Retail ETF Hitting Lifetime High Attracts Massive Inflow

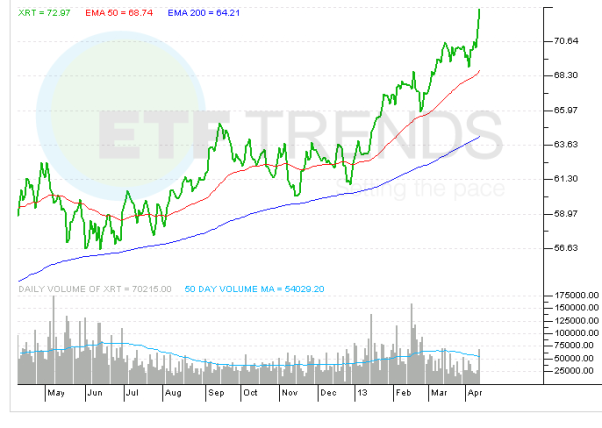

SPDR S&P Retail (XRT) has been trading on well-above-average volume lately amid a breakout to all-time price levels.

Interestingly, XRT has attracted almost $600 million in recent inflows, which accounts for a massive amount of the assets under management in the fund, about $922 million.

The retail sector ETF, which has an expense ratio of 0.35%, has been extremely active recently, in terms of both an acceleration in trading volume as well as related options activity.

Trading volume has been off the chart in recent sessions, as the fund had one session where nearly 15 million shares changed hands alone (average daily volume is about 4.4 million shares). [Retail Sales Lift Sector ETF to High on Heavy Volume]

Not everyone is bullish about the near term prospects of the ETF as we have also witnessed protective put spread buying in XRT in mostly March options.

It is very possible that the options activity could be a holder of the underlying ETF if not long individual retail based equities.

We point out that XRT is an equal weighted product with top holdings appearing as the following: RAD (1.35%), SFLY (1.15%), ABG (1.12%), MNRO (1.12%), and CONN (1.10%).

Most of these names may not be immediately recognizable to all portfolio managers, as there is a fair amount of small cap and mid cap representation in this ETF given its equal weighted methodology (and it re-balances regularly in order to trim holdings back into line, as some will naturally rise in price and become larger portions of the portfolio over time, and vice versa).

On the other hand other prominent Retail based ETFs that will likely be active in the near term include XLY (SPDR Consumer Discretionary Select SPDR, Expense Ratio 0.18%), VCR (Vanguard Consumer Discretionary, Expense Ratio 0.14%), FXD (First Trust Consumer Discretionary AlphaDEX, Expense Ratio 0.70%), IYC (iShares D.J. U.S. Consumer Services Sector, Expense Ratio, Expense Ratio 0.48%) and these ETFs largely have different compositions than XRT so it is worth digging into the individual nuances for those whom want to play the sector.

SPDR S&P Retail

For more information on Street One ETF research and ETF trade execution/liquidity services, contact Paul Weisbruch at pweisbruch@streetonefinancial.com.

Yahoo Finance

Yahoo Finance