Recent 8.8% pullback isn't enough to hurt long-term United States Steel (NYSE:X) shareholders, they're still up 120% over 1 year

United States Steel Corporation (NYSE:X) shareholders might be concerned after seeing the share price drop 10% in the last quarter. On the other hand, over the last twelve months the stock has delivered rather impressive returns. Like an eagle, the share price soared 119% in that time. So we think most shareholders won't be too upset about the recent fall. The real question is whether the business is trending in the right direction.

While this past week has detracted from the company's one-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for United States Steel

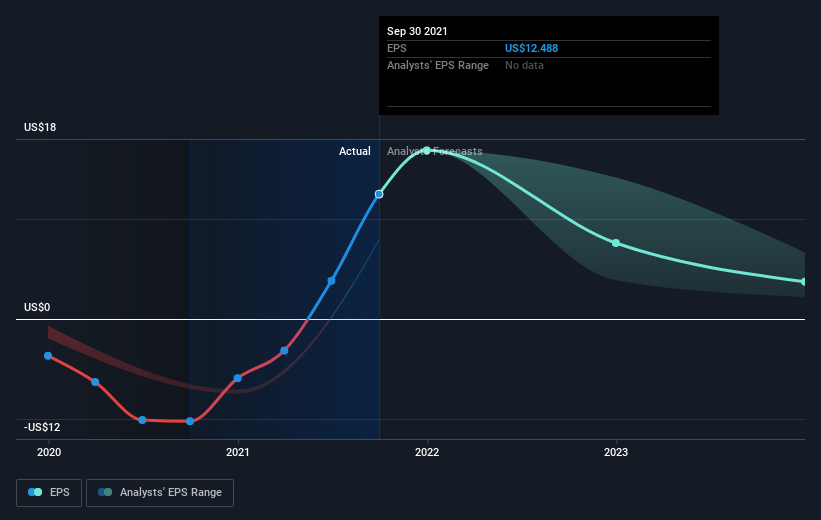

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

United States Steel went from making a loss to reporting a profit, in the last year.

The result looks like a strong improvement to us, so we're not surprised the market likes the growth. Generally speaking the profitability inflection point is a great time to research a company closely, lest you miss an opportunity to profit.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that United States Steel has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on United States Steel's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that United States Steel shareholders have received a total shareholder return of 120% over one year. And that does include the dividend. Notably the five-year annualised TSR loss of 4% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand United States Steel better, we need to consider many other factors. For example, we've discovered 3 warning signs for United States Steel (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance