Reitmans' shares rise after Fairfax buys stake

By Euan Rocha

TORONTO (Reuters) - Shares in Reitmans Canada Ltd (RETa.TO) rose 6.9 percent on Monday, following an announcement by Fairfax Financial Holdings (Toronto:FFH.TO - News) that it has acquired a sizable stake in the Canadian clothing retailer.

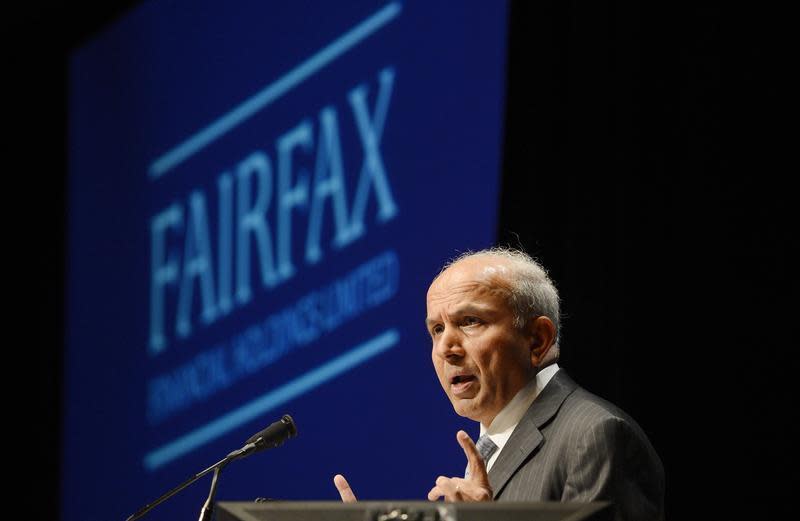

Toronto-based Fairfax, led by investor Prem Watsa, disclosed late on Friday that it now owns 13.8 percent of Reitmans' Class A shares.

Fairfax's investment makes it the second largest investor in the retailer behind a group of Reitmans' directors and senior officers, who together control about 57 percent of the company's common shares and 7 percent of its Class A non-voting shares.

Shares in Reitmans, which have fallen close to 60 percent in the last two years, rose 44 Canadian cents to C$6.79 in morning trading on the Toronto Stock Exchange.

Reitmans, which runs close to 900 stores under its banners such as RW & CO. Penningtons, Addition Elle, Thyme Maternity and its own namesake banner, has been facing stiff competition from a number of U.S. retailers that have expanded into the Canadian market.

The company has been shutting down underperforming stores, and earlier in December it disclosed that it had slashed its quarterly dividend payout to 5 Canadian cents a share, from 20 Canadian cents a share, due to disappointing results.

Fairfax, which has recently been in the spotlight for its investments in embattled smartphone maker BlackBerry Ltd (Toronto:BB.TO - News) (NasdaqGS:BBRY - News), did not provide any detail on why it has acquired the stake in the Canadian retailer.

The financial services company, which controls a number of property and casualty insurance companies, said it continually reviews its investment alternatives and may purchase additional shares of Reitmans from time to time.

RBC Capital Markets analyst Tal Woolley said Fairfax's move "could presage significant changes" at Reitmans, as the firm has helped turnaround small- to mid-cap-sized consumer companies in troubled situations.

Back in 2009, Fairfax stepped in to lend money to furniture retailer, The Brick, when it was in financial trouble. It named new management at the company and eventually helped orchestrate its merger with Leon's Furniture Ltd (Toronto:LNF.TO - News) late in 2012.

Woolley however noted that it is not clear whether Fairfax's investment has been previously discussed with, or is welcomed by the Reitman family, which still owns a controlling stake in the company.

"With the family having voting control, it will be challenging to effect broader organizational changes without their blessing," he wrote in a note to clients.

Fairfax and Reitmans were not immediately reachable for any comment.

(Reporting by Euan Rocha; Editing by Chris Reese and W Simon)

Yahoo Finance

Yahoo Finance