How regulation slowed FTX's growth, limiting the toll of its collapse in Canada

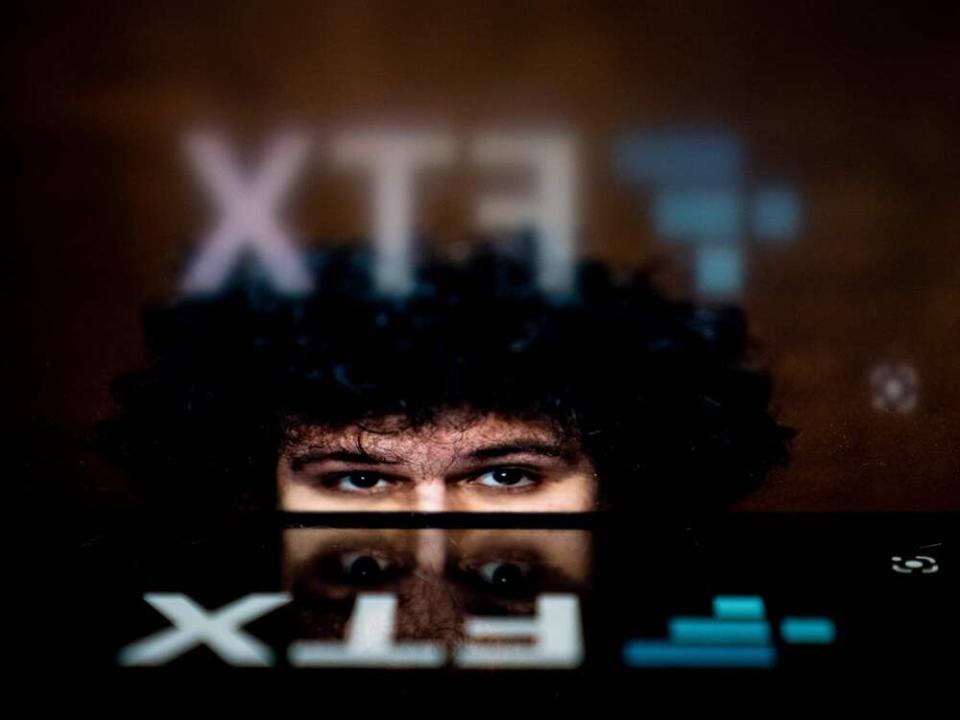

The fallout from collapsed crypto exchange FTX could have been worse in Canada, where regulatory intervention kept at least a partial lid on the venture capital-backed platform’s blistering expansion.

Now in bankruptcy proceedings and reportedly being probed by regulators in the United States and Bahamas over the handling of customer funds, FTX was in the midst of buying a Calgary-based crypto platform Bitvo Inc. when it revealed it was on the brink of collapse earlier this month.

Had the deal been completed, Bahamas-based FTX would have had access to Bitvo’s restricted dealer status — obtained from the Alberta Securities Commission in April — which the Calgary-based platform says gives it the ability to offer its crypto services across the country.

Bitvo said Tuesday that its main shareholder, Pateno Payments Inc., called off the FTX acquisition before it received regulatory approval and no longer has any connection to the tarnished crypto exchange.

“It did not close,” said Bitvo spokesperson Pamela Draper. “We were awaiting on regulatory approval and working towards that.”

Sources familiar with Canada’s crypto and regulatory landscape who were not authorized to speak publicly about the matter, say FTX had been keen to piggyback on Bitvo’s registration after a behind-the-scenes run-in with the Ontario Securities Commission in the summer of 2021.

In June of that year, sources say, the OSC, Canada’s largest securities regulator, told FTX to immediately halt the sale of crypto assets and derivative products to all Ontario retail investors until it was properly registered or obtained restricted dealer status.

FTX remained limited in what services it could offer in Ontario while Bitvo awaited regulatory approval of FTX’s takeover, which was ultimately terminated Tuesday, these sources say.

The now-distressed Bahamian firm acknowledged Ontario restrictions in a pop-up window on its website as recently as last week, which advised: “Registration on FTX from Ontario is not currently available.”

In addition, a list on the website of markets where the exchange did not provide services included the line: “FTX also does not onboard any users from Ontario.” As for the rest of the country, the note included Canada among jurisdictions where there “may be partial restrictions.”

It is estimated the platform had more than 30,000 users in Canada when it ran into trouble.

The OSC’s interaction with FTX in 2021, as described by sources familiar with events, has echoes of a protracted public fight between the OSC and Binance Holdings Ltd., the world’s largest crypto exchange that briefly flirted with buying FTX last week as it sunk into a liquidity and solvency crisis.

Shortly after the OSC announced in March of 2021 that all crypto platforms had to register with the regulator and bring their operations into compliance “or face potential regulatory action,” Binance announced its intention to withdraw its services from Ontario.

However, in December, Binance notified investors that it was allowed to continue its operations in the province, which prompted the OSC to issue a rebuke and insist “no entity in the Binance group of companies holds any form of securities registration in Ontario.”

The wrangle between the regulator and the crypto exchange continued behind the scenes until March, when Binance signed a legally enforceable “undertaking” committing to the OSC that activities involving Ontario residents had ceased — aside from expressly “permitted actions to protect investors.” Binance also committed to ensuring it would prevent any activities involving Ontario residents, and that it would provide fee waivers and offer fee reimbursements to some Ontario users.

While putting the matter aside, the OSC reserved the right to take enforcement action against Binance “for any past, present or future breaches” of Ontario securities law outside those specifically addressed by the undertaking.

On Nov. 9, just as the FTX meltdown was coming into view, Grant Vingoe, chief executive of the Ontario Securities Commission, told an audience at the Global Risk Institute’s 2022 Summit in Toronto that global crypto firms with “opaque” operations outside Canada, such as FTX, can have “really significant impacts” on Canadian investors.

Crypto proponents have pushed back against regulation by saying it stifles innovation and growth, but Vingoe said the OSC’s efforts to regulate the burgeoning and fast-evolving sector are challenging but necessary — adding that the FTX meltdown “highlighted the need for regulation on a collaborative basis, globally.”

On Wednesday, a trio of Canadian regulators including the Office of the Superintendent of Financial Institutions, issued a statement to regulated entities dealing with crypto, warning that while the sector may present opportunities, it can also carry “significant risks to consumer protection as well as the stability, integrity, privacy, and security of the financial system” as a whole.

“To better understand risks posed by crypto-related services and crypto-asset activities, the Office of the Superintendent of Financial Institutions (OSFI), the Financial Consumer Agency of Canada (FCAC), the Canada Deposit Insurance Corporation (CDIC), and other federal agencies have been proactively monitoring how risks posed by crypto-asset activities are managed by entities,” the statement said.

JP Vecsi, a senior public affairs specialist at the OSC, said the regulator would not be commenting on FTX at this time.

A recent OSC survey indicated that around 30 per cent of Canadians plan to invest in crypto products over the next 12 months, despite the fact that most who responded also lacked working knowledge of the practical, legal and regulatory particulars of owning them.

Calgary-based crypto platform Bitvo terminates deal to be acquired by FTX

Ontario Teachers’ Pension reveals US$95-million exposure to troubled crypto exchange FTX

FTX meltdown shows Canadian crypto investors need more protection, say watchdogs

Vingoe told the audience at the GRI Summit that he viewed that finding as a wake-up call about the need for more education and oversight, but that industry players immediately seized on the survey as a marketing pitch to entice more buyers for crypto products and services, highlighting a “fear of missing out” or being left behind.

Two large Canadian pension plans have found themselves enticed and then burned by crypto investments this year.

The Ontario Teachers’ Pension Plan Board revealed last week that it had made a US$95-million investment in FTX, while the Caisse de dépôt et placement du Québec said in August it had written off its US$150-million investment in Celsius Network LLC, which had entered court-supervised bankruptcy proceedings in the United States.

Caisse chief executive Charles Emond said at the time that his team had conducted extensive due diligence with outside experts and consultants. They were aware of management and regulatory issues at Celsius and underestimated the time it would take to resolve them, he said, adding the Caisse was keen on “seizing the potential of blockchain technology” and that perhaps the investment in Celsius had been made “too soon” in the company’s development.

• Email: bshecter@nationalpost.com | Twitter: BatPost

Yahoo Finance

Yahoo Finance