Reasons to Add DTE Energy (DTE) to Your Portfolio Right Now

DTE Energy Company’s DTE ongoing investments to strengthen infrastructure projects, focus on expanding the renewable portfolio and the gradual recovery of Michigan’s economy are expected to drive its performance over the long run.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a strong investment pick at the moment. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Growth Projection & Surprise History

The Zacks Consensus Estimate for DTE Energy’s 2022 earnings has moved up by 1.7% in the past 60 days to $6.04 per share. The Zacks Consensus Estimate for DTE’s 2023 earnings has moved up by 0.3% in the past 60 days to $6.30 per share.

DTE Energy’s long-term (three to five years) earnings growth is projected at 6%.

DTE Energy delivered an average earnings surprise of 8.97% in the last four quarters.

Systematic Investments & Emissions Reduction

DTE Energy follows a systematic capital spending program to maintain and upgrade the reliability of electric utility systems. DTE Electric currently expects to make capital investments of $15 billion over the 2022-2026 period, of which, $4 billion will be spent on the base infrastructure, $8 billion on the distribution infrastructure along with $3 billion for a cleaner generation.

Additionally, the DTE Electric segment plans to invest $40 billion over the next 10 years. Meanwhile, DTE Gas’ total capital investments over the 2022-2026 period are estimated at $3.1 billion, which comprises $1.5 billion for the base infrastructure and $1.6 billion for gas main renewal, meter move out and pipeline integrity programs.

DTE Energy is also investing steadily to enhance its renewable-generation assets. DTE Energy remains committed to reducing the carbon emission of its electric utility operations by 32% by 2023, 50% by 2030 and 80% by 2040 from the 2005 carbon emissions levels. The utility expanded the net-zero carbon emission goal for DTE Electric and DTE Gas by 2050.

Return on Equity

Return on Equity (ROE) indicates how efficiently a company is utilizing shareholders’ funds in the business to generate returns. At present, DTE Energy’s ROE is 13.6%, higher than the industry average of 10.3%. This indicates that DTE is utilizing the funds more effectively than industry peers.

Debt Position

The Debt to Capital of DTE Energy at the end of the first quarter of 2022 was 31% compared with the industry average of 58.3%. This indicates that DTE Energy is using comparatively lower debts to manage the business compared with peers.

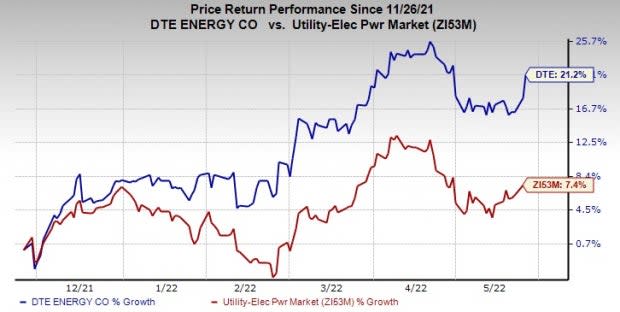

Price Performance

In the past six months, DTE stock has rallied 21.2% compared with the industry’s 7.4% growth.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other similar-ranked stocks from the same industry include American Electric Power AEP, Eversource Energy ES and Hawaiian Electric Industries HE.

The long-term earnings growth of American Electric Power, Eversource Energy and Hawaiian Electric Industries is projected at 6.2%, 6.2% and 3.2%, respectively.

American Electric Power, Eversource Energy and Hawaiian Electric Industries delivered an average earnings surprise of 2.4%, 0.1% and 30.8%, respectively, in the last four quarters.

In the past six months, AEP, ES and HE shares have surged 23.9%, 9.4% and 8.6%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

DTE Energy Company (DTE) : Free Stock Analysis Report

American Electric Power Company, Inc. (AEP) : Free Stock Analysis Report

Hawaiian Electric Industries, Inc. (HE) : Free Stock Analysis Report

Eversource Energy (ES) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance