Robust Acquisitions Aid Automatic Data Processing's (ADP) Growth

Automatic Data Processing, Inc. ADP has been reporting better-than-expected earnings performance in all four trailing quarters owing to its strong position in the human capital management (HCM) market along with strategic acquisitions. A strong revenue model, the recurring flow of income and healthy margins combined with low capital expenditure are boding well for the company.

Automatic Data Processing reported better-than-expected third-quarter fiscal 2023 results. Adjusted earnings per share of $2.52 (excluding 1 cent from non-recurring items) beat the Zacks Consensus Estimate by 4.1% and grew 14% from the year-ago fiscal quarter’s figure. Total revenues of $4.9 billion beat the consensus estimate by 0.9% and improved 9.2% from the year-ago fiscal quarter’s reading on a reported basis and 10% on an organic constant-currency basis.

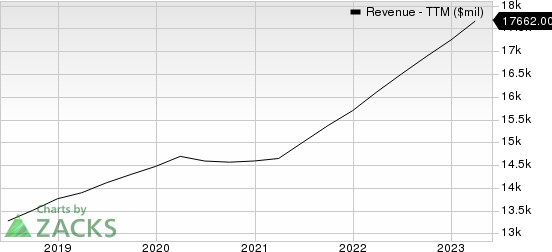

Automatic Data Processing, Inc. Revenue (TTM)

Automatic Data Processing, Inc. revenue-ttm | Automatic Data Processing, Inc. Quote

Current Situation of ADP

ADP has a three-tier business strategy that enables it to grow and deepen its hold in the HCM technology and services provider market. The company generates recurring revenues by virtue of its strong business model. This, in turn, allows it to earn healthy margins while keeping capital expenditures low, which ultimately aids the company’s growth.

The company’s initiatives to transform its customer experience through DataCloud penetration, investment in inside sales and mid-market migrations are praiseworthy. Automatic Data has also been reaping the benefits from its strategic acquisitions, which include an increasing customer base as well as expanding global markets. Strategic acquisitions like Celergo, WorkMarket, Global Cash Card and The Marcus Buckingham Company buyouts are prime examples. The company is on a continuous lookout for acquisitions that best suit its line of business and are easy to integrate.

Some Concerning Points

ADP's current ratio at the end of third-quarter fiscal 2023 was pegged at 1.00, lower than the current ratio of 1.01 reported at the end of third-quarter fiscal 2022. It indicates that the company may have problems meeting its short-term debt obligations.

ADP’s shares have declined 6.6% in the past year, compared with the industry’s 8.1% decline.

Zacks Rank and Stocks to Consider

ADP currently carries a Zacks Rank #3 (Hold).

Investors interested in the Zacks Business Services sector can consider the following stocks:

Green Dot GDOT: For second-quarter 2023, the Zacks Consensus Estimate of Green Dot’s revenues suggests a decline of 4.5% year over year to $339.2 million and the same for earnings indicates a 56.8% plunge to 32 cents per share. The company has an impressive earning surprise history, beating the consensus mark in all four trailing quarters, the average surprise being 37.3%.

GDOT has a Value score of A and currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Maximus MMS: For second-quarter 2023, the Zacks Consensus Estimate of Maximus’ revenues suggests an increase of 6.1% year over year to $1.2 billion and the same for earnings indicates a 46.2% rise to $1.14 per share. The company has an impressive earning surprise history, beating the consensus mark in three instances and missing on one instance, the average surprise being 9.6%.

MMS has a VGM score of A along with a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Automatic Data Processing, Inc. (ADP) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance