Rogers Sugar Reports Third Quarter 2021 Results, Maintains Higher Volumes Outlook for Sugar and Maple Business Segments for Fiscal 2021

Revenue and Adjusted EBITDA

Revenue and Adjusted EBITDA

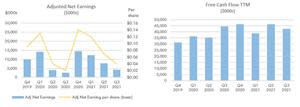

Adjusted Net Earnings and Free Cash Flow TTM

Adjusted Net Earnings and Free Cash Flow TTM

Sugar Volume Variance and Sugar Volumes

Sugar Volume Variance and Sugar Volumes

Adjusted Gross Margin

Adjusted Gross Margin

Maple Volumes and Adjusted Gross Margin

Maple Volumes and Adjusted Gross Margin

Free Cash Flow

Free Cash Flow

MONTREAL, Aug. 04, 2021 (GLOBE NEWSWIRE) -- Rogers Sugar Inc.’s (“our,” “we”, “us” or “Rogers”) (TSX: RSI) today reported third quarter fiscal 2021 results with consolidated adjusted EBITDA of $17.2 million and $66.2 million for the current quarter and the first nine months of the year, respectively.

"During the quarter, we continued to provide a reliable supply of high-quality products to meet our customers’ changing needs. Our operational flexibility allowed us to meet the higher volume demand in some segments while managing the impacts of volume reductions in others,” said John Holliday, President and Chief Executive Officer of Rogers and Lantic Inc. “We were able to mitigate the unfavourable impact of lower consumer retail volume attributable mainly to the timing in demand volatility as a result of the COVID-19 pandemic, with higher market-driven industrial, liquid and exports sales volumes. Over the next quarters, we anticipate a return to a more traditional volume mix and expect our overall performance to align with prior year levels.”

Third Quarter 2021 Consolidated Highlights | Q3 2021 | Q3 2020 | YTD 2021 | YTD 2020 | ||||

Financials ($000s) | ||||||||

Revenues | 210,931 | 206,147 | 650,700 | 614,589 | ||||

Adjusted gross margin(1) | 25,932 | 25,915 | 89,792 | 86,053 | ||||

Adjusted EBITDA(1) | 17,214 | 14,279 | 66,237 | 61,028 | ||||

Net earnings | 6,836 | 5,538 | 31,387 | 22,467 | ||||

per share (basic) | 0.07 | 0.05 | 0.30 | 0.22 | ||||

per share (diluted) | 0.07 | 0.05 | 0.29 | 0.22 | ||||

Adjusted net earnings(1) | 4,247 | 2,560 | 24,246 | 20,694 | ||||

Adjusted net earnings per share (basic)(1) | 0.04 | 0.02 | 0.23 | 0.20 | ||||

Trailing twelve months free cash flow(1) | 42,695 | 44,696 | 42,695 | 44,696 | ||||

Dividends per share | 0.09 | 0.09 | 0.27 | 0.27 | ||||

Volumes | ||||||||

Sugar (metric tonnes) | 190,563 | 172,054 | 564,752 | 535,659 | ||||

Maple Syrup (thousand pounds) | 11,471 | 14,313 | 40,578 | 39,999 | ||||

(1) See “Cautionary statement on Non-GAAP Measures” section of this press release for definition and reconciliation to GAAP measures.

Consolidated adjusted EBITDA for the third quarter of 2021 was $17.2 million, up 20.6% from the same quarter last year, driven by higher adjusted EBITDA in the Sugar segment offset by lower adjusted EBITDA in the Maple segment. Adjusted EBITDA for the first nine months of 2021 was $66.2 million, up 8.5% from the same period in 2020, largely as a result of improved adjusted EBITDA in both segments;

Adjusted EBITDA in the Sugar segment was $14.3 million in the third quarter, an increase of $3.3 million or 30.5% from the same quarter last year, largely due to higher volume and higher pricing, lower administration and selling expenses as well as lower distribution costs. This was partly offset by an increase in operating, energy and warehousing costs;

Sales volume in the Sugar segment increased by 10.8% to 190,563 metric tonnes in the third quarter, as stronger industrial, liquid and export volumes were partly offset by a reduction in consumer retail volume;

Adjusted EBITDA in the Maple segment was $2.9 million in the third quarter, a decrease of $0.4 million or 12.0% from the same quarter last year as a result of lower sales volume due mainly to the timing of the COVID-19 related demand during the current quarter offset by lower administration and selling expenses as well as lower distribution costs;

Free cash flow for the trailing 12 months ended July 3, 2021 was $42.7 million, a decrease of $2.0 million from the same period last year;

On April 30, 2021, Lantic issued $100 million in senior guaranteed Notes under a note purchase agreement as a private placement with certain institutional investors. The proceeds of the issuance were used to repay existing debt. The Notes carry an interest rate of 3.49% and are due on April 30, 2031 with interest payable semi-annually in arrears;

On June 18, 2021, we published our first Environmental, Social and Governance report. This report highlights our sustainability efforts in such areas as energy use, employee health and safety and Board of Directors renewal and diversity. The report can be accessed on SEDAR or on our website at www.Lanticrogers.com;

In the third quarter of 2021, we distributed $0.09 per share to our shareholders for a total amount of $9.3 million;

During the third quarter, Lantic participated in the fifth review of the orders of the Canadian International Trade Tribunal (“CITT”) concerning the anti-dumping and countervailing measures protecting the Canadian sugar industry against unfair imports of sugar from the United States and the European Union. We expect a decision from the CITT in the fourth quarter of 2021; and

On August 4, 2021, the Board of Directors declared a quarterly dividend of $0.09 per share, payable on October 12, 2021.

Sugar

Third Quarter 2021 Sugar Highlights | Q3 2021 | Q3 2020 | YTD 2021 | YTD 2020 | ||||

Financials ($000s) | ||||||||

Revenues | 161,237 | 144,173 | 476,656 | 442,597 | ||||

Adjusted gross margin(1) | 21,714 | 20,724 | 74,204 | 70,709 | ||||

Per metric tonne ($/ mt) (1) | 113.95 | 120.45 | 131.39 | 132.00 | ||||

Administration and selling expenses | 8,163 | 9,008 | 21,202 | 20,156 | ||||

Distribution costs | 3,747 | 4,844 | 12,439 | 12,069 | ||||

Adjusted EBITDA(1) | 14,265 | 10,928 | 54,007 | 50,895 | ||||

Volumes (metric tonnes) | ||||||||

Total volumes | 190,563 | 172,054 | 564,752 | 535,659 | ||||

(1) See “Cautionary statement on Non-GAAP Measures” section of this press release for definition and reconciliation to GAAP measures.

In the third quarter, revenue increased by 11.8% compared to the same period last year driven by higher volume and increased pricing.

Sugar volume increased by 10.8% or 18,509 metric tonnes in the third quarter 2021 compared to the same quarter last year as stronger industrial, liquid and export volumes were partly offset by a reduction in consumer volume.

The overall volume increase was due to higher industrial and liquid volumes from higher market driven demand, partially offset by a reduction in consumer volume. The reduction in consumer volume was due to higher volume purchased in 2020 related to the pantry-loading experienced in the early stage of the COVID-19 pandemic and timing of purchases from retailers who have high inventory of packed sugar.

Export volume also increased in the quarter due to higher beet sugar sales to the United States and Mexico. The increase was largely due to high demand, combined with improved availability of sugar from our Taber facility to fill those orders. The export sales were done under the Canadian United States Mexico Agreement quota (“CUSMA”) and through additional opportunistic sales to the United States and Mexico.

Adjusted gross margin increased by $1.0 million in the current quarter compared to the same quarter last year mainly as a result of higher sugar sales margin of $3.6 million from higher volume; and increased by-product net contribution of $1.9 million. This favourable variance was partially offset by higher processing costs of $4.7 million mainly driven by higher production volume at our Taber facility in the current quarter and higher energy and warehousing costs. On a per unit basis, adjusted gross margin for the third quarter was $113.95 per metric tonne, lower than last year by $6.50 per metric tonne. The decrease was due mainly to lower margin associated with the variance in sales mix from consumer retail to industrial and export.

Adjusted EBITDA for the third quarter increased by $3.3 million compared to the same period last year, largely as a result of higher adjusted gross margin, as mentioned above, and lower administration and selling expenses as well as lower distribution costs. During the quarter, administration and selling expenses were lower by $0.8 million compared to the same quarter last year due mainly to a decrease in related COVID-19 health and safety costs. Distribution costs decreased by $1.1 million as costs associated with reconfiguring our supply chain to serve our customers were lower compared to the same quarter last year due mainly to improved production volume from our Taber facility.

Maple

Third Quarter 2021 Maple Highlights | Q3 2021 | Q3 2020 | YTD 2021 | YTD 2020 | ||||

Financials ($000s) | ||||||||

Revenues | 49,694 | 61,974 | 174,044 | 171,992 | ||||

Adjusted gross margin(1) | 4,218 | 5,191 | 15,588 | 15,344 | ||||

As a percentage of revenues (%) (1) | 8.5 | % | 8.4 | % | 9.0 | % | 8.9 | % |

Administration and selling expenses | 2,563 | 2,810 | 7,078 | 8,392 | ||||

Distribution costs | 529 | 839 | 1,864 | 2,511 | ||||

Adjusted EBITDA(1) | 2,949 | 3,351 | 12,230 | 10,133 | ||||

Volumes (thousand pounds) | ||||||||

Total volumes | 11,471 | 14,313 | 40,578 | 39,999 | ||||

(1) See “Cautionary statement on Non-GAAP Measures” section of this press release for definition and reconciliation to GAAP measures.

Revenues for the third quarter of the current fiscal year were $12.3 million lower than the prior comparable period due to a reduction in orders from retail customers. The reduction was mainly attributable to higher volume purchased in 2020 related to the pantry-loading experienced in the early stage of the COVID-19 pandemic and timing of purchases from large retailers who have high inventory of maple syrup due to the volatility of the demand experienced throughout the pandemic.

Adjusted gross margin on percentage for the current quarter was 8.5%, higher by 10 basis points from the previous year. As a result of lower sales volume, adjusted gross margin was lower by $1.0 million from the comparable period last year. Adjusted EBITDA for the third quarter decreased by $0.4 million compared to the same period last year, largely as a result of lower adjusted gross margin, partially offset by lower administration and selling expenses as well as lower distribution costs. Administration and selling expenses were $0.2 million lower than the third quarter of last year, due mainly to a reduction of sales and marketing expenses related to trade shows and promotions, lower COVID-19 related costs as well as lower employee compensation and benefits costs. Distribution costs decreased by $0.3 million compared to the third quarter of last year, largely driven by a reduction in net freight costs from favourable negotiated agreements.

OUTLOOK

The health and safety of our employees remains our top priority. We are closely following all COVID-19 public health authority recommendations and have enhanced safety protocols in place. To date, our plants have operated without any disruption during the COVID-19 pandemic; however, the uncertainty and increased demand volatility make it difficult to estimate the impact on future sale volumes, operations and financial results. We are closely monitoring the situation and will continue to adapt quickly to the changing circumstances.

Fiscal 2021 had 52 weeks of operations while 2020 had 53 weeks, providing additional volumes in fiscal 2020 of approximately 14,000 metric tonnes for the Sugar segment and 1,000,000 lbs for the Maple segment. Despite an additional week of operations in fiscal 2020, we anticipate volumes to exceed prior year levels in both segments.

Sugar

Our full year fiscal 2021 sales volume guidance remains unchanged at approximately 776,000 metric tonnes, an increase of 15,000 metric tonnes over fiscal 2020, despite an extra week of operations in 2020. The volume for domestic sales is expected to remain consistent with prior year; however, a change in the mix from consumer retail to liquid industrial is expected to decrease overall sugar margin. We expect the reduction in retail consumer demand to be temporary and we anticipate demand for the retail market to return to pre-COVID-19 level over the next quarters.

Higher export volume driven by new export quotas including the CUSMA special quotas that took effect on July 1, 2020 and other opportunistic export sales to the United States and Mexico, are expected to yield an extra 20,000 metric tonnes of sales, which is expected to mitigate the unfavourable variance discussed above.

Our 2020 beet harvest campaign was completed, despite weather-related sugar beets deterioration, with an estimated production of 119,000 metric tonnes of beet sugar, 48,000 metric tonnes higher than last year but approximately 9,000 metric tonnes lower than expected as sugar beets had to be discarded at the end of the slicing campaign due to their severe deterioration. As a result, higher processing costs were incurred at the Taber facility due to the poor quality of the sugar beets at the end of the slicing campaign.

For the remainder of 2021, we expect distribution costs to be lower than last year as the impact of the current year crop shortfall in Taber was not as severe as last year’s crop issue, requiring less backfill of customer orders from our Vancouver facility.

Our capital spending expectation for the year will approximately range between $20 millions and $25 million, with about a quarter of these funds allocated to return-on-investment projects.

We are continuing to work with our strategic partner, Doux-Matok, to advance a unique sugar reduction solution based on cane sugar to food companies in North America. Although this is a small portion of the sweetener market, we believe this could provide a competitive offering in this niche market.

Maple

We saw a reduction in the demand for maple syrup in the third quarter as large retailers delayed their orders to adjust their high inventory of grocery related products. The high inventory levels for the retailers were mainly due to the volatility of the COVID-19 related demand. We expect demand for maple syrup to increase steadily over the next few quarters as the market stabilizes.

The improvements in sales margins and increased operational efficiencies evident in the first half of 2021, are expected to continue in the future. Sales margins are expected to improve as the impact of successful contract negotiations with new and existing customers comes into effect. In addition, we expect the ongoing optimization at our manufacturing facilities and efficiency improvements at our new Granby facility and existing Dégelis plant will continue to drive lower operating costs in the future.

We expect that firm underlying demand for maple syrup, combined with our improved margins and lower cost structure will result in improved financial performance for fiscal 2021, compared to 2020.

Capital investments are expected to be significantly lower for the Maple segment in 2021, following the completion of our capital projects in 2020 and the resulting increase in our production capacity.

See Cautionary statement on forward-looking information and NON-GAAP measure sections.

A full copy of Rogers third quarter 2021, including management’s discussion and analysis and unaudited condensed consolidated interim financial statements, can be found at www.LanticRogers.com.

Conference Call and Webcast

Rogers will host a conference call to discuss its third quarter fiscal 2021 results on August 4, 2021 starting at 5:30p.m. ET. To participate, please dial 1-888-400-2425. A recording of the conference call will be accessible shortly after the conference, by dialing 1-800-770-2030, access code 9031006#. This recording will be available until August 11, 2021. A live audio webcast of the conference call will also be available via www.LanticRogers.com.

About Rogers Sugar

Rogers is a corporation established under the laws of Canada. The Corporation holds all of the common shares of Lantic and its administrative office is in Montréal, Québec. Lantic operates cane sugar refineries in Montreal, Québec and Vancouver, British Columbia, as well as the only Canadian sugar beet processing facility in Taber, Alberta. Lantic also operate a custom blending and packaging operation and distribution center in Toronto, Ontario. Lantic’s sugar products are marketed under the “Lantic” trademark in Eastern Canada, and the “Rogers” trademark in Western Canada and include granulated, icing, cube, yellow and brown sugars, liquid sugars and specialty syrups. Lantic owns all of the common shares of TMTC and its head office is headquartered in Montréal, Québec. TMTC operates bottling plants in Granby, Dégelis and in St-Honore-de-Shenley, Québec and in Websterville, Vermont. TMTC’s products include maple syrup and derived maple syrup products supplied under retail private label brands in over fifty countries and also sold under various brand names, such as L.B. Maple Treat, Great Northern, Decacer and Highland Sugarworks.

For more information about Rogers please visit our website at www.LanticRogers.com.

Cautionary Statement Regarding forward-looking information

This report contains Statements or information that are or may be “forward-looking statements” or “forward-looking information” within the meaning of applicable Canadian securities laws. Forward-looking statements may include, without limitation, statements and information which reflect the current expectations of the Company with respect to future events and performance. Wherever used, the words “may,” “will,” “should,” “anticipate,” “intend,” “assume,” “expect,” “plan,” “believe,” “estimate,” and similar expressions and the negative of such expressions, identify forward-looking statements.

Although this is not an exhaustive list, Rogers cautions investors that statements concerning the following subjects are, or are likely to be, forward-looking statements:

future prices of raw sugar

natural gas costs

the opening of special refined sugar quotas in the United States (“U.S.”)

beet production forecasts

growth of the maple syrup industry

the status of labour contracts and negotiations

the level of future dividends

the status of government regulations and investigations

the impact of the COVID-19 pandemic on the Corporation and its operations.

Forward-looking statements are based on estimates and assumptions made by Rogers in light of its experience and perception of historical trends, current conditions and expected future developments, as well as other factors that we believe are appropriate and reasonable in the circumstances, including with respect to the continuity of its operations despite the COVID-19 pandemic, but there can be no assurance that such estimates and assumptions will prove to be correct. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. Actual performance or results could differ materially from those reflected in the forward-looking statements, historical results or current expectations. Readers should also refer to the section “Risks and Uncertainties” of the current quarter MD&A for additional information on risk factors and other events that are not within our control. These risks are also referred to in Rogers Annual Information Form in the “Risk Factors” section.

Although we believe that the expectations and assumptions on which forward-looking information is based are reasonable under the current circumstances, readers are cautioned not to rely unduly on this forward-looking information as no assurance can be given that it will prove to be correct. Forward-looking information contained herein is made as at the date of this press release and Rogers does not undertake any obligation to update or revise any forward-looking information, whether as a result of events or circumstances occurring after the date hereof, unless so required by law.

Cautionary Statement Regarding non-GAAP measures

In analyzing results, we supplement the use of financial measures that are calculated and presented in accordance with IFRS with a number of non-GAAP financial measures. A non-GAAP financial measure is a numerical measure of a company’s performance, financial position or cash flow that excludes (includes) amounts, or is subject to adjustments that have the effect of excluding (including) amounts, that are included (excluded) in most directly comparable measures calculated and presented in accordance with IFRS. Non-GAAP financial measures are not standardized; therefore, it may not be possible to compare these financial measures with the non-GAAP financial measures of other companies having the same or similar businesses. We strongly encourage investors to review the audited consolidated financial statements and publicly filed reports in their entirety, and not to rely on any single financial measure.

We use these non-GAAP financial measures in addition to, and in conjunction with, results presented in accordance with IFRS. These non-GAAP financial measures reflect an additional way of viewing aspects of the operations that, when viewed with the IFRS results and the accompanying reconciliations to corresponding IFRS financial measures, may provide a more complete understanding of factors and trends affecting our business. See “Non-GAAP measures” section at the end of the MD&A for the current quarter for additional information.

Financial Report Q3 2021

This Management’s Discussion and Analysis (“MD&A”) of Rogers Sugar Inc.’s (“Rogers”, “RSI” or “our,” “we”, “us”) dated August 4, 2021, should be read in conjunction with the unaudited condensed consolidated interim financial statements and related notes for the three- and nine-month periods ended July 3, 2021, as well as the audited consolidated financial statements and MD&A for the year ended October 3, 2020. The quarterly unaudited condensed consolidated interim financial statements and any amounts shown in this MD&A were not reviewed nor audited by our external independent auditors. This MD&A refers to Rogers, Lantic Inc. (“Lantic”) (Rogers and Lantic together referred as the “Sugar segment”), The Maple Treat Corporation (“Maple Treat”) and Highland Sugarworks Inc. (“Highland”) (the latter two companies together referred to as “TMTC” or the “Maple segment”).

Management is responsible for preparing the MD&A. This MD&A has been reviewed and approved by the Audit Committee of Rogers and its Board of Directors.

OUR BUSINESS

Rogers has a long history of providing high quality sugar products to the Canadian market and has been operating since 1888.

Lantic, Rogers wholly owned subsidiary, operates cane sugar refineries in Montreal, Québec and Vancouver, British Columbia, as well as the only Canadian sugar beet processing facility in Taber, Alberta. Lantic’s sugar products are marketed under the “Lantic” trademark in Eastern Canada, and the “Rogers” trademark in Western Canada and include granulated, icing, cube, yellow and brown sugars, liquid sugars and specialty syrups. We also operate a custom blending and packaging operation and distribution center in Toronto, Ontario.

Maple Treat operates bottling plants in Granby, Dégelis and in St-Honoré-de-Shenley, Québec and in Websterville, Vermont. Maple Treat’s products include maple syrup and derived maple syrup products supplied under retail private label brands in over fifty countries and also sold under various brand names, such as L.B. Maple Treat, Great Northern, Decacer and Highland Sugarworks.

Our Business has two distinct segments - Sugar – which includes refined sugar and by-products and Maple – which includes maple syrup and maple derived products.

UPDATE ON COVID-19

The ongoing COVID-19 pandemic has negatively impacted the global economy, disrupted financial markets and supply chain, significantly restricted business travel and interrupted business activity.

Our business is considered an essential service by the government and as such, our plants have continued to operate at usual capacity. We have established extensive protection measures and protocols to ensure the health and safety of our employees. COVID-19 could have a material effect on our business as it relates to customer demand, supply and delivery chain, operations, financial market volatility, pension and benefits liabilities and other economic fundamentals. For the third quarter and the first nine months of 2021, we incurred direct costs amounting to $0.6 million and $2.5 million respectively in relation to COVID-19. These costs were largely due to increased health and safety measures implemented across all production facilities.

The effect of COVID-19 on our business may continue for an extended period and the ultimate impact will depend on future developments that are uncertain and cannot be predicted, including and without limitations, the duration and severity of the pandemic, the duration of the government support measures, the effectiveness of the actions taken to contain and treat the disease and the length of time it takes for normal economic and operating conditions to resume.

BUSINESS HIGHLIGHTS

Consolidated adjusted EBITDA for the third quarter of 2021 was $17.2 million, up 20.6% from the same quarter last year, driven by higher adjusted EBITDA in the Sugar segment offset by lower adjusted EBITDA in the Maple segment. Adjusted EBITDA for the first nine months of 2021 was $66.2 million, up 8.5% from the same period in 2020, largely as a result of improved adjusted EBITDA in both segments;

Adjusted EBITDA in the Sugar segment was $14.3 million in the third quarter, an increase of $3.3 million or 30.5% from the same quarter last year, largely due to higher volume and higher pricing, lower administration and selling expenses as well as lower distribution costs. This was partly offset by an increase in operating, energy and warehousing costs;

Sales volume in the Sugar segment increased by 10.8% to 190,563 metric tonnes in the third quarter, as stronger industrial, liquid and export volumes were partly offset by a reduction in consumer retail volume;

Adjusted EBITDA in the Maple segment was $2.9 million in the third quarter, a decrease of $0.4 million or 12.0% from the same quarter last year as a result of lower sales volume due mainly to the timing of the COVID-19 related demand during the current quarter offset by lower administration and selling expenses as well as lower distribution costs;

Free cash flow for the trailing 12 months ended July 3, 2021 was $42.7 million, a decrease of $2.0 million from the same period last year;

On April 30, 2021, Lantic issued $100 million in senior guaranteed Notes under a note purchase agreement as a private placement with certain institutional investors. The proceeds of the issuance were used to repay existing debt. The Notes carry an interest rate of 3.49% and are due on April 30, 2031 with interest payable semi-annually in arrears;

On June 18, 2021, we published our first Environmental, Social and Governance report. This report highlights our sustainability efforts in such areas as energy use, employee health and safety and Board of Directors renewal and diversity. The report can be accessed on SEDAR or on our website at www.Lanticrogers.com;

In the third quarter of 2021, we distributed $0.09 per share to our shareholders for a total amount of $9.3 million;

During the third quarter, Lantic participated in the fifth review of the orders of the Canadian International Trade Tribunal (“CITT”) concerning the anti-dumping and countervailing measures protecting the Canadian sugar industry against unfair imports of sugar from the United States and the European Union. We expect a decision from the CITT in the fourth quarter of 2021; and

On August 4, 2021, the Board of Directors declared a quarterly dividend of $0.09 per share, payable on October 12, 2021.

SELECTED FINANCIAL DATA AND HIGHLIGHTS

(unaudited) | Q3 2021 | Q3 2020 | YTD 2021 | YTD 2020 |

Sugar (metric tonnes) | 190,563 | 172,054 | 564,752 | 535,659 |

Maple syrup (‘000 pounds) | 11,471 | 14,313 | 40,578 | 39,999 |

Total revenues | 210,931 | 206,147 | 650,700 | 614,589 |

Gross Margin | 30,064 | 29,873 | 100,128 | 88,309 |

Adjusted gross margin(1) | 25,932 | 25,915 | 89,792 | 86,053 |

Results from operating activities | 15,062 | 12,372 | 57,545 | 45,181 |

Adjusted results from operating activities(1) | 10,930 | 8,414 | 47,209 | 42,925 |

Adjusted EBITDA(1) | 17,214 | 14,279 | 66,237 | 61,028 |

Net earnings | 6,836 | 5,538 | 31,387 | 22,467 |

per share (basic) | 0.07 | 0.05 | 0.30 | 0.22 |

per share (diluted) | 0.07 | 0.05 | 0.29 | 0.22 |

Adjusted net earnings(1) | 4,247 | 2,560 | 24,246 | 20,694 |

Adjusted net earnings per share (basic)(1) | 0.04 | 0.02 | 0.23 | 0.20 |

Trailing twelve months free cash flow(1) | 42,695 | 44,696 | 42,695 | 44,696 |

Dividends per share | 0.09 | 0.09 | 0.27 | 0.27 |

(1) See “Non-GAAP Measures” section for definition and reconciliation to GAAP measures.

Revenue and Adjusted EBITDA: https://www.globenewswire.com/NewsRoom/AttachmentNg/e4a50546-2855-4aaf-b433-2e23508d87a5

Adjusted Net Earnings and Free Cash Flow: https://www.globenewswire.com/NewsRoom/AttachmentNg/5d0fa2c0-ee4b-465e-9b6b-85393d3e446e

Adjusted results

In the normal course of business, we use derivative financial instruments consisting of sugar futures, foreign exchange forward contracts, natural gas futures and interest rate swaps. We have designated our natural gas futures and our interest rate swap agreements entered into in order to protect us against natural gas prices and interest rate fluctuations as cash flow hedges. Derivative financial instruments pertaining to sugar futures and foreign exchange forward contracts are marked-to-market at each reporting date and are charged to the consolidated statement of earnings. The unrealized gains/losses related to natural gas futures and interest rate swaps are accounted for in other comprehensive income. The amount recognized in other comprehensive income is removed and included in net earnings under the same line item in the consolidated statement of earnings and comprehensive income as the hedged item, in the same period that the hedged cash flows affect net earnings, reducing earnings volatility related to the movements of the valuation of these derivatives hedging instruments.

We believe that our financial results are more meaningful to management, investors, analysts, and any other interested parties when financial results are adjusted by the gains and losses from financial derivative instruments. These adjusted financial results provide a more complete understanding of factors and trends affecting our business. This measurement is a non-GAAP measurement. See “Non-GAAP measures” section.

We use the non-GAAP adjusted results of the operating company to measure and to evaluate the performance of the business through our adjusted gross margin, adjusted results from operating activities, adjusted EBITDA, adjusted net earnings, adjusted net earnings per share and trailing twelve months free cash flow. In addition, we believe that these measures are important to our investors and parties evaluating our performance and comparing such performance to past results. We also use adjusted gross margin, adjusted EBITDA, adjusted results from operating activities and adjusted net earnings when discussing results with the Board of Directors, analysts, investors, banks and other interested parties. See “Non-GAAP measures” section.

OUR RESULTS ARE ADJUSTED AS FOLLOWS:

Income (loss) | Q3 2021 | Q3 2020 | |||||||||

Sugar | Maple | Total | Sugar | Maple | Total | ||||||

Mark-to-market on: | |||||||||||

Sugar futures contracts | (489 | ) | - | (489 | ) | 1,302 | - | 1,302 | |||

Foreign exchange forward contracts | (416 | ) | 341 | (75 | ) | 2,135 | 944 | 3,079 | |||

Total mark-to-market adjustment on derivatives | (905 | ) | 341 | (564 | ) | 3,437 | 944 | 4,381 | |||

Cumulative timing differences | 5,785 | (1,089 | ) | 4,696 | (1,213 | ) | 741 | (472 | ) | ||

Adjustment to cost of sales | 4,880 | (748 | ) | 4,132 | 2,224 | 1,685 | 3,909 | ||||

Amortization of transitional balance to cost of sales and changes in fair value of expired contracts for cash flow hedges | - | - | - | 49 | - | 49 | |||||

Total adjustment to costs of sales | 4,880 | (748 | ) | 4,132 | 2,273 | 1,685 | 3,958 | ||||

Income (loss) | YTD 2021 | YTD 2020 | ||||||

Sugar | Maple | Total | Sugar | Maple | Total | |||

Mark-to-market on: | ||||||||

Sugar futures contracts | 552 | - | 552 | 965 | - | 965 | ||

Foreign exchange forward contracts | 3,406 | 2,233 | 5,639 | 613 | (59 | ) | 554 | |

Total mark-to-market adjustment on derivatives | 3,958 | 2,233 | 6,191 | 1,578 | (59 | ) | 1,519 | |

Cumulative timing differences | 7,196 | (3,051 | ) | 4,145 | 532 | 134 | 666 | |

Adjustment to cost of sales | 11,154 | (818 | ) | 10,336 | 2,110 | 75 | 2,185 | |

Amortization of transitional balance to cost of sales and changes in fair value of expired contracts for cash flow hedges | - | - | - | 71 | - | 71 | ||

Total adjustment to costs of sales | 11,154 | (818 | ) | 10,336 | 2,181 | 75 | 2,256 | |

Fluctuations in the mark-to-market adjustment on derivatives are due to the price movements in #11 world raw sugar and foreign exchange variations.

We recognize cumulative timing differences, as a result of mark-to-market gains or losses, only when sugar is sold to a customer. The gains or losses on sugar and related foreign exchange paper transactions are largely offset by corresponding gains or losses from the physical transactions, namely sale and purchase contracts with customers and suppliers.

The above described adjustments are added to or deducted from the mark-to-market results to arrive at the total adjustment to cost of sales. For the three and nine months periods ended on July 3, 2021, the total cost of sales adjustment is a gain of $4.1million and $10.3 million, respectively, to be deducted from the consolidated results versus a gain of $4.0 million and $2.3 million to be deducted from the consolidated results for the comparable periods last year, respectively.

See the “Non-GAAP measures” section for more information on these adjustments.

SEGMENTED INFORMATION

Segmented Results | Q3 2021 | Q3 2020 | |||||

Sugar | Maple | Total | Sugar | Maple | Total | ||

Revenues | 161,237 | 49,694 | 210,931 | 144,173 | 61,974 | 206,147 | |

Gross margin | 26,594 | 3,470 | 30,064 | 22,997 | 6,876 | 29,873 | |

Administration and selling expenses | 8,163 | 2,563 | 10,726 | 9,008 | 2,810 | 11,818 | |

Distribution costs | 3,747 | 529 | 4,276 | 4,844 | 839 | 5,683 | |

Results from operating activities | 14,684 | 378 | 15,062 | 9,145 | 3,227 | 12,372 | |

Adjustment to cost of sales(2) | 4,880 | (748 | ) | 4,132 | 2,273 | 1,685 | 3,958 |

Adjusted Gross margin(1) | 21,714 | 4,218 | 25,932 | 20,724 | 5,191 | 25,915 | |

Adjusted results from operating activities(1) | 9,804 | 1,126 | 10,930 | 6,872 | 1,542 | 8,414 | |

Adjusted EBITDA(1) | 14,265 | 2,949 | 17,214 | 10,928 | 3,351 | 14,279 | |

Additional information: | |||||||

Additions to property, plant and equipment and intangible assets, net of disposals | 5,215 | 247 | 5,462 | 4,986 | 882 | 5,868 | |

Increase in asset retirement obligation provision included in property, plant and equipment | 3,131 | - | 3,131 | 100 | - | 100 | |

Additions to right-of-use assets | 1,475 | 823 | 2,298 | 1,615 | - | 1,615 | |

(1) See “Non-GAAP Measures” section for definition and reconciliation to GAAP measures

(2) See “Adjusted results” section

Segmented Results | YTD 2021 | YTD 2020 | |||||

Sugar | Maple | Total | Sugar | Maple | Total | ||

Revenues | 476,656 | 174,044 | 650,700 | 442,597 | 171,992 | 614,589 | |

Gross margin | 85,358 | 14,770 | 100,128 | 72,890 | 15,419 | 88,309 | |

Administration and selling expenses | 21,202 | 7,078 | 28,280 | 20,156 | 8,392 | 28,548 | |

Distribution costs | 12,439 | 1,864 | 14,303 | 12,069 | 2,511 | 14,580 | |

Results from operating activities | 51,717 | 5,828 | 57,545 | 40,665 | 4,516 | 45,181 | |

Adjustment to cost of sales(2) | 11,154 | (818 | ) | 10,336 | 2,181 | 75 | 2,256 |

Adjusted Gross margin(1) | 74,204 | 15,588 | 89,792 | 70,709 | 15,344 | 86,053 | |

Adjusted results from operating activities(1) | 40,563 | 6,646 | 47,209 | 38,484 | 4,441 | 42,925 | |

Adjusted EBITDA(1) | 54,007 | 12,230 | 66,237 | 50,895 | 10,133 | 61,028 | |

Additional information: | |||||||

Additions to property, plant and equipment and intangible assets, net of disposals | 18,180 | 725 | 18,905 | 12,217 | 5,991 | 18,208 | |

Increase in asset retirement obligation provision included in property, plant and equipment | 3,131 | - | 3,131 | 100 | - | 100 | |

Additions to right-of-use assets | 1,858 | 823 | 2,681 | 2,953 | 7,813 | 10,766 | |

(1) See “Non-GAAP Measures” section for definition and reconciliation to GAAP measures

(2) See “Adjusted results” section

Sugar

REVENUES

Q3 2021 | Q3 2020 | ∆ | YTD 2021 | YTD 2020 | ∆ | |

(In thousands of dollars) | 161,237 | 144,173 | 17,064 | 476,656 | 442,597 | 34,059 |

Sugar Volume Variance and Sugar Volumes: https://www.globenewswire.com/NewsRoom/AttachmentNg/954aeec7-5698-4df4-83fb-524ea491dc99

In the third quarter and first nine months of fiscal 2021, revenues increased by 11.8% and 7.7% respectively, compared to the same periods last year driven by higher volume and increased pricing.

Sugar volume increased by 10.8% or 18,509 metric tonnes in the third quarter 2021 compared to the same quarter last year as stronger industrial, liquid and export volumes were partly offset by a reduction in consumer volume.

The overall volume increase was due to higher industrial and liquid volumes from higher market driven demand, partially offset by a reduction in consumer volume. The reduction in consumer volume was due to higher volume purchased in 2020 related to the pantry-loading experienced in the early stage of the COVID-19 pandemic and timing of purchases from retailers who have high inventory of packed sugar.

Export volume also increased in the quarter due to higher beet sugar sales to the United States and Mexico. The increase was largely due to high demand, combined with improved availability of sugar from our Taber facility to fill those orders. The export sales were done under the Canadian United States Mexico Agreement quota (“CUSMA”) and through additional opportunistic sales to the United States and Mexico.

In the first nine months of 2021, sugar volume totaled 564,752 metric tonnes, an increase of 5.4% or 29,093 metric tonnes compared to the same period last year, as stronger industrial, liquid and export volumes were partly offset by a reduction in consumer volume.

The overall increase was due to higher industrial and liquid volumes, from higher market driven demand from existing and new customers, partially offset by a reduction in consumer volume. The reduction in consumer volume was due to lower purchases from retailers mainly in the third quarter as explained above.

Export volume also increased in the first nine months of 2021 due to higher beet sugar sales to the United States and Mexico throughout the period. The increase was largely due to high demand, combined with improved availability of sugar from our Taber facility to fill those orders. The export sales were done under the quota CUSMA and through additional opportunistic sales to the United States and Mexico.

GROSS MARGIN

Q3 2021 | Q3 2020 | ∆ | YTD 2021 | YTD 2020 | ∆ | |||||||

(In thousands of dollars, except per metric tonne information) | ||||||||||||

Gross margin | 26,594 | 22,997 | 3,597 | 85,358 | 72,890 | 12,468 | ||||||

Total adjustment to cost of sales(2) | (4,880) | (2,273) |

| (11,154) | (2,181) | (8,973) | ||||||

Adjusted gross margin(1) | 21,714 | 20,724 | 990 | 74,204 | 70,709 | 3,495 | ||||||

Adjusted gross margin per metric tonne(1) | 113.95 | 120.45 | (6.50) | 131.39 | 132.00 | (0.61) | ||||||

Included in Gross margin: | 3,757 | 3,576 | 181 | 11,332 | 10,998 | 334 | ||||||

(1) See “Non-GAAP Measures” section for definition and reconciliation to GAAP measures

(2) See “Adjusted results” section

Gross margins were $26.6 million and $85.4 million for the three and nine months ended July 3, 2021, and include a gain of $4.9 and $11.2 million, respectively, for the mark-to-market of derivative financial instruments. For the same periods last year, gross margins were $23.0 million and $72.9 million, respectively, with a mark-to-market gain of $2.3 million and $2.2 million.

Adjusted gross margin were $21.7 million and $74.2 million for the third quarter and for the first nine months of 2021, respectively, as compared to $20.7 million and $70.7 million in the same periods of 2020.

Adjusted gross margin increased by $1.0 million in the current quarter compared to the same quarter last year mainly as a result of higher sugar sales margin of $3.6 million from higher volume; and increased by-product net contribution of $1.9 million. This favourable variance was partially offset by higher processing costs of $4.7 million mainly driven by higher production volume at our Taber facility in the current quarter and higher energy and warehousing costs. On a per unit basis, adjusted gross margin for the third quarter was $113.95 per metric tonne, lower than last year by $6.50 per metric tonne. The decrease was due mainly to lower margin associated with the variance in sales mix from consumer retail to industrial and export.

Adjusted gross margin for the first nine months of 2021 was $3.5 million higher than the comparable period last year, mainly due to higher sales volumes for sugar and by-products, partially offset by higher production costs mainly associated with the unfavourable weather-related sugar beet storage, causing severe sugar beet deterioration, encountered in the second quarter of 2021. This deterioration resulted in higher processing costs as well as sugar beets being discarded and therefore reducing the expected sugar production from Taber by 9,000 metric tonnes. On a per unit basis, for the first nine months of 2021, adjusted gross margin amounted to $131.39 per metric tonne compared to $132.00 per metric tonne.

Adjusted Gross Margin: https://www.globenewswire.com/NewsRoom/AttachmentNg/f7009d76-a674-4ddf-9c47-a5df1cfa3319

OTHER EXPENSES

Q3 2021 | Q3 2020 | ∆ | YTD 2021 | YTD 2020 | ∆ | |

(In thousands of dollars) | ||||||

Administration and selling expenses | 8,163 | 9,008 | (845) | 21,202 | 20,156 | 1,046 |

Distribution costs | 3,747 | 4,844 | (1,097) | 12,439 | 12,069 | 370 |

Included in Administration and selling expenses: | 49 | 213 | (164) | 676 | 632 | 44 |

Included in Distribution costs: | 654 | 267 | 387 | 1,435 | 781 | 654 |

In the third quarter, administration and selling expenses were lower by $0.8 million compared to the same quarter last year due mainly to a decrease in COVID-19 related health and safety costs. Distribution costs decreased by $1.1 million as costs associated with reconfiguring our supply chain to serve our customers were lower compared to the same quarter last year due to improved production volume from our Taber facility.

For the first nine months of 2021, administration and selling expenses were $1.0 million higher than the comparable period last year, due mainly to incremental COVID-19 related costs incurred in the first three quarters of 2021. Distribution cost increased by $0.4 million compared to the first nine months of 2020, largely driven by additional logistical costs incurred to support our supply chain in the first quarter of 2021, as strong demand in the fourth quarter of fiscal 2020 resulted in lower than typical inventory levels at the beginning of fiscal year 2021. This increased logistical cost was offset by lower distribution costs in the second and third quarters of 2021 as the costs to reconfigure our supply chain to compensate for the crop shortfall during these quarters were lower compared to the same quarters last year.

RESULTS FROM OPERATING ACTIVITIES AND ADJUSTED EBITDA

Q3 2021 | Q3 2020 | ∆ | YTD 2021 | YTD 2020 | ∆ | |||||

(In thousands of dollars) | ||||||||||

Results from operating activities | 14,684 | 9,145 | 5,539 | 51,717 | 40,665 | 11,052 | ||||

Total adjustment to cost of sales (2) | (4,880 | ) | (2,273 | ) | (2,607) | (11,154 | ) | (2,181 | ) | (8,973) |

Adjusted results from operating activities (1) | 9,804 | 6,872 | 2,932 | 40,563 | 38,484 | 2,079 | ||||

Depreciation of property, plant and equipment, right-of-use assets, and amortization of intangible assets | 4,461 | 4,056 | 405 | 13,444 | 12,411 | 1,033 | ||||

Adjusted EBITDA(1) | 14,265 | 10,928 | 3,337 | 54,007 | 50,895 | 3,112 | ||||

(1) See “Non-GAAP Measures” section for definition and reconciliation to GAAP measures

(2) See “Adjusted results” section

Results from operating activities for the third quarter and the first nine months of 2021 were $14.7 million and $51.7 million respectively, an increase from $9.1 million and $40.7 million compared to the same periods last year. These results include gains and losses from the mark-to-market valuation of derivative financial instruments, as well as timing differences in the recognition of any gains and losses on the liquidation of derivative instruments. In addition, higher non-cash depreciation and amortization expense from new in service assets had a negative impact on the results from operating activities.

Adjusted results from operating activities in the third quarter of 2021 were $2.9 million higher than the same period last year, mainly due to higher adjusted gross margin and lower administration and selling expenses as well as lower distribution costs as explained above. Adjusted results from operating activities for the first nine months of 2021 were $2.1 million higher than the same period last year, as higher adjusted gross margin was offset by higher administration and selling expenses and higher distribution costs.

Adjusted EBITDA for the third quarter increased by $3.3 million compared to the same period last year, largely as a result of higher adjusted gross margin and lower administration and selling expenses as well as lower distribution costs. Adjusted EBITDA for the first nine months increased by $3.1 million largely due to higher adjusted gross margin offset by higher administration and distribution costs, as mentioned above.

Maple

REVENUES

Q3 2021 | Q3 2020 | ∆ | YTD 2021 | YTD 2020 | ∆ | |

(In thousands of dollars, except volumes) | ||||||

Volumes (‘000 pounds) | 11,471 | 14,313 | (2,842) | 40,578 | 39,999 | 579 |

Revenues | 49,694 | 61,974 | (12,280) | 174,044 | 171,992 | 2,052 |

Maple Volumes and Adjusted Gross Margin: https://www.globenewswire.com/NewsRoom/AttachmentNg/91db2be3-29bd-404c-920d-1911194225f3

Revenues for the third quarter of the current fiscal year were $12.3 million lower than the prior comparable period due to a reduction in orders from retail customers. The reduction was mainly attributable to higher volume purchased in 2020 related to the pantry-loading experienced in the early stage of the COVID-19 pandemic and timing of purchases from large retailers who have high inventory of maple syrup due to the volatility of the demand experienced throughout the pandemic. For the first nine month of the current fiscal year, revenues were $2.1 million higher than last year, as the unfavourable variance of the third quarter of 2021, was offset by the strong demand of the first half of the year.

GROSS MARGIN

Q3 2021 | Q3 2020 | ∆ | YTD 2021 | YTD 2020 | ∆ | |||||

(In thousands of dollars, except adjusted gross margin rate information) | ||||||||||

Gross margin | 3,470 | 6,876 | (3,406) | 14,770 | 15,419 | (649) | ||||

Total adjustment to cost of sales(2) | 748 | (1,685 | ) | 2,433 | 818 | (75 | ) | 893 | ||

Adjusted gross margin(1) | 4,218 | 5,191 | (973) | 15,588 | 15,344 | 244 | ||||

Adjusted gross margin percentage(1) | 8.5 | % | 8.4 | % | 0.1% | 9.0 | % | 8.9 | % | 0.1% |

Included in Gross margin: | 954 | 785 | 169 | 2,722 | 2,274 | 448 | ||||

(1) See “Non-GAAP Measures” section for definition and reconciliation to GAAP measures

(2) See “Adjusted results” section

Gross margin was $3.5 million and $14.8 million for the three and nine months ended in the current fiscal year and include a loss of $0.7 and $0.8 million, respectively, for the mark-to-market of derivative financial instruments. For the same periods last year, gross margin was $6.9 million and $15.4 million, respectively, with a mark-to-market gain of $1.7 million and $0.1 million.

Adjusted gross margin on percentage for the current quarter was 8.5%, higher by 10 basis points from the previous year. As a result of lower sales volume, adjusted gross margin was lower by $1.0 million from the comparable period last year.

Adjusted gross margin and adjusted gross margin percentage for the first nine months of the current fiscal year were both slightly higher than the comparable period last year.

OTHER EXPENSES

Q3 2021 | Q3 2020 | ∆ | YTD 2021 | YTD 2020 | ∆ | |

(In thousands of dollars) | ||||||

Administration and selling expenses | 2,563 | 2,810 | (247) | 7,078 | 8,392 | (1,314) |

Distribution costs | 529 | 839 | (309) | 1,864 | 2,511 | (647) |

Included in Administration and selling expenses: | 869 | 879 | (10) | 2,615 | 2,629 | (14) |

Administration and selling expenses were $0.2 million and $1.3 million lower than the third quarter and the first nine months of last year, respectively, due to a reduction of sales and marketing expenses related to trade shows and promotions, lower COVID-19 related costs as well as lower employee compensation and benefits costs. Distribution costs decreased by $0.3 million and $0.6 million compared to the third quarter and the first nine months of last year, respectively, largely driven by a reduction in net freight costs from favourable negotiated agreements.

RESULTS FROM OPERATING ACTIVITIES AND ADJUSTED EBITDA

Q3 2021 | Q3 2020 | ∆ | YTD 2021 | YTD 2020 | ∆ | |||

(In thousands of dollars) | ||||||||

Results from operating activities | 378 | 3,227 | (2,849) | 5,828 | 4,516 | 1,312 | ||

Total adjustment to cost of sales(2) | 748 | (1,685 | ) | 2,433 | 818 | (75 | ) | 893 |

Adjusted results from operating activities(1) | 1,126 | 1,542 | (416) | 6,646 | 4,441 | 2,205 | ||

Non-recurring expenses: | ||||||||

Other one-time non-recurring items | - | 145 | (145) | 247 | 789 | (542) | ||

Depreciation and amortization | 1,823 | 1,664 | 159 | 5,337 | 4,903 | 434 | ||

Adjusted EBITDA(1) | 2,949 | 3,351 | (402) | 12,230 | 10,133 | 2,097 | ||

(1) See “Non-GAAP Measures” section for definition and reconciliation to GAAP measures

(2) See “Adjusted results” section

Results from operating activities for the third quarter and the first nine months of 2021 were $0.4 million and $5.8 million respectively, compared to $3.2 million and $4.5 million in the same periods last year. These results include gains and losses from the mark-to-market of derivative financial instruments, as well as timing differences in the recognition of any gains and losses on the liquidation of derivative instruments.

Certain non-cash items and non-recurring expenses had an impact on the results from operating activities. As such, Management believes that the Maple segment’s financial results are more meaningful to management, investors, analysts, and any other interested parties when financial results are adjusted for the above-mentioned items. Other non recurrent items in the third quarter and the first nine months of 2020 were mainly costs associated with having two locations in Granby.

Adjusted results from operating activities for the current quarter were $0.4 million lower than the same period last year, due to lower adjusted gross margin, partially offset by lower administration and selling expenses as well as lower distribution costs as explained above. For the first nine months of fiscal 2021, adjusted results from operating activities were $2.2 million higher than the comparable period last year, mainly explained by a reduction in administration and selling expenses as well as lower distribution costs.

Adjusted EBITDA for the third quarter decreased by $0.4 million compared to the same period last year, largely as a result of lower adjusted gross margin offset by lower administration and selling expenses as well as lower distribution costs. Adjusted EBITDA for the first nine months increased by $2.1 million largely explained by lower administration and selling expenses as well as lower distribution costs, as mentioned above.

OUTLOOK

The health and safety of our employees remains our top priority. We are closely following all COVID-19 public health authority recommendations and have enhanced safety protocols in place. To date our plants have operated without any disruption during the COVID-19 pandemic; however, the uncertainty and increased demand volatility make it difficult to estimate the impact on future sale volumes, operations, and financial results. We are closely monitoring the situation and will continue to adapt quickly to the changing circumstances.

Fiscal 2021 had 52 weeks of operations while 2020 had 53 weeks, providing additional volumes in fiscal 2020 of approximately 14,000 metric tonnes for the Sugar segment and 1,000,000 lbs for the Maple segment. Despite an additional week of operations in fiscal 2020, we anticipate volumes to exceed prior year levels in both segments.

Sugar

Our full year fiscal 2021 sales volume guidance remains unchanged at approximately 776,000 metric tonnes, an increase of 15,000 metric tonnes over fiscal 2020, despite an extra week of operations in 2020. The volume for domestic sales is expected to remain consistent with prior year; however, a change in the mix from consumer retail to liquid industrial is expected to decrease overall sugar margin. We expect the reduction in retail consumer demand to be temporary and we anticipate demand for the retail market to return to pre-COVID-19 level over the next quarters.

Higher export volume driven by new export quotas including the CUSMA special quotas that took effect on July 1, 2020, and other opportunistic export sales to the United States and Mexico, are expected to yield an extra 20,000 metric tonnes of sales, which is expected to mitigate the unfavourable variance discussed above.

Our 2020 beet harvest campaign was completed, despite weather-related sugar beets deterioration, with an estimated production of 119,000 metric tonnes of beet sugar, 48,000 metric tonnes higher than last year but approximately 9,000 metric tonnes lower than expected as sugar beets had to be discarded at the end of the slicing campaign due to their severe deterioration. As a result, higher processing costs were incurred at the Taber facility due to the poor quality of the sugar beets at the end of the slicing campaign.

For the remainder of 2021, we expect distribution costs to be lower than last year as the impact of the current year crop shortfall in Taber was not as severe as last year’s crop issue, requiring less backfill of customer orders from our Vancouver facility.

Our capital spending expectation for the year will approximately range between $20 million and $25 million, with about a quarter of these funds allocated to return-on-investment projects.

We are continuing to work with our strategic partner, Doux-Matok, to advance a unique sugar reduction solution based on cane sugar to food companies in North America. Although this is a small portion of the sweetener market, we believe this could provide a competitive offering in this niche market.

Maple

We saw a reduction in the demand for maple syrup in the third quarter as large retailers delayed their orders to adjust their high inventory of grocery related products. The high inventory levels for the retailers were mainly due to the volatility of the COVID-19 related demand. We expect demand for maple syrup to increase steadily over the next few quarters as the market stabilizes.

The improvements in sales margins and increased operational efficiencies evident in the first half of 2021, are expected to continue in the future. Sales margins are expected to improve as the impact of successful contract negotiations with new and existing customers comes into effect. In addition, we expect the ongoing optimization at our manufacturing facilities and efficiency improvements at our new Granby facility and existing Dégelis plant will continue to drive lower operating costs in the future.

We expect that firm underlying demand for maple syrup, combined with our improved margins and lower cost structure will result in improved financial performance for fiscal 2021, compared to 2020.

Capital investments are expected to be significantly lower for the Maple segment in 2021, following the completion of our capital projects in 2020 and the resulting increase in our production capacity.

See “Forward Looking Statements” section and “Risks and Uncertainties” section.

CONSOLIDATED RESULTS AND SELECTED FINANCIAL INFORMATION

Q3 2021 | Q3 2020 | YTD 2021 | YTD 2020 | ||

(unaudited) | |||||

Sugar (metric tonnes) | 190,563 | 172,054 | 564,752 | 535,659 | |

Maple syrup (000 pounds) | 11,471 | 14,313 | 40,578 | 39,999 | |

Total revenues | 210,931 | 206,147 | 650,700 | 614,589 | |

Gross margin | 30,064 | 29,873 | 100,128 | 88,309 | |

Adjusted Gross Margin(1) | 25,932 | 25,915 | 89,792 | 86,053 | |

Results from operating activities | 15,062 | 12,372 | 57,545 | 45,181 | |

Adjusted results from operating activities(1) | 10,930 | 8,414 | 47,209 | 42,925 | |

Adjusted EBITDA(1) | 17,214 | 14,279 | 66,237 | 61,028 | |

Net finance costs | 5,345 | 4,147 | 14,424 | 13,532 | |

Income tax expense | 2,881 | 2,687 | 11,734 | 9,182 | |

Net earnings | 6,836 | 5,538 | 31,387 | 22,467 | |

per share (basic) | 0.07 | 0.05 | 0.30 | 0.22 | |

per share (diluted) | 0.07 | 0.05 | 0.29 | 0.22 | |

Adjusted net earnings(1) | 4,247 | 2,560 | 24,246 | 20,694 | |

per share (basic)(1) | 0.04 | 0.02 | 0.23 | 0.20 | |

Dividends per share | 0.09 | 0.09 | 0.27 | 0.27 | |

(1) See “Non-GAAP Measures” section for definition and reconciliation to GAAP measures

Total revenues

Revenues increased by $4.8 million and $36.1 million for the third quarter and for the first nine months of 2021, respectively versus comparable periods last year. Revenue increased due to increased sales volume and higher prices from the Sugar segment.

Gross margin

Excluding the mark-to-market of derivative financial instruments, adjusted gross margin for the third quarter of the current year remained largely unchanged as the increase in the Sugar segment was offset by the decrease in the Maple segment. For the Sugar segment, the adjusted gross margin per metric tonne was lower by $6.50 per metric tonne in the current quarter, due mainly to higher processing cost at our Taber facility. For the Maple segment, the adjusted gross margin percentage improved by 10 basis points to 8.5% compared to 8.4% in the same period last year.

For the first nine months of 2021, adjusted gross margin was $3.7 million higher than the same period last year mainly driven by higher sugar sales margin and increased by-product net contribution.

Results from operating activities

Excluding the mark-to-market of derivative financial instruments, adjusted results from operating activities for the current quarter amounted to $10.9 million compared to $8.4 million in the same quarter last year, an increase of $2.5 million. For the first nine months of 2021, adjusted results from operating activities were $47.2 million compared to $42.9 million, representing an increase of $4.3 million. The improvement in the current quarter was mainly driven by higher contribution from the Sugar segment offset by the lower results from the Maple segment. For the first nine months of fiscal 2021, the improvement in the adjusted results from operating activities resulted from higher contribution from both segments.

Net finance costs

Q3 2021 | Q3 2020 | ∆ | YTD 2021 | YTD 2020 | ∆ | |

(In thousands of dollars) | ||||||

Interest expense on convertible unsecured subordinated debentures | 2,101 | 2,114 | (13) | 6,241 | 6,285 | (44) |

Interest on revolving credit facility | 1,314 | 1,461 | (147) | 4,670 | 4,990 | (320) |

Interest on private placement | 612 | - | 612 | 612 | - | 612 |

Amortization of deferred financing fees | 316 | 297 | 19 | 909 | 890 | 19 |

Other interest expense | 391 | 275 | 116 | 1,381 | 1367 | 14 |

Net change in fair value in interest rate swaps | 611 | - | 611 | 611 | - | 611 |

Net finance costs | 5,345 | 4,147 | 1,198 | 14,424 | 13,532 | 892 |

For the third quarter and first nine months of the current year, net finance costs were $1.2 million and $0.9 million higher than the comparable periods last year, respectively, which was due mainly to interest cost on the newly issued private placement and the impact of changes in fair value related to derecognized contracts pertaining to interest rate swaps that no longer meet the criteria for hedge accounting. This unfavourable variance was offset by lower average interest cost on the revolving credit facility.

Other interest expense pertained mainly to interest payable to the Producteurs et Productrices Acericoles du Quebec (“PPAQ”) on syrup purchases, in accordance with the PPAQ payment terms and interest accretion on discounted lease obligations.

Taxation

Q3 2021 | Q3 2020 | ∆ | YTD 2021 | YTD 2020 | ∆ | |

(In thousands of dollars) | ||||||

Current | 2,458 | 541 | 1,917 | 10,713 | 8,845 | 1,868 |

Deferred | 423 | 2,146 | (1,723) | 1,021 | 337 | 684 |

Income tax expense | 2,881 | 2,687 | 194 | 11,734 | 9,182 | 2,552 |

The variation in current and deferred tax expense period-over-period is consistent with the variation in earnings before income taxes in fiscal 2021.

Deferred income taxes reflect temporary differences, which result primarily from the difference between depreciation claimed for tax purposes and depreciation amounts recognized for financial reporting purposes, employee future benefits and derivative financial instruments. Deferred income tax assets and liabilities are measured using the enacted or substantively enacted tax rates anticipated to apply to income in the years in which temporary differences are expected to be realized or reversed. The effect of a change in income tax rates on future income taxes is recognized in income in the period in which the change occurs.

Net earnings

Net earnings in the third quarter and for the first nine months of fiscal 2021 were $1.3 million and $8.9 million higher than the comparative periods of fiscal 2020, respectively. These increases were mainly attributable to higher results from operating activities offset by higher financing costs and income tax expenses.

Adjusted net earnings in the third quarter and for the first nine months of fiscal 2021 were $1.7 million and $3.6 million higher than the comparative periods of fiscal 2020, respectively. These increases were mainly attributable to higher adjusted results from operating activities offset by higher financing costs and income tax expenses.

Summary of Quarterly Results

The following is a summary of selected financial information of the unaudited condensed consolidated interim financial statements and non-GAAP measures of the Company for the last eight quarters:

(In thousands of dollars, except for volumes | QUARTERS(2) (3) | |||||||||||||||

2021 | 2020 | 2019 | ||||||||||||||

Third | Second | First | Fourth | Third | Second | First | Fourth | |||||||||

Sugar volumes (MT) | 190,563 | 183,749 | 190,440 | 225,396 | 172,054 | 175,226 | 188,379 | 196,903 | ||||||||

Maple products volumes (‘000 pounds) | 11,471 | 14,214 | 14,892 | 13,181 | 14,313 | 12,893 | 12,792 | 10,163 | ||||||||

Total revenues | 210,931 | 215,929 | 223,840 | 246,212 | 206,147 | 199,126 | 209,316 | 207,572 | ||||||||

Gross margin | 30,064 | 31,451 | 38,613 | 37,890 | 29,873 | 19,390 | 39,046 | 29,073 | ||||||||

Adjusted gross margin(1) | 25,932 | 27,407 | 36,452 | 40,065 | 25,915 | 23,612 | 36,526 | 29,026 | ||||||||

Results from operations | 15,062 | 19,151 | 23,332 | 22,829 | 12,372 | 6,058 | 26,751 | (32,800 | ) | |||||||

Adjusted results from operations(1) | 10,930 | 15,107 | 21,171 | 25,004 | 8,414 | 10,280 | 24,231 | 17,153 | ||||||||

Adjusted EBITDA(1) | 17,214 | 21,375 | 27,647 | 31,231 | 14,279 | 16,522 | 30,227 | 22,215 | ||||||||

Net earnings (loss) | 6,836 | 10,778 | 13,773 | 12,952 | 5,538 | 965 | 15,964 | (40,021 | ) | |||||||

Per share - basic | 0.07 | 0.10 | 0.13 | 0.13 | 0.05 | 0.01 | 0.15 | (0.38 | ) | |||||||

Per share - diluted | 0.07 | 0.10 | 0.13 | 0.12 | 0.05 | 0.01 | 0.14 | (0.38 | ) | |||||||

Adjusted net earnings(1) | 4,247 | 7,751 | 12,248 | 14,551 | 2,560 | 4,036 | 14,098 | 9,910 | ||||||||

Per share - basic | 0.04 | 0.07 | 0.12 | 0.14 | 0.02 | 0.04 | 0.13 | 0.09 | ||||||||

Per share - diluted | 0.04 | 0.07 | 0.11 | 0.14 | 0.02 | 0.04 | 0.13 | 0.09 | ||||||||

Sugar - Adjusted gross margin rate per MT(1) | 113.95 | 118,60 | 161.18 | 157.51 | 120.45 | 109.63 | 163.37 | 123.71 | ||||||||

Maple - Adjusted gross margin percentage(1) | 8.5 | % | 9.4 | % | 8.9 | % | 7.9 | % | 8.4 | % | 7.9 | % | 10.6 | % | 9.7 | % |

(1) See “Non-GAAP Measures” section for definition and reconciliation to GAAP measures

(2) All quarters are 13 weeks with the exception of the fourth quarter of 2020 which is 14 weeks

(3) The three 2021 quarters and the 2020 quarters results include the impacts from the adoption of IFRS 16 Leases as discussed in note 3 (h) of the 2020 audited consolidated financial statements. As is permitted with this new standard, comparative information has not been restated and, therefore, may not be comparable

Historically the first quarter (October to December) of the fiscal year is the best quarter of the sugar segment for adjusted gross margins and adjusted net earnings due to the favourable sales mix associated with an increased proportion of consumer sales during that period of the year. At the same time, the second quarter (January to March) historically has the lowest volumes as well as an unfavourable customer mix, resulting in lower revenues, adjusted gross margins and adjusted net earnings.

Usually, there is minimal seasonality in the Maple products segment. However, for the last two quarters of 2020 and the three quarters of 2021, we experienced volatility in sales volume partially attributable to demand from COVID-19.

Financial condition

(In thousands of dollars) | July 3, 2021 | June 27, 2020 | October 3, 2020 | |||

Total assets | $ | 913,006 | $ | 879,608 | $ | 887,144 |

Total non-current liabilities | 479,803 | 436,097 | 448,128 | |||

The increase in total assets in the current fiscal quarter compared to the same quarter prior year is mainly due to higher inventory of $29.7 million and higher property, plant and equipment of $14.1 million, partially offset by a reduction of trade receivable of $8.6 million.

Non-current liabilities for the current fiscal quarter also increased compared to the same quarter 2020 due mainly to the net impact of the private placement note issued on April 30, 2021, of 98.7 million and an increase in employee benefits liabilities of $7.1 million, mostly as a result of a change in pension actuarial assumptions. This was partially offset by a reduction of our non-current revolving credit facility of $65.0 million.

Liquidity

Cash flow generated by Lantic is paid to Rogers by way of dividends and return of capital on the common shares and by the payment of interest on the subordinated notes of Lantic held by Rogers, after taking a reasonable reserve for capital expenditures, debt reimbursement and working capital. The cash received by Rogers is used to pay administrative expenses, interest on the convertible debentures, income taxes and dividends to its shareholders. Lantic had no restrictions on distributions of cash arising from the compliance of financial covenants for the year.

Q3 2021 | Q3 2020 | YTD 2021 | YTD 2020 | |||||||||

(In thousands of dollars) | ||||||||||||

Net cash flow from operating activities | 24,752 | 28,409 | 29,715 | 49,118 | ||||||||

Cash flow used in financing activities | (16,263 | ) | (23,086 | ) | (9,608 | ) | (32,699 | ) | ||||

Cash flow used in investing activities | (5,689 | ) | (6,110 | ) | (17,785 | ) | (16,521 | ) | ||||

Effect of changes in exchange rate on cash | 1 | (258 | ) | (18 | ) | 175 | ||||||

Net increase (decrease) in cash | 2,801 | (1,045 | ) | 2,304 | 73 | |||||||

Cash flow from operating activities for the current quarter decreased by $3.7 million compared to the same quarter last year, which was due mainly to an increase in interest paid of $4.1 million, an increase in income taxes paid of $3.6 million and a negative non-cash working capital variation of $5.6 million partially offset by an increase in net earnings adjusted for non-cash items of $9.7 million. For the first nine months of 2021, cash flow from operating activities decreased by $19.4 million, which is mainly explained by a negative non-cash working capital variation of $29.9 million, an increase of interest paid of $3.4 million, and an increase of income taxes paid of $2.9 million. This was partially offset by an increase in earnings adjusted for non-cash items of $16.8 million.

Cash flow used in financing activities were lower by $6.8 million for the current quarter compared to the same quarter last year due mainly to the proceed received from the issuance of the private placement note of $98.7 million, partially offset by a decrease of $92.3 million in borrowings from the revolving credit facility and the bank overdraft. For the first nine months of 2021, cash flow used in financing activities were lower by $23.1 million, explained mainly by the proceed received from the private placement note of $98.7 million and the share repurchase expenditures incurred in 2020 under the NCIB of $6.5 million, partially offset by a decrease of $81.9 million in borrowings from the revolving credit facility and the bank overdraft.

The cash outflow used in investing activities decreased by $ 0.4 million in the current quarter and increased by $1.3 million for the first nine months of 2021 when compared to the same periods last year. The variances were mainly related to timing of capital expenditures.

In order to provide additional information, the Company believes it is appropriate to measure free cash flow that is generated by the operations of the Company. Free cash flow is a non-GAAP measure and is defined as cash flow from operations excluding changes in non-cash working capital, mark-to-market and derivative timing adjustments and financial instruments’ non-cash amounts, and including capital expenditures, net of operational excellence capital expenditures, and the payment of capital leases.

Free cash flow

Trailing twelve months | ||||

(In thousands of dollars) | 2021 | 2020 | ||

Cash flow from operations | 45,197 | 89,767 | ||

Adjustments: | ||||

Changes in non-cash working capital | 28,771 | (23,765 | ) | |

Mark-to-market and derivative timing adjustments | (7,527 | ) | (1,890 | ) |

Amortization of transitional balances | (23 | ) | (680 | ) |

Financial instruments non-cash amount | (685 | ) | 126 | |

Capital expenditures and intangible assets | (27,416 | ) | (26,293 | ) |

Value added capital expenditures | 9,751 | 10,675 | ||

Payment of leases obligation | (5,373 | ) | (3,088 | ) |

Deferred financing charges | - | (156 | ) | |

Free cash flow(1) | 42,695 | 44,696 | ||

Declared dividends | 37,287 | 37,634 | ||

Shares repurchased | - | (7,176 | ) | |

(1) See “Non-GAAP Measures” section for definition and reconciliation to GAAP measures.

Free Cash Flow: https://www.globenewswire.com/NewsRoom/AttachmentNg/f3c4e077-1597-494b-823e-a9633034d465

Free cash flow for the trailing twelve months ending on July 3, 2021, amounted to $42.7 million, representing a decrease of $2.0 million compared to the same period last year. This decrease in free cash flow is mainly due to higher taxes and interest paid of $13.5 million, higher capital lease payments and higher capital expenditures of $4.3 million during the period, partially offset by an increase in EBITDA of $14.2 million.

Capital and intangible assets expenditures, net of value-added capital expenditures, increased by $2.0 million compared to last year’s rolling twelve months due mainly to timing in spending. Free cash flow is not reduced by value added capital expenditures, as these projects are not necessary for the operation of the plants but are undertaken because of the operational savings that are realized once the projects are completed.

Financing charges for short term debt are paid when a new debt financing agreement is completed, and such charges are deferred and amortized over the term of that debt. The cash used in the year to pay for such fees is therefore not available and as a result is deducted from free cash flow.

Payments made for capital leases are deducted from free cash flow as such cash flow is no longer reflected as a reduction in cash flow from operation and is therefore not available.

The Board of Directors declared a quarterly dividend of 9.0 cents per common share every quarter, totalling 36.0 cents for both trailing twelve months periods.

Changes in non-cash operating working capital represent year-over-year movements in current assets, such as accounts receivable and inventories, and current liabilities, such as accounts payable. Movements in these accounts are due mainly to timing in the collection of receivables, receipts of raw sugar and payment of liabilities. Increases or decreases in such accounts are due to timing issues and therefore do not constitute free cash flow. Such increases or decreases are financed from available cash or from our available credit facility of $265.0 million. Increases or decreases in bank indebtedness are also due to timing issues from the above and therefore do not constitute available free cash flow.

The combined impact of the mark-to-market and derivative timing adjustments, amortization of transitional balances and financial instruments non-cash positive amount of $8.2 million for the current rolling twelve months does not represent cash items as these contracts will be settled when the physical transactions occur, which is the reason for the adjustment to free cash flow.

Contractual obligations

There are no material changes in the contractual obligations table disclosed in the Management’s Discussion and Analysis of the October 3, 2020 Annual Report.

As at July 3, 2021, Lantic had commitments to purchase a total of 1,148,000 metric tonnes of raw sugar, of which 222,771 metric tonnes had been priced for a total dollar commitment of $100.7 million.

On April 7, 2021, we signed a two-year extension to the existing agreement with Alberta Sugar Beets Growers, which commits us to purchase the 2021 and 2022 crops.

Capital resources

Lantic has a total of $265.0 million of available working capital from which it can borrow at prime rate, LIBOR rate or under bankers’ acceptances, plus 20 to 250 basis points, based on achieving certain financial ratios. As at July 3, 2021, a total of $519.7 million of assets have been pledged as security for the revolving credit facility, compared to $481.0 million as at June 27, 2020; including trade receivables, inventories and property, plant and equipment.

As at July 3, 2021, $120.0 million had been drawn from the working capital facility and $4.3 million in cash was also available.

Cash requirements for working capital and other capital expenditures are expected to be paid from available cash resources and funds generated from operations. Management believes that the unused credit under the revolving facility is adequate to meet its expected cash requirements.

On April 30, 2021, Lantic issued a private placement of $100 million in the form of senior guaranteed Notes under a note purchase agreement entered into with certain institutional investors. The Notes are guaranteed and rank pari pasu with our existing revolving credit facility. The Notes are due on April 30, 2031. The interest of the Notes was set at 3.49% and the interest will be payable semi-annually in arrears in equal installments on April 30th and October 30th of each year, commencing on October 30, 2021. The proceeds received from the private placement on April 30th were used to refinance existing credit facility indebtedness.

As at July 3, 2021, Lantic was in compliance with all the covenants under its revolving credit facility and its private placement.

OUTSTANDING SECURITIES

A total of 103,686,923 shares were outstanding as at July 3, 2021 and August 4, 2021, respectively (103,536,923 as at June 27, 2020).