SASE Gaining Momentum: Can Palo Alto Maintain Dominance?

Secure access service edge (SASE) is the new buzzword in the computer security world. The term SASE has recently been coined by Gartner and described as one of the most promising emerging technologies in enterprise networking.

SASE, pronounced as “sassy”, is conceptually an architecture, which integrates SD-WAN with network security and delivers applications and services from cloud to edge.

Notably, Palo Alto Networks PANW, Cato Networks, Infoblox, Netskope, VMware VMW, and Zscaler ZS are some of the security vendors offering SASE-based solutions.

Moreover, security startup, Perimeter 81, recently joined the SASE bandwagon by coming up with a product, which integrated its zero-trust networking platform with SonicWall’s cloud-delivered security services.

Palo Alto is a dominant name in this space due to its comprehensive SASE platform — Prisma Access. Although private networking firms, Cato Networks and Infoblox, are two of the first to enter the SASE market, Palo Alto is among the first public companies to claim a stake.

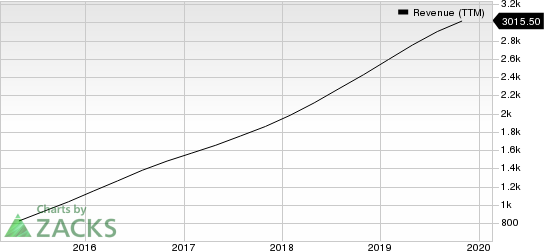

Palo Alto Networks, Inc. Revenue (TTM)

Palo Alto Networks, Inc. revenue-ttm | Palo Alto Networks, Inc. Quote

VMware, Inc. Revenue (TTM)

VMware, Inc. revenue-ttm | VMware, Inc. Quote

Zscaler, Inc. Revenue (TTM)

Zscaler, Inc. revenue-ttm | Zscaler, Inc. Quote

SASE Set to Rule the Security Industry

Enterprises using a SASE platform can scan active sessions for malware and sensitive content regardless of device or user location. SASE also enables enterprises to utilize a zero-trust approach to networking.

Unlike a traditional WAN, SASE eliminates the concept of connecting the branch to the central office and instead tries to connect individual users and equipment to a centralized cloud-based service.

Traditionally, in enterprise networks, the data center is the most important point of access. Per Gartner, this approach is becoming increasingly ineffective as enterprises are migrating to software-as-a-service (SaaS), cloud services and edge compute platforms.

Notably, this architectural transformation is a threat to traditional network and security models. The emerging SASE model converges networking and security in the cloud, which is beyond the capacity of traditional models.

Moreover, since it is no longer enough to protect the perimeter, given the emergence of cloud, mobility, edge computing and 5G, SASE is the next big thing in the security world.

However, analysts from IHS Markit and IDC are still doubtful about calling SASE a game-changer. Clifford Grossner, executive director of research and technology, IHS Markit, said, “SASE doesn’t feel like a new market, let alone a new technology or product.”

Nonetheless, the skepticism does not seem to be deterring vendors from jumping on the SASE bandwagon, and their encouragement is justified.

SASE’s Growth Prospects Aplenty

The technology is still in a nascent stage, with less than 1% adoption. This means that it has the opportunity to grow significantly.

Gartner predicts that the SASE technology will see strong adoption over the next 10 years. This adoption is likely to be driven by the ongoing architectural transformation of traditional data center-centric networking and security to better cater to the current mobile workforce and achieve higher adoption of the cloud technology.

Palo Alto’s SASE Model Faces VMWare & Zscaler Challenge

Notably, in November last year, Palo Alto announced new enhancements to the comprehensive SASE platform Prisma Access, including cloud-delivered SD-WAN and data loss prevention capabilities. These upgrades extend the company’s comprehensive cloud security strategy, Prisma, and enhance its capabilities to provide end-to-end protection for modern applications. This, in turn, safeguards clients’ journey to the cloud in a much better fashion.

However, Palo Alto has started facing competition in this space. Zscaler and VMware, both carrying a Zacks Rank #3 (Hold) currently, have been innovating to offer a completely SASE-based security model.

Zscaler’s Cloud Security Platform is a SASE solution, which brings together wide-area network capabilities with security functions. The solution aims to shorten and secure users’ path to their enterprise applications.

Moreover, VMware SD-WAN by VeloCloud delivers a comprehensive SASE platform that enables enterprises to leverage a globally-available Network of Cloud Services to drive their businesses.

Conclusion

Last year, Check Point Software co-founder, Shlomo Kramer, discussed that Palo Alto did not build a complete SASE-based platform.

However, this does not seem to be a concern as none of Palo Alto’s competitors have come up with a better SASE-based model yet. All its primary competitors, like Fortinet FTNT and FireEye FEYE, both currently having a Zacks Rank #2 (Buy), are using more or less the same next-generation firewall technology as Palo Alto. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Companies like Intel and Cisco are also still trying to crack the SASE challenge. Hence, this provides a significant first-mover advantage to Palo Alto, which currently has a Zacks Rank #3.

Free: Zacks’ Single Best Stock Set to Double

Today you are invited to download our latest Special Report that reveals 5 stocks with the most potential to gain +100% or more in 2020. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This pioneering tech ticker had soared to all-time highs and then subsided to a price that is irresistible. Now a pending acquisition could super-charge the company’s drive past competitors in the development of true Artificial Intelligence. The earlier you get in to this stock, the greater your potential gain.

See 5 Stocks Set to Double>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

VMware, Inc. (VMW) : Free Stock Analysis Report

Fortinet, Inc. (FTNT) : Free Stock Analysis Report

Palo Alto Networks, Inc. (PANW) : Free Stock Analysis Report

FireEye, Inc. (FEYE) : Free Stock Analysis Report

Zscaler, Inc. (ZS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance