Reasons to Add Global Water Resources (GWRS) to Your Portfolio

Global Water Resources Inc.’s GWRS investments in infrastructure, expansion of operations through an inorganic route, rising earnings estimates and increase in water connections are expected to drive its performance in the long run.

Let’s focus on the factors that make this Zacks Rank #1 (Strong Buy) stock a strong investment pick at the moment. You can see the complete list of today’s Zacks #1 Rank stocks here.

Growth Projection & Surprise History

The Zacks Consensus Estimate for Global Water Resources’ 2022 earnings has moved up by 25% in the past 60 days to 20 cents per share. The Zacks Consensus Estimate for GWRS’ 2023 earnings has moved up by 10% in the past 60 days to 22 cents per share.

Global Water Resources delivered an average earnings surprise of 154.2% in the last four quarters.

Long-term EPS Growth and Dividend Yield

Global Water Resources’ long-term (three to five years) earnings growth is projected at 15%.

The current dividend yield of GWRS is 2.18%, better than Zacks S&P 500 Composite’s average yield of 1.74%.

Acquisitions Expanding Operation

Global Water Resources is making significant progress by adding new water connections through acquisitions. The company expanded its footprint in the first quarter of 2022 by acquiring the assets of Rincon Water Company. These acquisitions added a total of 91 connections and nearly 9.1 square miles of service area to the company’s regional and growing footprint.

During the beginning of the second quarter, GWRS signed a definitive agreement to acquire Farmers Water Company. The acquisition, when completed, will add approximately 3,300 active water service connections and nearly 21.5 square miles of service area. Global Water Resources has plans to pursue more accretive acquisitions during the remaining of 2022, which will continue to strengthen and expand its operation.

Return on Equity

Return on Equity (ROE) indicates how efficiently a company is utilizing shareholders’ funds in the business to generate returns. At present, Global Water Resources’ ROE is 11.6%, higher than the industry average of 9.7%. This indicates that the company is utilizing the funds more effectively than the industry peers.

Investments

Global Water Resources is accelerating capital investments for upgrading and maintaining infrastructure. The company invested $6.2 million in infrastructure projects in the first quarter to fulfill the ongoing commitment to strategic capital expansions.

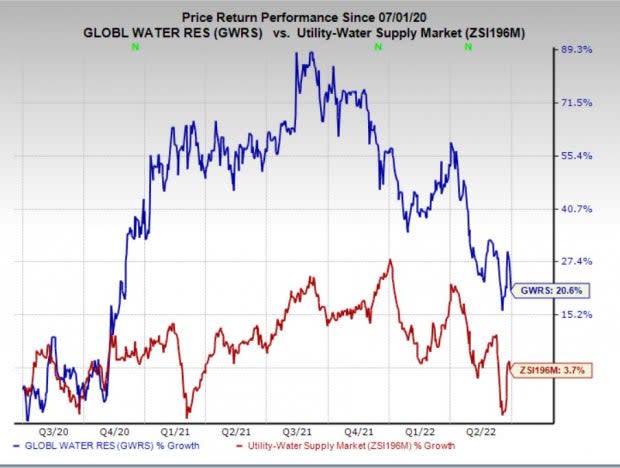

Price Performance

In the past two years, Global Water Resources’ stock has rallied 20.6% compared with the industry’s 3.7% rise.

Image Source: Zacks Investment Research

Other Stocks to Consider

Other top-ranked stocks in the same sector include American Electric Power AEP and American Water Works AWK, each currently holding a Zacks Rank #2 (Buy), while Otter Tail Corporation OTTR sports a Zacks Rank of #1.

American Electric Power, American Water Works and Otter Tail delivered an earnings surprise of 2.4%, 5.2% and 36.9%, respectively, on average.

The Zacks Consensus Estimate for 2022 earnings for American Electric Power, American Water Works and Otter Tail suggests growth of 5.3%, 4.9% and 26.9%, respectively, from their previous years’ corresponding reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

American Water Works Company, Inc. (AWK) : Free Stock Analysis Report

Otter Tail Corporation (OTTR) : Free Stock Analysis Report

Global Water Resources, Inc. (GWRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance