Rhinomed (ASX:RNO) jumps 20% this week, taking one-year gains to 113%

It hasn't been the best quarter for Rhinomed Limited (ASX:RNO) shareholders, since the share price has fallen 18% in that time. On the other hand, over the last twelve months the stock has delivered rather impressive returns. Indeed, the share price is up an impressive 113% in that time. So we think most shareholders won't be too upset about the recent fall. More important, going forward, is how the business itself is going.

Since it's been a strong week for Rhinomed shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Rhinomed

Given that Rhinomed didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last twelve months, Rhinomed's revenue grew by 34%. We respect that sort of growth, no doubt. The revenue growth is decent but the share price had an even better year, gaining 113%. Given that the business has made good progress on the top line, it would be worth taking a look at its path to profitability. But investors need to be wary of how the 'fear of missing out' could influence them to buy without doing thorough research.

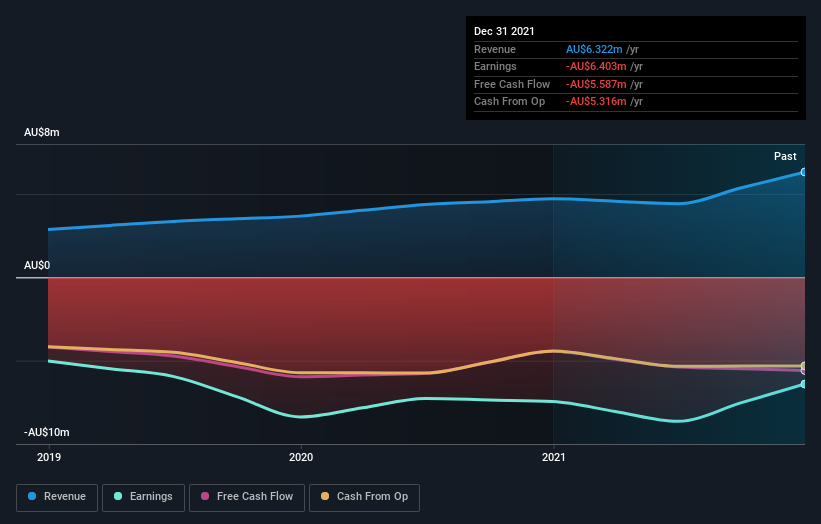

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Dive deeper into the earnings by checking this interactive graph of Rhinomed's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Rhinomed shareholders have received a total shareholder return of 113% over one year. That's better than the annualised return of 6% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 6 warning signs with Rhinomed (at least 2 which shouldn't be ignored) , and understanding them should be part of your investment process.

Rhinomed is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance