Royal Gold (RGLD) Announces Highest Dividend Hike Since 2013

Royal Gold, Inc.’s RGLD board of directors approved a hike of 17% — the largest percentage increase since 2013 — to an annual dividend of $1.40 per share. This marks the company’s 21st consecutive annual dividend increase. The new quarterly dividend of 35 cents per share will be payable Jan 21, 2022, to shareholders of record as of Jan 7, 2022.

This will take Royal Gold’s dividend yield from the current 1.12% to 1.31%, higher than the S&P 500 composite’s 1.2% average. The move highlights the company’s record revenues from its strong portfolio in first-quarter fiscal 2022 (ended Sep 30, 2021) combined with expectations of revenue growth from its new producing assets as well as a solid balance sheet.

Revenues were $174 million, reflecting year-over-year growth of 19%. Higher gold sales at Mount Milligan, rise in gold production at Cortez, gold sales from the newly acquired NX Gold Stream and an increase in average copper prices contributed to the top-line performance in the quarter. Adjusted earnings per share were $1.07 in the quarter, up 30.5% year over year, aided by record revenues and strong operating performance.

Net cash from operating activities for Royal Gold was $129.9 million in the fiscal first quarter compared with the prior-year quarter’s $94 million. The increase primarily resulted from an increase in cash proceeds received from the company’s stream and royalty interests, net of cost of sales, and production taxes of $33.1 million. As of Sep 30, 2021, the company had $1.1 billion of total liquidity.

Royal Gold last raised its quarterly dividend by 7% (or 8 cents per share) to 30 cents in November 2020. Over the past 10 years, Royal Gold has grown its quarterly payout from 11 cents per share to the current announced dividend of 35 cents, reflecting a 10-year CAGR of 12%. Since it started paying dividends in 2000, RGLD has paid out around $680 million in dividends to shareholders. Royal Gold currently has a payout ratio of 38.24%, higher than the industry’s 33.42% and S&P 500’s 30.33%. The company has a five-year dividend growth rate of 5.6%.

The company outscores its peer Franco-Nevada Corporation FNV, which has a dividend yield of 0.81%, a five-year dividend growth rate of 5.5% and a payout of 31.82%. The gold-focused royalty and stream company hiked its quarterly dividend this March by 15% to 30 cents, marking its 14th annual dividend increase.

Franco-Nevada is financially strong and has a debt-free balance sheet. FNV generated $676 million in operating cash flow in the first nine months of 2021, up from the $558 million witnessed in the prior-year period. As of Sep 30, 2021, the company had available capital of $1.4 billion.

In August, gold miner Barrick Gold Corp GOLD announced a 12.5% dividend hike to 9 cents per share. GOLD plans to return $750 million to shareholders in 2021. This is in addition to the payment of a third $250-million capital return tranche (or 14 cents per share).

Barrick Gold plans to return $750 million to shareholders in 2021. GOLD has a strong liquidity position and generates healthy cash flows, which positions the company well to take advantage of attractive development, exploration and acquisition opportunities. Barrick Gold achieved its target of zero net debt at the end of 2020.

In August, Wheaton Precious Metals WPM announced a quarterly dividend of 15 cents per share, an increase of 50% from the last year and representing the fourth quarterly dividend increase in a row. WPM, which is one of the largest precious metal streaming companies in the world that generates revenues primarily from the sale of gold, silver and palladium, offers investors leverage to increasing precious metal prices, a sustainable dividend payout, and organic and acquisition growth opportunities.

Wheaton’s strong cash position, operating cash flows and available credit capacity provide scope for investments to acquire additional accretive precious metals. It had roughly $372 million of cash in hand at the end of the third quarter of 2021, with no outstanding debt.

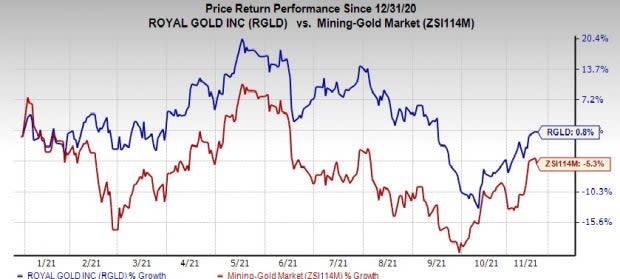

Price Performance

Image Source: Zacks Investment Research

So far this year, shares of Royal Gold have gained 0.8% against the industry’s decline of 5.3%.

Zacks Rank

Royal Gold currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Gold, Inc. (RGLD) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

FrancoNevada Corporation (FNV) : Free Stock Analysis Report

Wheaton Precious Metals Corp. (WPM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance