Rockwell Automation (ROK) Q2 Earnings Lag Estimates, Up Y/Y

Rockwell Automation Inc. ROK delivered second-quarter fiscal 2019 (ended Mar 31, 2018) adjusted earnings of $2.04, missing the Zacks Consensus Estimate of $2.11. However, earnings improved 8% from the prior-year quarter as gains from higher sales and lower share count were somewhat offset by increased investment spending and higher interest expense.

The company witnessed profitable growth across all regions, led by strong process industry performance. Growth in Information Solutions and Connected Services was noted reflecting adoption of the Connected Enterprise. However, weaker-than-expected automotive sales negatively impacted results.

Including one-time items, the company reported earnings of $2.88 per share compared with $1.77 reported in the year-ago quarter.

Total revenues came in at $1,657 million, missed the Zacks Consensus Estimate of $1,717 million. However, the figure was up 0.4% year over year. While organic sales rose 3.6%, foreign currency translations declined 3.2%.

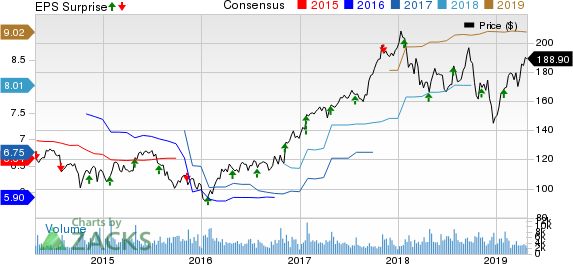

Rockwell Automation, Inc. Price, Consensus and EPS Surprise

Rockwell Automation, Inc. price-consensus-eps-surprise-chart | Rockwell Automation, Inc. Quote

Operational Update

Cost of sales increased 0.2% year over year to $949 million. Gross profit increased 0.6% to $708 million from $704 million reported in the year-ago quarter. Selling, general and administrative expenses declined 0.4% year over year to $385 million.

Consolidated segment operating income totaled $354 million, up approximately 3% from $345 million reported in the prior-year quarter. Segment operating margin was 21.3% in second-quarter 2019, up 40 bps from the year-earlier quarter aided by higher sales which was partially offset by higher investment spending.

Segment Results

Architecture & Software: Net sales for the segment were $740 million in the reported quarter, down 2.2% from the prior-year quarter. Organic sales were up 1.2%, acquisitions contributed 0.1% while currency translation had a negative impact of 3.5%.Segment operating earnings came in at $210 million compared with $217 million recorded in the prior-year quarter. Segment operating margin was 28.4% compared with 28.7% reported in the year-ago quarter.

Control Products & Solutions: Net sales climbed 2.5% year over year to $918 million in the reported quarter. Organic sales increased 5.7% while currency translation reduced sales by 3.2%. Segment operating earnings increased around 13% to $144 million from the year-ago quarter. Segment operating margin came in at 15.7% compared with 14.3% reported in the prior-year quarter.

Financials

At second quarter fiscal 2019-end, cash and cash equivalents totaled $780 million, up from $619 million as of fiscal 2018-end. As of Mar 31, 2019, total debt was $2,231 million, up from $1,776 million as of Sep 30, 2018.

Cash flow from operations in the first half of fiscal 2019 was $356 million compared with $594 million in the comparable period last year. Return on invested capital was 39.6% as of Mar 31, 2019 compared with 43.6% as of Mar 31, 2018.

During the reported quarter, Rockwell Automation repurchased 1.4 million shares for $236 million. As of the quarter end, $579.6 million remains available under the existing share-repurchase authorization.

Other Developments

In February 2019, Rockwell Automation entered into a joint venture (JV) agreement with Schlumberger SLB, named Sensia. The transaction is expected to close in calendar 2019, subject to regulatory approvals and other customary conditions. Sensia will operate as an independent entity, with Rockwell Automation owning 53% and Schlumberger owning the balance. Rockwell Automation will make a cash payment of $250-million to Schlumberger

Sensia is expected to generate initial annual revenue of approximately $400 million, slightly less than half of which relates to businesses to be contributed to the joint venture by Rockwell Automation.

Guidance

For fiscal 2019, Rockwell Automation lowered adjusted EPS guidance and organic sales growth guidance due to the prevailing weakness in automotive sales. The company now anticipates earnings per share in fiscal 2019 in the band of $8.85-$9.15, down from the prior $8.85-$9.25. It anticipates organic sales to improve 3.7-5.3%, down from its previous projection of 3.7-6.7%.

Share Price Performance

In a year’s time, Rockwell Automation’s shares have gained 12.9%, compared with the industry’s growth of 18.6%.

Zacks Rank & Stocks to Consider

Rockwell Automation carries a Zacks Rank #4 (Sell).

A few better-ranked stocks in the Industrial Products sector are DMC Global Inc. BOOM and Lawson Products, Inc. LAWS, both sporting a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

DMC Global has an estimated earnings growth rate of 77.3% for the ongoing year. The company’s shares have soared 117% in the past year.

Lawson Products has an impressive expected earnings growth rate of 102.5% for the current year. The stock has appreciated 35% in a year’s time.

Radical New Technology Creates $12.3 Trillion Opportunity

Imagine buying Microsoft stock in the early days of personal computers… or Motorola after it released the world’s first cell phone. These technologies changed our lives and created massive profits for investors.

Today, we’re on the brink of the next quantum leap in technology. 7 innovative companies are leading this “4th Industrial Revolution” - and early investors stand to earn the biggest profits.

See the 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Rockwell Automation, Inc. (ROK) : Free Stock Analysis Report

DMC Global Inc. (BOOM) : Free Stock Analysis Report

Lawson Products, Inc. (LAWS) : Free Stock Analysis Report

Schlumberger Limited (SLB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance