Restaurant Brands (QSR) Q2 Earnings Beat Estimates, Up Y/Y

Restaurant Brands International, Inc. QSR reported better-than-expected second-quarter 2019 results. Also, its top and bottom lines gained on a year-over-year basis.

The company’s adjusted earnings of 71 cents per share surpassed the Zacks Consensus Estimate of 67 cents andgrew7.6% from the year-ago quarter number. This uptick can be primarily attributed to consistent improvement in Restaurant Brands' top line.

Total revenues were $1,400 million, which outpaced the consensus mark of $1,385 million. The metric also improved 4.2% from the year-ago quarter figure, courtesy of increased system-wide sales across the company’s brands.

Segmental Revenues

Restaurant Brands operates through three segments — Tim Hortons, Burger King and Popeye’s Louisiana Kitchen.

Revenues at Tim Hortons totaled $842 million compared with $823 million in the prior-year quarter. Also, system-wide sales rose 1.6% on net restaurant growth. Meanwhile, comps at this segment improved0.5% compared with flat comps in the prior-year quarter.

Burger King’s revenues grew from $418 million in second-quarter 2018 to $447 million in the quarter under review, mainly driven by increased franchise and property revenues. Also, system-wide sales rose 9.8%, wider than 8.4% growth registered in the year-ago comparable period. System-wide sales growth can be attributed to net restaurant growth of 5.8% and positive comps growth. Comps grew 3.6% compared with 1.8% rise in the prior-year quarter.

Popeye’s Louisiana Kitchen, which was acquired on Mar 27, 2017, reported revenues of $111 million compared with $102 million in the year-ago quarter.System-wide sales rose 8.8%, owing to net restaurant growth of 6.1% and 3% rise in comps. Notably, system-wide sales growth compared unfavorably with the prior-year quarter’s 10.7% increase. Comparable sales grew 3%, comparing favorably with year-ago quarter’s increase of 2.9%.

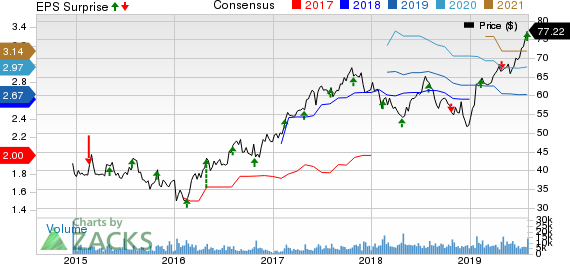

Restaurant Brands International Inc. Price, Consensus and EPS Surprise

Operating Performance

In the quarter under review, the company’s adjusted EBITDA rose 6.3% on an organic basis, driven by system-wide sales growth. Segment-wise, Tim Horton’s EBITDA rose 3.5%. Burger King’s EBITDA grew 10% year over year. Popeye’s EBITDA was up 4.6%.

Cash and Capital

Restaurant Brands exited the second quarter with cash and cash equivalent balance of $1,028 million. As of Jun 30, 2019, total debt was $12.3 billion. The company’s board of directors declared a dividend payout of 50 cents per share for the third quarter of 2019, payable Oct 3 to its shareholders of record at the close of business as of Sep 17.

Zacks Rank & Peer Releases

Restaurant Brands currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Darden DRI reported fourth-quarter fiscal 2019 results, wherein earnings surpassed the Zacks Consensus Estimate, whereas revenues lagged the same. Adjusted earnings of $1.76 per share beat the Zacks Consensus Estimate of $1.73. Moreover, the bottom line rose26.6% year over year on higher revenues.

Domino’s DPZ reported mixed second-quarter 2019 financial numbers, wherein earnings surpassed the Zacks Consensus Estimate but revenues missed the same. Adjusted earnings were $2.19 per share, which outpaced the Zacks Consensus Estimate of $2.00. The metric also grew 19% on a year-over-year basis. The bottom-line improvement was driven by higher net income and lower diluted share count as a result of share repurchases.

Chipotle CMG reported better-than-expected results in the second quarter of 2019. Its adjusted earnings of $3.99 per share surpassed the Zacks Consensus Estimate of $3.69 by 8.1%. Further, the bottom line grew 39% from the year-ago quarter, backed by an increase in revenues and strong operating margins.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Click to get this free report Darden Restaurants, Inc. (DRI) : Free Stock Analysis Report Restaurant Brands International Inc. (QSR) : Free Stock Analysis Report Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report Domino's Pizza Inc (DPZ) : Free Stock Analysis Report To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance