Salesforce Offers Limited Near-Term Upside: 2 Stocks to Buy Instead

Salesforce CRM, the customer relationship management software giant reported earnings on Thursday after the market close. Although CRM beat earnings handily, raised guidance, and returned cash to shareholders the stock sold off, nonetheless.

After rallying close to 60% YTD, completing a major restructuring, and dramatically boosting profits, it seems Salesforce may have been priced to perfection. With so much good news discounted in the stock price, it may be time for CRM to take a break.

Earnings: $1.69 per share, adjusted, vs. $1.61 per share as expected by analysts

Revenue: $8.25 billion, vs. $8.18 billion as expected by analysts

Returned $2.1 Billion in First Quarter to Stockholders through Share Buybacks

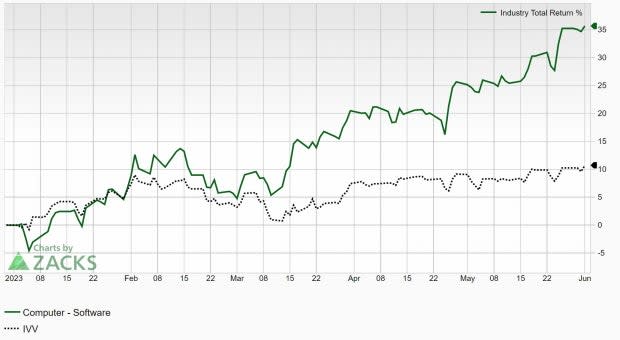

Salesforce is a member of the Software industry, which currently ranks in the top 46% of the Zacks Industry Rank. It has been extremely strong YTD, so we know there are other stocks investors can rotate into if they are ready to take profits in CRM.

Image Source: Zacks Investment Research

Two stocks that boast strong long-term performance, that also currently have superior earnings revision trends are VeriSign VRSN and Dassault Systemes DASTY. VeriSign has averaged an annualized return of 15.7% over the last 20 years, and Dassault Systemes 14.4% over that same period.

Image Source: Zacks Investment Research

VeriSign

VeriSign is a leading provider of domain name registry services and internet infrastructure solutions. With a focus on managing the stability and security of the DNS infrastructure, VeriSign ensures the reliable functioning of .com and .net domain names. By leveraging advanced technologies and offering additional services like DDoS protection, VeriSign plays a crucial role in maintaining a secure online environment and enabling seamless internet accessibility.

VeriSign has a Zacks Rank #2 (Buy), indicating upward trending earnings revisions. Current quarter earnings have been revised higher by nearly 2% and are expected to grow 10.4% YoY and FY23 earnings have been upgraded by 2.7%, with estimates of 10.9% YoY growth.

Image Source: Zacks Investment Research

You can see in the chart below the VRSN has done almost nothing over the last five years, trading in a large range. The stock made a huge run up from 2011 to 2019, more than 10’xing over that time.

Now that VRSN has had some time to cool off, and grow into its valuation, it should be ready for another bull run soon. Moreover, the presence of catalysts driving positive earnings revisions and an attractive valuation further contribute to the breakout potential.

Image Source: TradingView

VRSN is trading at a one-year forward earnings multiple of 32x, which is above the industry average of 30x, and below its five-year median of 37x. This below average valuation could draw in buyers looking for undervalued tech stocks.

Image Source: Zacks Investment Research

Dassault Systemes

Dassault Systemes is a renowned global leader in 3D design, engineering, and collaborative software solutions. The company, founded in 1981 and headquartered in France, offers a comprehensive portfolio of innovative products and services that cater to various industries, including aerospace, automotive, manufacturing, and life sciences.

Dassault Systemes' flagship software, CATIA, is widely recognized as a leading design and modeling tool, while its other offerings, such as SOLIDWORKS and SIMULIA, provide advanced simulation and virtual testing capabilities. With a strong focus on digital transformation and sustainable innovation, Dassault Systemes empowers businesses to enhance their product development processes, improve efficiency, and drive meaningful customer experiences.

Through its cutting-edge technologies and industry expertise, DASTY continues to shape the future of design and engineering, enabling companies to stay at the forefront of their respective sectors.

Dassault Systemes has seen near unanimous upgrades in its earnings estimates, earning it a Zacks Rank #1 (Strong Buy). Current quarter earnings have been upgraded by 11% and are expected to grow 7% YoY. FY23 earnings have been revised 9% higher and are expected to climb 9% YoY.

Additionally, current quarter sales are expected to grow 8.8% YoY and FY23 sales are projected to grow 10% YoY. These are extremely steady numbers for a $60 billion company.

Image Source: Zacks Investment Research

DASTY is trading at a one-year forward earnings multiple of 37.5x, which is above the industry average, and in line with its 10-year median. Dassault Systemes clearly trades at a premium valuation; however, it is for good reason.

Dassault Systemes’ applications are the leader in PLM (Product Lifecycle Management) and Engineering software. It is estimated that it owns the largest share in the market at 17% and increased that share by 8.3% over the last year. DASTY has over 300,000 customers in more than 140 countries.

Image Source: Zacks Investment Research

Bottom Line

There is no doubt that Salesforce is a powerhouse in the stock market, but with the incredible run it has gone on, it may be time to look for value elsewhere. With its mixed earnings revisions, and limited bullish catalysts, investors may want to proceed with caution in holding the software giant.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM) : Free Stock Analysis Report

VeriSign, Inc. (VRSN) : Free Stock Analysis Report

Dassault Systemes SA (DASTY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance