How Risky Is TTM Technologies?

Printed circuit board manufacturer TTM Technologies (NASDAQ: TTMI) is in dire straits these days, at least by some measures. TTM fell short of Wall Street's expectations in this month's first-quarter report, share prices have plunged 48% in 52 weeks, and the stock is trading at multiyear lows. On top of all that, TTM's stock sports a beta value of 2.3, meaning that it's more than twice as volatile as the broader market.

That's a lot of warning signs around a company that used to be a model of decorum and tranquility. But all of those red flags are subjective measures based on market reactions and analyst estimates. How much real-world risk does a TTM investor have to shoulder right now?

Let's have a look.

Image source: Getty Images.

TTM by the numbers

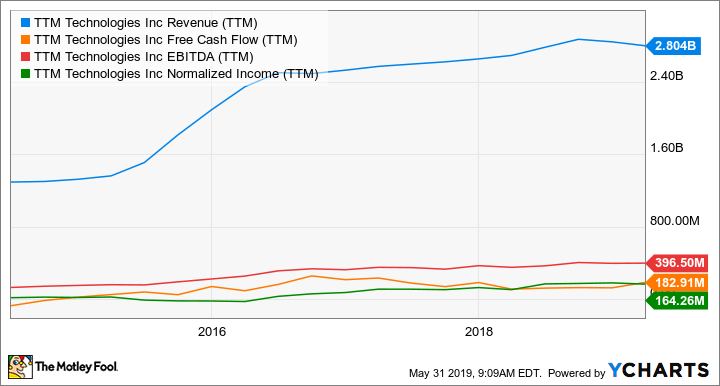

Over the last five years, TTM has grown its sales at an annual clip of 16% while earnings increased by an average of 38% over the same period. Some of this growth stemmed from buyouts, but TTM also simply enjoyed healthy demand from many of its key markets in recent years.

You'll find the company's largest customers in enterprise networking gear, leading smartphone models, and plenty of industrial machinery. TTM's quick-turn circuit board delivery positions the company to win high-margin contracts where product introduction deadlines are tight. As a result, TTM's gross and net margins are among the widest in the circuit board industry.

And then we have the share price situation. TTM's stock is trading at 7.3 times trailing earnings or 5.2 times the company's free cash flow. Those multiples are low compared to TTM's own trading history, more affordable than key rivals like Plexus (NASDAQ: PLXS) or Jabil Circuit (NYSE: JBL), and of a level normally found in companies headed straight for the trash heap of history. In fact, TTM's shares can be had for 0.76 times the company's book value, which means that investors could theoretically do better if TTM simply shut down its operations, sold off all of its assets, and returned that cash directly to shareholders.

Market worries

So why is TTM's stock not getting any respect even though its profit margin looks fine and revenue is soaring?

Some of the company's most important target markets are suffering these days, often due to the Chinese-American trade wars. That geopolitical tension makes it harder to turn a profit on devices made in China with components provided by American companies -- such as TTM -- and that's bad news for everything from smartphones to cars. Moreover, smartphone sales have hit a global lull. Many phone users are holding off on upgrading to new devices until 5G-enabled phones and matching networks become widely available. Others just don't see any reason to get excited about the latest and not-that-great devices, because they're not that different from last year's top phones or even older flagships.

So TTM takes it on the chin because of political gamesmanship and a consumer-powered smartphone order slowdown. That makes sense, but Wall Street is overreacting as usual. Yes, TTM's sales have hit a speed bump and the near-term future might not look quite as bright as it did in early 2018. But the company still produces solid profits on every level and the revenue headwinds won't stick around forever. Does this look like the financial trends of a company that should just give up on business and liquidate all of its assets? I think not:

TTMI Revenue (TTM) data by YCharts.

In other words, TTM's stock is priced as if the company is doomed to fail, but the financial statements tell a very different story. These shares are not nearly as risky as they might seem at first glance.

More From The Motley Fool

Anders Bylund has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance