REITs to Watch for Q1 Earnings on May 6: AVB, ESS, MAA & More

A number of real estate investment trusts (REITs), including AvalonBay Communities, Inc. AVB, Essex Property Trust, Inc. ESS, Mid-America Apartment Communities, Inc. MAA, UDR Inc. UDR, Federal Realty Investment Trust FRT, Equinix EQIX, Extra Space Storage EXR and Welltower, Inc. WELL are slated to report first-quarter earnings numbers on May 6.

Per the Zacks industry classification, the REIT industry is part of the broader Finance sector. The first-quarter earnings picture looks bleak for Finance, as companies that have already reported Q1 numbers have reported 39.9% decline in earnings on 3.7% higher revenues, per the latest Earnings Outlook.

Despite being a defensive industry, REITs underperformed broad equity markets in the first quarter amid concerns relating to the global economic impact of the coronavirus pandemic. In fact, uncertainty regarding duration of the widespread property closings due to social distancing measures and tenants’ ability to pay rent further impacted all REIT segments. Further, overall liquidity crisis resulted in a number of companies slashing or suspending dividends.

Nonetheless, as the underlying asset categories and location of properties play a crucial role in determining REITs’ performance, not all REIT types were equally challenged. In fact, there was a wide disparity in the performance of companies that were severely impacted (hotel and retail REITs) and those less directly impacted (industrial, self-storage, data center REITs).

Let’s analyze the factors that are expected to have played a key role in these REITs’ quarterly performance.

AvalonBay’s quarterly performance is likely to reflect growth in revenues as well as funds from operations (FFO) per share. Though the coronavirus pandemic jeopardized the second half of the March-end quarter, the period had commenced on a positive note with a resilient economy and decent job-market strength. Therefore, the pandemic’s impact is likely to be more pronounced on real estate fundamentals in the second quarter than in the first.

Amid this, AvalonBay is expected to have registered steady rental revenues, given its ownership of high-quality assets located in some of the premium markets of the country.

For the week ended Mar 22, 2020, the company had a physical occupancy rate of 96.1% for established communities compared with 95.8% recorded during the same week of March 2019. Also, through the week ending Mar 22, blended like-term effective rent change for established communities for March 2020 was 2.3% versus 2.9% for March 2019.

The Zacks Consensus Estimate for the quarterly FFO per share is currently pinned at $2.40, indicating 4.4% year-on-year growth. (Read more: What to Expect From AvalonBay This Earnings Season?)

The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of a FFO beat. But that’s not the case here as AvalonBay currently carries a Zacks Rank of 3 and has an Earnings ESP of -0.63%.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

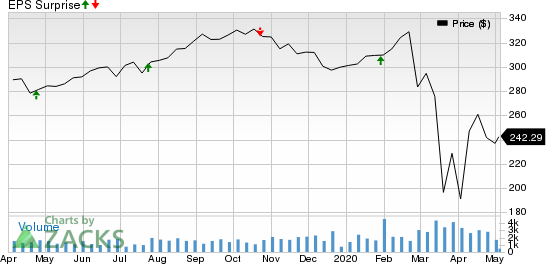

The chart below shows the company’s earnings surprise over the trailing four quarters.

AvalonBay Communities, Inc. Price and EPS Surprise

AvalonBay Communities, Inc. price-eps-surprise | AvalonBay Communities, Inc. Quote

Residential REIT Essex Property is likely to have leveraged on favorable demographic trends and household formation in its markets in first-quarter 2020. Substantial exposure to the West Coast market, which is home to several innovation and technology companies, is anticipated to have provided ample scope to bolster its top line in the quarter under review.

As such, the Zacks Consensus Estimate of $383.2 million for first-quarter revenues indicates a 7.6% improvement, year on year. In addition, the company had earlier estimated core FFO per share of $3.36-$3.46 for the quarter. The Zacks Consensus Estimate for the same is currently pinned at $3.42, suggesting5.9% growth from the prior-year quarter’s reported tally.

However, in this seasonally-slower demand period, occupancy and rent growth are likely to have been limited. (Read more: Key Factors to Impact Essex Property's Q1 Earnings)

Our proven model does not predict a beat in terms of FFO per share for the company this season, as its carries a Zacks Rank of 3 and has an Earnings ESP of -0.48%.

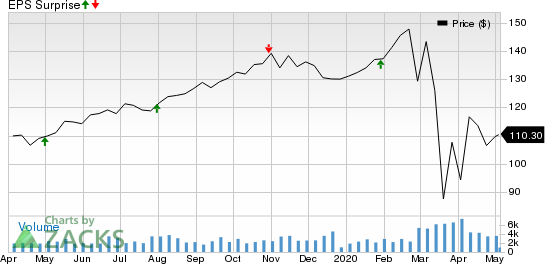

The chart below shows the company’s earnings surprise over the trailing four quarters.

Essex Property Trust, Inc. Price and EPS Surprise

Essex Property Trust, Inc. price-eps-surprise | Essex Property Trust, Inc. Quote

Mid-America Apartment Communities — commonly known as MAA — is expected to have continued its redevelopment initiatives and smart-home installations across its existing asset base in the first quarter of 2020. This is expected to have resulted in higher average rental rate growth and boosted its top line. Notably, the Zacks Consensus Estimate for first-quarter 2020 revenues is pinned at $418 million, suggesting year-over-year improvement of 4.18%.

Late March, providing an update relating to the coronavirus outbreak, the company’s reiterated its first-quarter estimates that were provided with fourth-quarter results. Further, until Mar 24, 2020, the company had same-store average physical occupancy of 95.7%.

The Zacks Consensus Estimate for the company’s first-quarter 2020 FFO per share has remained unchanged at $1.60 over the past month. Nevertheless, the figure indicates a year-over-year increase of 1.27%. For the quarter, core FFO per share is expected in the band of$1.53-$1.65. (Read more: Factors Driving Mid-America Apartment's Q1 Earnings)

Our proven model does not conclusively predict a beat in terms of FFO per share for the company this season as its carries a Zacks Rank of 3 and has an Earnings ESP of -0.98%.

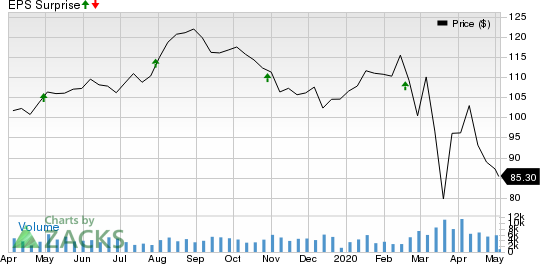

The chart below shows the company’s earnings surprise over the trailing four quarters.

Mid-America Apartment Communities, Inc. Price and EPS Surprise

Mid-America Apartment Communities, Inc. price-eps-surprise | Mid-America Apartment Communities, Inc. Quote

UDR has been steadily implementing its Next Generation operating platform consisting of SmartHome installations and other infrastructure buildouts. These efforts are expected to have boosted its margin and supported its operational platform during the March-end quarter.

Late March, UDR also reinstated its first-quarter guidance.

The Zacks Consensus Estimate for first-quarter revenues is currently pegged at $310.4 million, indicating 15.8% year-over-year growth. Further, the Zacks Consensus Estimate for the January-March quarter FFO per share remained unchanged at 54 cents over the past 30 days. Nonetheless, it suggests year-over year growth of 5.9%. The company projects FFO as adjusted per share at 53-55 cents. (Read more: UDR to Report Q1 Earnings: What's in Store for the Stock?)

Our proven model does not conclusively predict a beat in terms of FFO per share for the company this season, as its carries a Zacks Rank of 3 and has an Earnings ESP of 0.00%.

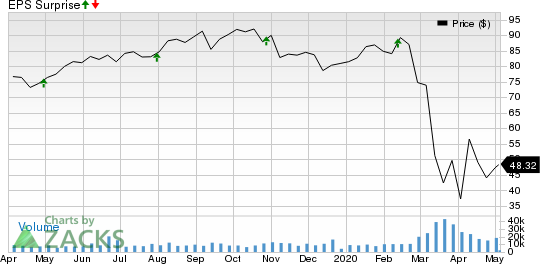

The chart below shows the company’s earnings surprise over the trailing four quarters.

United Dominion Realty Trust, Inc. Price and EPS Surprise

United Dominion Realty Trust, Inc. price-eps-surprise | United Dominion Realty Trust, Inc. Quote

Retail REIT Federal Realty has been undertaking concerted measures to reposition, redevelop and re-merchandise its portfolio amid the fast-evolving retail environment. Such initiatives involve considerable upfront costs, tend to drag down near-term profitability and might have curbed the company’s growth tempo in the first quarter.

Nonetheless, it has a portfolio of premium retail assets in markets with superior demographics, dense population and strong household income. With this, the company has likely seen solid demand in first-quarter 2020.

The Zacks Consensus Estimate for quarterly revenues is pegged at $233.3 million, indicating a 0.5% rise from the year-ago reported figure. The consensus estimate for first-quarter FFO per share was revised 1.9% downward to $1.54 in a month’s time. This suggests a year-over-year decline of 1.3%. (Read more: What's in the Cards for Federal Realty's Q1 Earnings?)

Our proven model does not conclusively predict a beat in terms of FFO per share for the company this season, as its carries a Zacks Rank of 3 and has an Earnings ESP of -1.11%.

The chart below shows the company’s earnings surprise over the trailing four quarters.

Federal Realty Investment Trust Price and EPS Surprise

Federal Realty Investment Trust price-eps-surprise | Federal Realty Investment Trust Quote

Data-center REIT, Equinix has been making efforts to strengthen its data-center footprint on the back of acquisitions, in light of growing demand for colocation and inter-connection services as well as higher demand from cloud users. These efforts are expected to have aided the company in increasing its cabinet capacity and cabinet equivalent billing in the first quarter.

Further, the company is expected to have seen stable revenues in first-quarter 2020 owing to its recurring revenue model. Notably, the Zacks Consensus Estimate for first-quarter recurring revenues from the United States is pegged at $638 million, suggesting 3.7% growth from the prior-year quarter’s figure.

However, integration costs relating to its acquisitions are expected to have impacted the company’s earnings in the quarter. In fact, the Zacks Consensus Estimate of FFO per share for the quarter has declined marginally to $5.98 over the past month, reflecting analysts’ bearish sentiments. However, it suggests year-over-year growth of 0.5%. (Read more: Equinix to Report Q1 Earnings: Will it Disappoint?)

Our proven model does not conclusively predict a beat in terms of FFO per share for the company this season, as its carries a Zacks Rank of 3 and has an Earnings ESP of -2.56%.

The chart below shows the company’s earnings surprise over the trailing four quarters.

Equinix, Inc. Price and EPS Surprise

Equinix, Inc. price-eps-surprise | Equinix, Inc. Quote

Self-storage REIT Extra Space Storage is likely to have benefited from its strong presence in key cities and concerted measures to boost geographical footprint through acquisitions and third-party management in the first quarter.

The Zacks Consensus Estimate of $282 million for property rental revenues suggests a 4.1% rise from the prior-year quarter’s tally. Also, the Zacks Consensus Estimate for first-quarter FFO per share remained unchanged at $1.20 in a month’s time. However, it indicates 3.5% improvement from the year-ago quarter’s reported figure. (Read more: Factors to Impact Extra Space Storage's Q1 Earnings)

Our proven model predicts a beat in terms of FFO per share for the company this season, as its carries a Zacks Rank of 3 and has an Earnings ESP of -0.21%.

The chart below shows the company’s earnings surprise over the trailing four quarters.

Extra Space Storage Inc Price and EPS Surprise

Extra Space Storage Inc price-eps-surprise | Extra Space Storage Inc Quote

Healthcare REIT, Welltower announced that the senior housing operating portfolio, which generates a significant portion of the net operating income, witnessed a decline in occupancy in the first quarter. The occupancy level fell from 85.8% as of Feb 28, to 85.4% as of Mar 27, and this trend is likely to prevail, given tour limitations in many of its communities as well as check on resident move-ins.

Nonetheless, a significant increase in outpatient visits and the growing need for value-based care are anticipated to have boosted revenues at its outpatient medical segment.

The Zacks Consensus Estimate for total revenues is pegged at $1.28 billion, suggesting year-over-year growth of 0.5%. The consensus mark for FFO per share moved 1.9% south to $1.01 over the past month. It suggests a nearly 1% decline year over year. (Read more: What's in the Offing for Welltower’s Q1 Earnings?)

Our proven model does not conclusively predict a beat in terms of FFO per share for the company this season, as its carries a Zacks Rank of 3 and has an Earnings ESP of -1.56%.

The chart below shows the company’s earnings surprise over the trailing four quarters.

Welltower Inc. Price and EPS Surprise

Welltower Inc. price-eps-surprise | Welltower Inc. Quote

Note:Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Equinix, Inc. (EQIX) : Free Stock Analysis Report

United Dominion Realty Trust, Inc. (UDR) : Free Stock Analysis Report

Federal Realty Investment Trust (FRT) : Free Stock Analysis Report

Mid-America Apartment Communities, Inc. (MAA) : Free Stock Analysis Report

AvalonBay Communities, Inc. (AVB) : Free Stock Analysis Report

Essex Property Trust, Inc. (ESS) : Free Stock Analysis Report

Extra Space Storage Inc (EXR) : Free Stock Analysis Report

Welltower Inc. (WELL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance