RenaissanceRe's (RNR) Earnings Surpass in Q2, Decline Y/Y

RenaissanceRe Holdings Ltd. RNR delivered second-quarter 2019 operating earnings per share of $4.78, beating the Zacks Consensus Estimate by 33.5%. The result was backed by operational efficiency and higher revenues. However, the bottom line declined 8.6% year over year.

Quarterly Operational Update

RenaissanceRe’s second-quarter operating revenues of $1 billion surpassed the Zacks Consensus Estimate by 56%. The top line also skyrocketed nearly 104.8% year over year on the back of improved net premiums earned plus net foreign exchange gain and other income.

Gross premiums written surged 51.1% year over year to $977 million owing to higher premiums in the Property as well as the Casualty and Specialty segments.

Net investment income came in at $115 million, down 9.4% year over year.

RenaissanceRe’s total expenses were $780 million, having escalated 250% year over year, primarily due to higher Net claims and claim expenses incurred, acquisition expenses, operational expenses, corporate expenses and interest expenses.

Underwriting income of $170.8 million was 24.6% lower than the year-ago quarter’s income.

Combined ratio was 81.3% for the second quarter compared with the year-ago quarter’s tally of 47.2%.

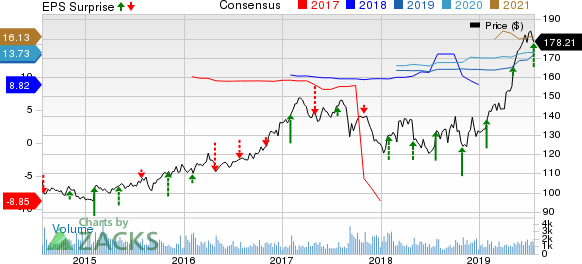

RenaissanceRe Holdings Ltd. Price, Consensus and EPS Surprise

RenaissanceRe Holdings Ltd. price-consensus-eps-surprise-chart | RenaissanceRe Holdings Ltd. Quote

Quarterly Segment Update

Property Segment

Gross premiums written were $839.2 million, up 51.9 % year over year, led by higher premiums written in catastrophe class of business.

Underwriting income of $151.7 million, down 29% year over year. Combined ratio was 64.3% against a negative 4.7% in the year-ago quarter.

Casualty and Specialty Segment

Gross premiums written were $637.7 million, up 50.1% from the prior-year quarter. This upside is driven by the buyouts in connection with TMR Group Entities and growth in the current and new business opportunities within a few classes of business.

The company incurred underwriting income of $19 million, up 46.2% year over year.

Combined ratio of 96.1% expanded 190 basis points year over year.

Business Update

The company’s takeover of Tokio Millennium Re AG, Tokio Millennium Re (UK) Limited and the subsidiaries of both impacted the second-quarter results.

Financial Position

As of Jun 30, 2019, total assets of RenaissanceRe were $26 billion, up 39.7% from 2018-end level.

The company had total debt of $1.4 billion as of Jun 30, 2019, up nearly 40% from the level at 2018 end.

Cash and cash equivalents were $670.6 million, down 39.5% from the tally at 2018 end.

Book value per share of $119.17 rose 14.4% from the figure at 2018 end.

Return on equity for the quarter under review is 28.9%.

Zacks Rank

RenaissanceRe sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Peer Releases From Finance Sector

The Hartford Financial Services Group, Inc. HIG is set to report second-quarter earnings on Aug 1 and the consensus mark for the same stands at $1.11. The stock has a Zacks Rank #3.

Lincoln National Corporation’s LNC consensus mark for second-quarter earnings is pegged at $2.32. This Zacks #3 Ranked player is scheduled to release second-quarter earnings on Jul 31.

Alleghany Corporation Y is slated to announce second-quarter earnings on Aug 6. The Zacks Consensus Estimate for the same is pinned on $9. The stock carries a Zacks Rank of 3.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln National Corporation (LNC) : Free Stock Analysis Report

The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

RenaissanceRe Holdings Ltd. (RNR) : Free Stock Analysis Report

Alleghany Corporation (Y) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance