proposed Transaction, including as to break fees. As well, further details with respect to the Proposed Transaction are summarized in Savanna’s news release dated January 27, 2022.

Management

Following the completion of the Proposed Transaction, the Resulting Issuer will be led by: Kenny Choi, CEO; Ryan Ptolemy, CFO; and Aaron Atin, Corporate Secretary. The Resulting Issuer’s board of directors is expected to consist of four directors.

Kenny Choi – CEO

Kenny Choi is a corporate lawyer who graduated from Western University’s JD/HBA program in 2013. He was previously an associate at a top-tier Bay Street firm, where he honed his skills in areas including equity and debt financing, mergers and acquisitions, fund formation and private and public securities law. Mr. Choi has occupied various management roles in publicly-traded CSE, TSXV, TSX and NEO companies, in particular in the mining industry.

Ryan Ptolemy - CFO

Mr. Ptolemy is a CPA, CGA and CFA charterholder who also attained a bachelor of arts from Western University. Mr. Ptolemy serves as chief financial officer to many public and private companies in the investment, fintech and resource sectors. Mr. Ptolemy formerly served as chief financial officer for an independent investment dealer in Toronto, where he was responsible for financial reporting, budgeting and the company's internal controls.

Aaron Atin – Corporate Secretary

Mr. Atin is a corporate and securities lawyer with extensive experience in securities, M&A and corporate finance. Mr. Atin is currently a legal consultant to various Toronto Stock Exchange, TSX Venture Exchange and Canadian Securities Exchange-listed companies in various sectors. These include mining, financial services, agriculture and technology. Mr. Atin began his legal career as a securities law associate at a large Toronto corporate law firm. He holds an engineering diploma from Centennial College, a Bachelor of Arts from the University of Waterloo and a J.D. from the University of Toronto, Faculty of Law.

Russell Starr –Chairman of the Board

Mr. Starr is an entrepreneur and financial professional, focused on private and public mining & exploration, corporate advisory, corporate development, and M&A. Mr. Starr has over 20 years of corporate finance, M&A, investment and business development experience. Mr. Starr is currently the Chief Executive Officer and Executive Chairman of DeFi Technologies Inc. (NEO: DEFI) and a director of Trillium Gold Mines Inc. (TSXV: TGM), and Leviathan Gold Ltd. (TSXV: LVX).

Vincent Chen – Director

Mr. Chen is a Chartered Professional Accountant (CPA) who obtained his BBA of Accounting from the Beedie School of Business at Simon Fraser University. Mr. Chen has an extensive background in the mining and precious metals industry having previously worked as a Senior Analyst at Yamana Gold Inc. – one of Canada’s largest gold producers – where he honed his skills in financial reporting, financial modelling, equity and debt financing, and Life of Mine assessment. Mr. Chen was also formerly a Senior Associate at PricewaterhouseCoopers (PwC) working within the mining assurance practice where he specialized in IFRS and US GAAP reporting standards for large public mining corporations in Toronto.

Craig Marchuk –Director

Mr. Marchuk is a seasoned M&A leader with deep experience in M&A lifecycle management and transaction execution. Mr. Marchuk has 10+ years of experience managing M&A transactions, structuring unique solutions and raising capital. He started his career at boutique energy-focused investment banks but was most recently at Nutrien, the world’s largest provider of agricultural inputs, services and solutions. In his role, he was responsible for the analysis and execution of mergers, acquisitions, and divestitures that further Nutrien’s global strategy implementation. He played a key role in 20+ transactions totalling over $75Bn in enterprise value. He attended the University of Calgary, where he earned a bachelor’s degree in Commerce majoring in Finance and a bachelor’s degree in Arts majoring in Economics. He also holds the Chartered Financial Analyst (CFA) designation.

Dmitri Kralik –Director

Mr. Kralik is a financial consultant who provides corporate finance and advisory services. Mr. Kralik currently works with several public and private companies in various sectors and has an entrepreneurial background with experience growing companies from early-stage operations. Mr. Kralik is a CFA charterholder and holds an HBA from Ivey Business School.

Savanna Shareholder Meeting and Anticipated Closing

It is anticipated that an annual general and special shareholder meeting of Savanna to approve, among other matters, the Name Change, will take place on April 6, 2022. Further information on the Savanna Meeting Matters can be found in the management information circular of Savanna to be posted on Savanna’s SEDAR profile at www.sedar.com.

Concurrent Financing

Savanna has no material liabilities, approximately $40,000 in cash, 4,615,000 common shares (the “Savanna Common Shares”) and 443,200 options (the “Savanna Options”) issued and outstanding. Prior to the completion of the Transaction, it is anticipated that San Luis will complete a non-brokered private placement of approximately 10,000,000 units (the “Target Units”) at a price of C$0.15 per Target Unit for gross proceeds of approximately C$1,500,000.00 (the “San Luis Offering”). Each Target Unit shall entitle the unitholder to receive, upon satisfaction of certain escrow release conditions, and without payment of additional consideration, one common share in the capital of San Luis (a “San Luis Common Share”) and one common share purchase warrant (a “Target Warrant”) exercisable for 24 months from the date of the issuance at a price of C$0.25 per Target Warrant.

Qualified Persons

The scientific and technical information contained in this press release has been reviewed, prepared and approved by Dr. Andreas Rompel, PhD, Pr. Sci. Nat. (400274/04), FSAIMM, who is a “Qualified Person” as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Savanna

Savanna is a Capital Pool Company (as defined in the policies of the TSX Venture Exchange) listed on the Exchange.

About San Luis

San Luis ON is a private Ontario corporation that has a 100% interest in San Luis MX. San Luis MX. holds the mineral claims covering approximately 1,216.99 ha in the Municipality of San Luis del Cordero in the State of Durango, Mexico (the “San Luis Property”). Further details on the historical activities of San Luis and the San Luis Property will be provided in the listing statement for the Resulting Issuer and the National Instrument 43-101: Standards of Disclosure of Mineral Projects with respect to the San Luis Property.

Further Information

For further information regarding the proposed Transaction, please contact:

Savanna Capital Corp.

Kenny Choi

Tel: (416) 861-2262

E-mail: Kenny.choi@fmresources.ca

San Luis

Aaron Atin

Tel: (416) 861-5888

Email: aaron.atin@fmresources.ca

All information contained in this news release with respect to Savanna and San Luis was supplied by the parties respectively for inclusion herein, and each party and its directors and officers have relied on the other party for any information concerning the other party.

Completion of the Transaction is subject to a number of conditions, including but not limited to, Exchange acceptance. Where applicable, the transaction cannot close until the required shareholder approval is obtained. There can be no assurance that the transaction will be completed as proposed or at all.

Investors are cautioned that, except as disclosed in the management information circular or filing statement to be prepared in connection with the transaction, any information release or received with respect to the transaction may not be accurate or complete and should not be relied upon. Trading in the securities of a capital pool company should be considered highly speculative.

The TSX Venture Exchange Inc. has in no way passed upon the merits of the proposed transaction and has neither approved nor disapproved the contents of this news release

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION:

This news release contains “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, to: the terms and conditions of the proposed Transaction; the terms and conditions of the proposed Offering; use of proceeds raised in the Offering, the proposed officers and directors of the Resulting Issuer; and the business and operations of the Resulting Issuer after the proposed Transaction. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; and the delay or failure to receive board, shareholder or regulatory approvals. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this news release.

Readers should not place undue reliance on the forward-looking statements and information contained in this news release. Savanna and San Luis assume no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

The securities to be offered in the Offering have not been, and will not be, registered under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”) or any U.S. state securities laws, and may not be offered or sold in the United States or to, or for the account or benefit of, United States persons absent registration or any applicable exemption from the registration requirements of the U.S. Securities Act and applicable U.S. state securities laws. This news release shall not constitute an offer to sell or the solicitation of an offer to buy securities in the United States, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Yahoo Finance

Yahoo Finance