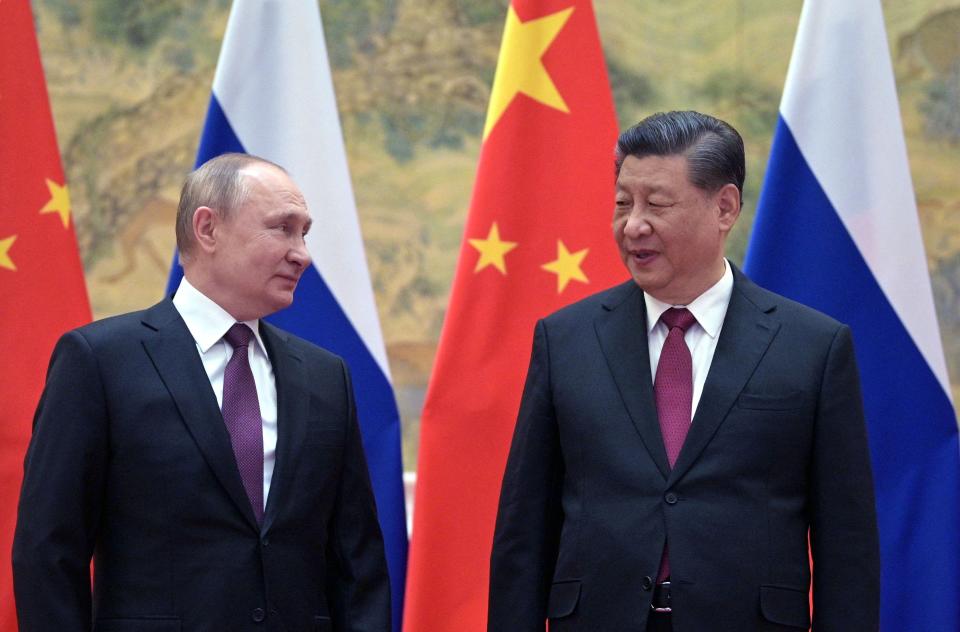

Russia faces new sanctions on its energy exports - but this time China and India may not come to Putin's rescue

The European Union's upcoming ban on Russian oil products could spell more turmoil for the Kremlin.

China and India are unlikely to buy refined Russian fuels that were once sold to the EU, which will ban them on February 5.

That's in contrast to Russian crude oil, which were snapped up by China and India after Europe shunned those supplies.

Russia faces new sanctions on its energy exports, but this time China and India may not come to President Vladimir Putin's rescue.

The European Union will ban imports of refined Russian fuels on February 5, adding to its embargo on seaborne Russian crude oil that began in December.

But while China and India eagerly snapped up discounted supplies of Russian crude that Europe shunned, they are unlikely to buy refined Russian fuels that were once sold to the EU.

"Both are net exporters of products, so there's no need for them to be importing more," Viktor Katona, lead crude analyst at Kpler, told Insider.

Russian fuels could instead find buyers in Singapore and Fujairah in the United Arab Emirates, then head to larger Asian markets from there, but not the big ones, he added.

Russian products could also flow to West Africa and Latin America, while Europe will likely start sourcing more of its diesel from the US and Asia in a "round of musical chairs," Katona said.

China and India produce fuels at their own refineries that could also supply Europe. In fact, a Chinese cargo is already headed to Latvia, according to the Financial Times, despite the extra time and cost of shipping across such distances.

In addition, a ban on Russian fuels could give both China and India more room to bargain for any supplies they do end up buying, according to Morningstar energy and utilities strategist Stephen Ellis.

Looming over the fuel market is a price cap on Russian fuels. Similar to the oil price cap, the EU and G7 plan to bar other countries from accessing insurance and shipping services unless they abide by a cap on refined products.

EU officials are considering a cap of $100 per barrel for Russian diesel and a cap of $45 a barrel for Russian fuel oil, sources told Bloomberg.

However, Moscow wouldn't be helpless. Russia could refine less fuel but keep oil production stable, resulting in even more crude exports to India and China, Katona said.

The Kremlin could also "weaponize refined products by cutting exports," said Ellis. That would eventually result in lower supplies for Europe.

"China will likely to have to use its own products, reducing refined products exports from China that would have otherwise been available to EU buyers," he said.

Read the original article on Business Insider

Yahoo Finance

Yahoo Finance