Real Estate Development Stocks Outlook: Industry Losing Steam?

Real estate development companies are primarily engaged in owning, developing and managing a variety of real estate properties, including commercial, residential and mixed-use parcels. While some developers undertake construction on their land holdings to eventually sell the properties to homebuilders, retaining and operating these properties is also a common practice. Operating the properties offers a recurring revenue source for these companies.

Additionally, some industry participants actively undertake strategic activities, such as infrastructure improvement, along with land planning and development to promote economic development, attract quality job creators and diversify the regions in which they operate. They also provide real estate leasing, stewardship, underwriting, planning and entitlement services.

It is worth noting that real estate development companies are primarily classified as financial companies, not construction companies.

Here are the three major themes in the industry:

Compliance with governmental laws and regulatory changes: Development companies are subject to elaborate environment and land use laws that affect their core business. These include zoning, entitlements, building codes, construction permits and lengthy approval processes. Compliance with these regulations requires significant expenditure, which affects their ability to develop realties. Further, the impact of regulatory change continues to play out across the industry. In fact, federal tax law changes are limiting deductions like mortgage interest expense and real estate taxes for calculation of taxable income. This is anticipated to inflate the after-tax cost of owning a home, discouraging demand for homes, and could reduce the prices of high-priced apartments.

Rising consumer confidence: A strong U.S. economy, low unemployment levels and improved consumer sentiment are vital growth catalysts for the industry. This is because, as business opportunities increase, demand for commercial properties spike up. Further, new jobs and higher income create fresh household formations, thereby increasing homebuilding and home sales. Moreover, the recent rate hike indicates strengthening of the economy, which is anticipated to have positive ripple effects across the industry.

Exploring alternative financing options: In the light of constrained mortgage environment, market contraction and increasing regulatory requirements, banks are becoming reluctant to provide construction loans and financing. Alternatively, private lenders and real estate fintech firms are being considered to meet capital needs, especially for riskier projects and lesser-known borrowers. Particularly, real estate fintechs provide platforms for firms to expand and diversify their lender base, thus, enabling financing and investment in development projects. In addition, developers can use these platforms for a variety of services, like leasing, acquisition, disposition decisions, and obtaining detailed financial models for property construction financing.

Zacks Industry Rank Indicates Gloomy Prospects

The Zacks Real Estate – Development industry is housed within the broader Zacks Finance sector. It carries a Zacks Industry Rank #204, which places it at the bottom 20% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates bleak near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

The industry’s positioning in the bottom 50% of the Zacks-ranked industries is a result of negative earnings outlook for the constituent companies in aggregate. Looking at the aggregate earnings estimate revisions, it appears that analysts are losing confidence in this group’s earnings growth potential. In the past three months, the industry’s earnings estimate for the current year has declined by 16.7%.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Lags on Stock Market Performance

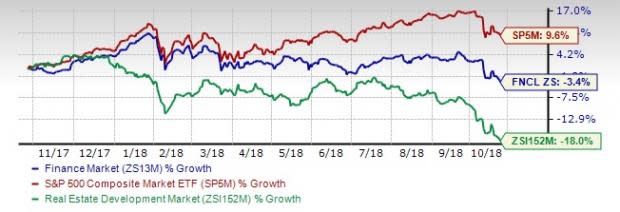

The Zacks Real Estate – Development Industry has lagged the broader Zacks Finance Sector as well as the Zacks S&P 500 composite over the past year.

The industry has declined 18% over this period compared to the S&P 500 index’s rise of 9.6%. In the same time frame, the broader sector declined 3.4%.

One-Year Price Performance

Industry’s Current Valuation

On the basis of forward 12-month price-to-earnings (P/E) ratio, which is a commonly used multiple for valuing real estate development companies, we see that the industry is currently trading at 13.5X compared to the S&P 500’s 16.3X. The industry is trading above the Finance sector’s forward 12-month P/E of 11.7X. This is shown in the chart below.

Forward 12 Month Price-to-Earnings (P/E) Ratio

Over the last five years, the industry has traded as high as 38.53X, as low as 10.11X, with a median of 19.22X.

Bottom Line

The real estate development industry is currently struggling to capitalize on a growing domestic economy and the existing strong real estate fundamentals. Although construction of new property continues, as companies are continuously on the lookout for higher returns, rising construction costs may impede growth over the next few years. Elevated raw-material costs make some development unfeasible and escalate prices of realties. Furthermore, with continued rise in interest rates, companies are witnessing a rise in financing costs as well.

The Zacks Real Estate – Development space doesn’t currently have stocks to buy. However, we present three stocks, with a Zacks Rank of 3 (Hold) that investors may consider holding on to.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Howard Hughes Corporation (HHC): This Wacker Drive, CHI-based company develops master-planned communities. The company’s Zacks Consensus Estimate for the current year EPS remained unchanged at $1.65, over the last 30 days. Further, the EPS for 2019 is expected to be up 92.7% year over year.

Price and Consensus: HHC

BBX Capital Corporation (BBX): Formerly known as BFC Financial Corporation, this Florida-based company is involved in the acquisition, ownership and management of joint ventures and investments in real estate and real estate development projects. The 2018 consensus EPS estimate for the company remained unchanged at 24 cents, over the last seven days. Further, the company is expected to witness 83.3% year-over-year EPS growth in 2019.

Price and Consensus: BBX

Marcus & Millichap, Inc. (MMI): The Calabasas, CHI-based company offers commercial real estate investment brokerage services for multifamily, retail, office, industrial, land, self-storage, seniors housing, manufactured housing, and mixed-use/other property types. The 2018 consensus EPS estimate for this company remained unchanged at $1.99, over the last 30 days. Additionally, its 2019 EPS is expected to witness year-over-year growth of 6.28%.

Price and Consensus: MMI

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Marcus & Millichap, Inc. (MMI) : Free Stock Analysis Report

Howard Hughes Corporation (The) (HHC) : Free Stock Analysis Report

BBX Capital Corp. (BBX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance