ReneSola (SOL) Q1 Earnings Miss Estimates, Revenues Rise Y/Y

ReneSola Ltd. SOL incurred a loss of 4 cents per American Depositary Share (ADS) from continuing operations in first-quarter 2020, wider than the Zacks Consensus Estimate of a loss of 3 cents. The reported figure, however, narrowed from the year-ago quarter’s loss of 14 cents.

Notably, the loss incurred in the reported quarter can be attributed to the company’s dismal top-line performance.

Revenues

ReneSola’s first-quarter net revenues of $21.2 million missed the Zacks Consensus Estimate of $32 million by 33.9%. The top line, however, soared 61.8% year over year from $13.1 million. Quarterly revenues missed the company’s projected range of $30-$33 million.

Projects

As of Mar 31, 2020, ReneSola had more than 215.8 megawatts (MW) of rooftop projects in operation. Of these, the company operates 172 MW of rooftop projects in China, 24.1 MW in the United States, 15.4 MW in Romania and 4.3 MW in the U.K. Further, it has 15 MW of rooftop projects under construction in the United States and Hungary, respectively.

As of Mar 31, 2020, the company had a pipeline of almost 1.45 gigawatts of projects in various stages, of which 423.2 MW are late-stage projects. Of these late-stage projects, 30 MW are under construction.

Operational Highlights

Operating expenses totaled $2.5 million during the first quarter, up 1.3% year over year.

Operating loss in the quarter came in at $1.14 million compared with the year-ago quarter’s operating loss of $2.1 million.

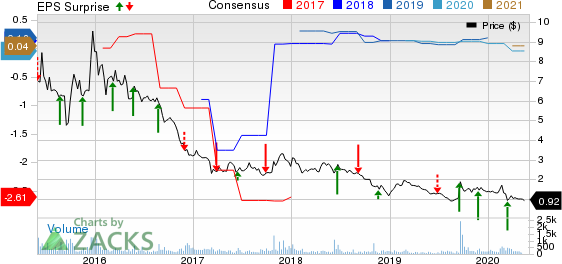

Renesola Ltd. Price, Consensus and EPS Surprise

Renesola Ltd. price-consensus-eps-surprise-chart | Renesola Ltd. Quote

Financial Condition

As of Mar 31, 2020, ReneSola had cash and cash equivalents of $15.5 million compared with $24.3 million as of Dec 31, 2019.

Long-term borrowings were $8.5 million as of Mar 31, 2020, compared with $3.4 million at the end of 2019.

Operating cash outflow from continuing operations summed $9.9 million as of Mar 31, 2020, compared with cash outflow of $10.6 million in the year-ago period.

Guidance

ReneSola expects second-quarter 2020 revenues of $22-$25 million, with an overall gross margin of 17-20%. For second-quarter revenues, the Zacks Consensus Estimate is pegged at $14.9 million, much below the company’s anticipated view.

For 2020, the company continues to expect revenues of $80-$100 million, with an overall gross margin of 18-20%. The Zacks Consensus Estimate for ReneSola’s 2020 revenues is pegged at $88.2 million, which lies below the midpoint of the company’s guidance.

Zacks Rank

ReneSola currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Solar Releases

Enphase Energy ENPH reported first-quarter 2020 adjusted earnings of 38 cents per share, which surpassed the Zacks Consensus Estimate of 32 cents by 18.8%. The bottom line also surged a massive 375% from 8 cents reported in the prior-year quarter.

SunPower SPWR reported first-quarter 2020 adjusted loss of 10 cents per share, narrower than the Zacks Consensus Estimate of a loss of 21 cents and a loss of 41 cents reported in the year-ago quarter.

SolarEdge Technologies SEDG reported first-quarter 2020 adjusted earnings of $1.03 per share, which missed the Zacks Consensus Estimate of $1.20 by 14.2%. The bottom-line figure, however, surged 47.1% from 70 cents registered in the prior-year quarter.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

This young company’s gigantic growth was hidden by low-volume trading, then cut short by the coronavirus. But its digital products stand out in a region where the internet economy has tripled since 2015 and looks to triple again by 2025.

Its stock price is already starting to resume its upward arc. The sky’s the limit! And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Renesola Ltd. (SOL) : Free Stock Analysis Report

SunPower Corporation (SPWR) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report

SolarEdge Technologies, Inc. (SEDG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance