Rolls-Royce is taking a dramatic step to protect its profits

Reuters/Enrique Castro-Mendivil

The struggling engineering firm Rolls-Royce is about to cut its dividend for the first time in 24 years, according to reports from several media outlets, including the Daily Telegraph.

Though the company hasn't confirmed that it will definitely be cutting the payout to investors when it releases its annual results on Friday, it is widely reported that this will be the case. Rolls said in November that it was considering its position regarding the dividend.

Rolls is really struggling. The company has issued five profit warnings in just under two years, and it has seen its share price fall off a cliff.

While the reasons for this struggle are numerous, the company is blaming a slowdown in servicing older aircraft engines and weakness in its marine engine business because of the crashing price of oil.

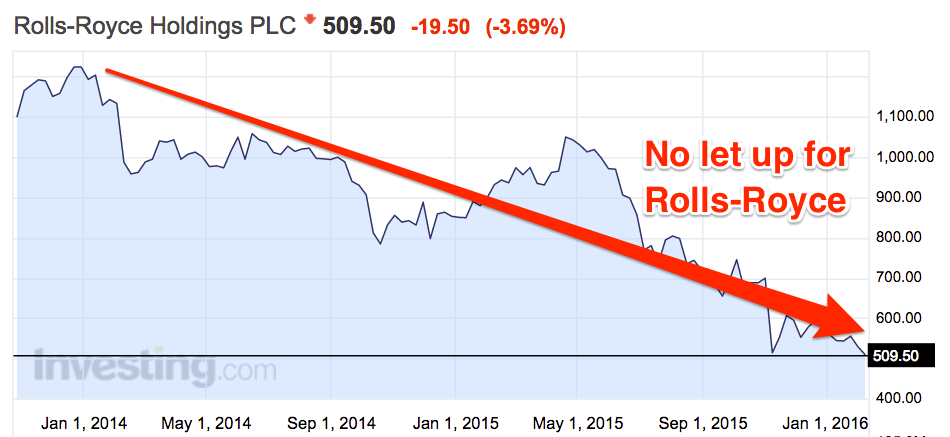

Warren East took over as CEO in July, given the task of turning the company around, but since his appointment shares have fallen by more than 30%, and investors are no more keen on the firm since he took over. Shares have fallen 58% since late 2013. Here's how that looks:

Reuters/Enrique Castro-MendivilNeil Woodford, probably the best-known money manager in Britain, dumped his stake in Rolls in December after losing "long-term confidence in the business model."

East has started to make major changes since appointed, including launching a major review of operations and jettisoning a whole level of senior management, but nothing has stopped the rot.

Last Monday, Norwegian Airlines confirmed that it was buying $2.7 billion worth of engines from Rolls-Royce, but even that huge deal didn't really buoy investors, and shares were flat on the day of the announcement.

One of the biggest questions surrounding Rolls-Royce is whether the company will give the American hedge fund ValueAct a seat on the board. ValueAct, a renowned activist investor, owns about 10% of the engineering firm, and it has been demanding a seat on the board since late last year.

No one from Rolls has officially commented on whether this might happen, but according to a Financial Times report, chairman Ian Davis has been asking investors in recent weeks whether they think doing so is a good idea. One shareholder told the FT: "In the short to medium term it is a good thing because they are agents of change and that is something the board seems to need."

While a dividend cut would generally be seen as a bad thing, some investors are welcoming the possible cut and even receiving no dividend at all. One unnamed "top shareholder" told the FT: "In principle we would probably be happy if they scrapped it." "There's a lot for them to invest in," the shareholder added.

Speculation about the dividend cut has sent shares in Rolls diving on Monday morning, and as of 10:15 a.m. GMT (5 a.m. ET) the company's stock is down 3.7% to £5.09 ($7.32) a share.

NOW WATCH: Martin Shkreli offered Kanye West $10 million to not release his newest album

See Also:

SEE ALSO: Rolls-Royce is taking drastic action to get back on track

Yahoo Finance

Yahoo Finance