RingCentral (RNG) Q2 Earnings Top Estimates, Revenues Up Y/Y

RingCentral RNG reported second-quarter 2020 non-GAAP earnings of 24 cents per share, which surpassed the Zacks Consensus Estimate by 20%. The figure increased 14.3% on a year-over-year basis.

Net revenues of $233.4 million also beat the consensus mark by 5.7% and jumped 29.2% from the year-ago quarter. The results reflect solid demand for RingCentral’s cloud-communication solutions.

Quarter Details

Software-subscription (92.5% of total revenues) revenues surged 32% year over year to $257 million.

Annualized Exit Monthly Recurring Subscriptions (ARR) increased 33% year over year to $1.1 billion.

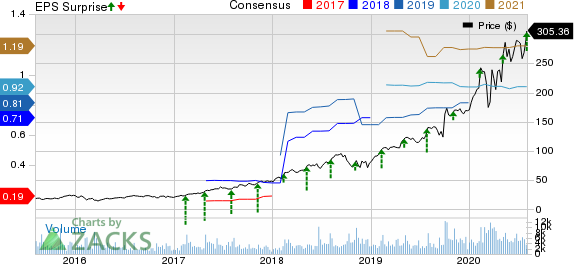

Ringcentral, Inc. Price, Consensus and EPS Surprise

Ringcentral, Inc. price-consensus-eps-surprise-chart | Ringcentral, Inc. Quote

RingCentral Office ARR soared 36% year over year to $1 billion. Mid-market and Enterprise ARR jumped 50% to $581 million.

Moreover, enterprise ARR surged 58% year over year to $363 million. Channel ARR soared 60% year over year to $375 million.

Other revenues (7.5% of total revenues) climbed 2.9% year over year to $20.9 million.

Meanwhile, second-quarter 2020 non-GAAP gross margin contracted 10 basis points (bps) from the year-ago quarter to 76.6%.

On a non-GAAP basis, research & development expenses increased 24.4% year over year to $33.7 million. Sales and marketing expenses were up 29.6% to $120.4 million. General and administrative expenses rose 21.7% to $29.9 million in the reported quarter.

On a non-GAAP basis, operating income was $28.8 million, up 41.2% year over year. Non-GAAP operating margin expanded 9 bps from the year-ago quarter to 10.4%.

Key Q2 Developments

During the quarter, RingCentral expanded its MessageVideo Phone portfolio of solutions through the addition of RingCentral Video, a reimagined video-meetings experience.

The company also expanded its strategic partnership with Atos SE with new Unify Office as the exclusive UCaaS solution for 40 million users of the Atos Unify family of products.

Moreover, Avaya Cloud Office by RingCentral was made available in Australia, Canada and the United Kingdom.

Further, the company announced RingCentral Cloud PBX for Microsoft Teams, enabling Direct Routing integration.

Guidance

For the third quarter of 2020, RingCentral expects revenues between $283.5 million and $289.5 million, indicating year-over-year growth of 21-24%.

Moreover, software-subscription revenues for the quarter are expected between $263 million and $265 million, indicating year-over-year growth of 25-26%.

Operating Margin is expected to be in the 10-10.2% range for the third quarter. Earnings are expected to be 24 cents per share.

For 2020, RingCentral expects revenues between $1.135 billion and $1.143 billion, rising from the previous guidance of $1.116-$1.125 billion and indicating year-over-year growth of 24-25%.

Further, software-subscription revenues for the year are expected between $1.043 billion and $1.048 billion, implying year-over-year growth of 25-26%.

Operating Margin is expected between 9.6% and 9.7% for full-year 2020.

Earnings are expected between 92 cents and 94 cents per share, up from the previous guidance of 91-94 cents.

Zacks Rank & Stocks to Consider

Currently, RingCentral has a Zacks Rank #4 (Sell).

Better-ranked stocks in the broader computer & technology sector are Benefitfocus BNFT, Cogent Communications CCOI and Cambium Networks CMBM. All the three stocks carry Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Benefitfocus, Cogent Communications and Cambium Networks are set to report their quarterly earnings on Aug 5, 6 and 11, respectively.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ringcentral, Inc. (RNG) : Free Stock Analysis Report

Cogent Communications Holdings, Inc. (CCOI) : Free Stock Analysis Report

Benefitfocus, Inc. (BNFT) : Free Stock Analysis Report

Cambium Networks Corporation (CMBM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance