Report Forecasts Explosive Growth for EVs

At the moment, in the United States, it can seem tough to imagine a future when electric vehicles will outsell their gasoline counterparts. Demand for electric vehicles here remains tepid-with the noteworthy exception of Tesla-and EVs accounted for barely over 1 percent of the U.S. market last year. And a freeze of U.S. clean-vehicle standards or a challenge to California’s ZEV mandate could markedly reduce the incentives automakers have to produce electrics in America.

Yet in China, it seems like the tide is already turning. EV sales made up more than 2.5 percent of the passenger-vehicle market in 2017, and by some accounts it’s trending at well over 3 percent so far this year. And that’s in a market that absorbed 28 million new vehicles in 2017, or 11 million more than the U.S. market that year, so the difference in the sheer number of EVs is far greater than the percentage share suggests. It means Chinese buyers are taking five times as many EVs as U.S. consumers.

Bloomberg New Energy Finance (BNEF) points to China’s New Energy Vehicle credit system, which it compares to California’s ZEV mandate, as “the single most important piece of EV policy globally.” It will drive annual EV sales in China to reach 10 percent by 2022, 19 percent by 2025, and 60 percent by 2040.

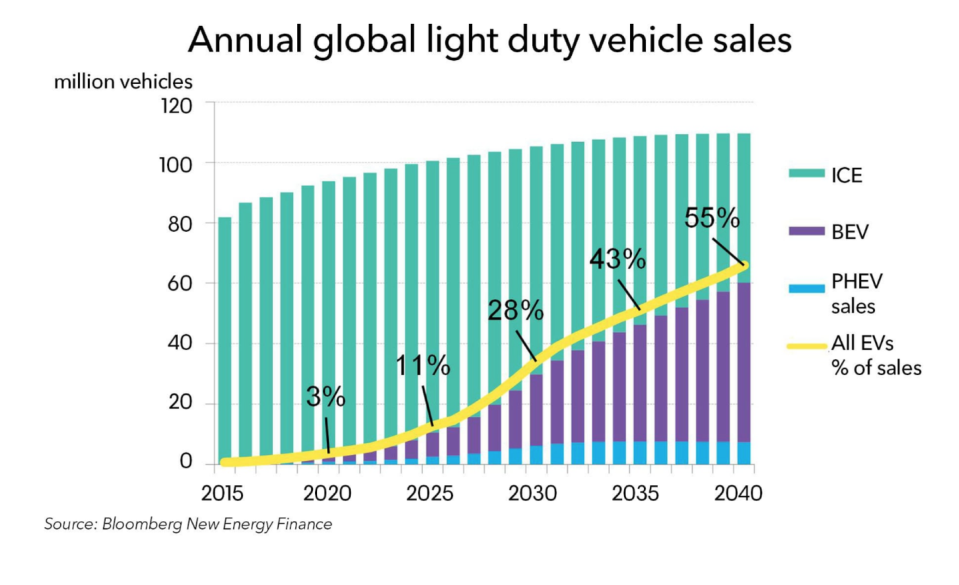

Provided that policy remains in place, growth in China is one reason BNEF remains bullish about a burgeoning global EV market in its Electric Vehicle Outlook 2018 report, released this week. Compared to its year-ago forecast, BNEF now projects global market share of EVs to grow more quickly and sooner. And it has nudged upward some long-term numbers; it now expects 55 percent of new-vehicle sales worldwide will be battery-electric vehicles or plug-in hybrids in 2040. By that year, the report anticipates 559 million electric vehicles on the road globally, comprising about one-third of the global passenger-vehicle fleet.

In the near term, the firm sees annual sales of electric vehicles reaching 11 million in 2025 and 30 million in 2030, with China accounting for nearly half the world’s appetite for new EVs in 2025. But rapid growth will happen in the U.S. market, too, from 2021 or so when a cohort of longer-range electric vehicles will hit the market, out to 2024 and beyond, when BNEF projects that electric vehicles will start being truly cost competitive with gasoline vehicles, without any government incentives. “The number of ICE vehicles sold per year (gasoline or diesel) is expected to start declining in the mid-2020s, as EVs bite hard into their market,” it predicts.

As Salim Morsy, BNEF’s advanced transport analyst, put it: “An automaker with no electrification strategy today is like a fixed-line phone company with no mobile strategy in 1995.”

Already Past a Tipping Point?

BNEF cites rising commitments from automakers as a reason to believe that this change will occur, yet it points to a weak charging infrastructure in some countries as a barrier. Another obstacle is the supply of some raw materials as a limiting factor for how quickly costs can come down. “Developments over the last 12 months, such as manufacturers’ plans for model rollouts and new regulations on urban pollution, have bolstered our bullish view of the prospects for EVs,” added Colin McKerracher, the firm’s lead analyst on advanced transportation.

In recent months, several automakers have raised their level of commitment with a promise of significant production volume-Volvo and Honda are a couple of examples-rather than only producing a certain number of electrified models to meet regulatory requirements.

A continuing trend toward more affordable batteries should also push whole-vehicle affordability in a positive direction-the forecast is for costs to drop significantly below $100 per kilowatt-hour by 2030, which is well under today’s average price of $209 perkWh and $1000 per kWh in 2010 when Bloomberg first started tracking the cost. Energy density has continued to improve at a rate of 5 to 7 percent per year, and that should help offset the concern over material costs as a soaring global demand for lithium-ion battery cells drives the price of cobalt, lithium, and nickel higher.

Growth of electrics will also be affected by the expansion of shared-mobility services like Lyft, Uber, and General Motors’ Maven-all of which aim to electrify their future fleets-as well as the rise of autonomous vehicle technology.

Buses before Cars

The economic full picture of this scenario involves more than cars. Electric buses remain a niche curiosity in the United States, where a number of major metropolitan areas have tested them-some, like Los Angeles, with disappointing results-but have not yet made large-scale commitments. So the vast majority of the world’s e-buses in operation are in China. But that’s slated to change in the near future as the economics start making sense and the policy turns against diesel. By 2040, BNEF expects 80 percent of the global bus fleet to be electric, based on ownership and operating costs. Electric buses for shorter-range routes (under 106 miles) are already cheaper to run today than those with engines aboard. And Navigant, a market research firm, projects that electric buses will pick up the plug-in pace quicker than cars in the United States, too, making up 27 percent of new-bus sales in America by 2027.

The two vehicle types combined-electric passenger vehicles plus e-buses-will increase global electricity demand by 6 percent by 2040. At that rate of migration, EVs would displace 7.3-million barrels of fuel per day-including 2.5 million in China, 2.3 million in the U.S., and 1.1 million barrels attributable to Europe.

The EV scenario for China is not quite as rosy as it sounds. The advantage of electric vehicles is that their emissions are generally anticipated to be reduced as time goes by, as the electrical grid is modernized and more renewable energy sources are brought online. While electric vehicles may be a cleaner choice in much of the United States-superior in terms of greenhouse-gas emissions and, in most regions, smog-forming emissions-the majority of China’s power plants burn coal. While the infrastructure is cleaning up quickly, with more renewables brought online, the U.S. Energy Information Administration projects that all other sources combined won’t surpass coal generation until the 2030s. The situation isn’t much, if at all, better in some other vehicle-dense countries such as India and Indonesia.

Electric Vehicles Tread as Lightly as the Grids They Plug Into

Not Zero: Emissions from Driving an EV Vary Widely by Country

GM CEO Barra: Profitable, Affordable 300-Mile Electric Vehicles by 2021

As this new report indicates, the question is no longer whether electric vehicles will become a significant portion of the market, but when it will happen. The economies of scale that tip the balance won’t be driven by the U.S. market as much as by global sales, led by China. And cleaning up the transportation system will warrant paying as much attention to what comes out of power-plant smokestacks as we have to emissions from vehicle tailpipes.

You Might Also Like

Yahoo Finance

Yahoo Finance