Raytheon (RTX) Wins Deal to Aid DDG 1000 Class Combat System

Raytheon Technologies Inc. RTX recently secured a modification contract to support the DDG 1000-class combat system. The award has been offered by the Naval Sea Systems Command, Washington, D.C.

Details of the Deal

Valued at $11.2 million, the contract is expected to be completed by November 2023. Per the terms of the deal, Raytheon will provide total ship computing environment lab hardware for modernization/technical refresh and Conventional Prompt Strike to support DDG 1000-class combat system activation, sustainment and modernization.

The majority of the work related to this deal will be carried out in Nashua, NH.

Raytheon & DDG 1000

The Zumwalt-class destroyers, also known as DDG 1000, are America’s next-generation combat ships. Notably, Raytheon’s Missiles & Defense serves as the prime mission systems equipment integrator for all electronic and combat systems for the DDG 1000 program.

In particular, Raytheon provides ship computing environment, electronic modular enclosures, integrated undersea warfare system, MK57 vertical launching system, advanced gun system and integrated power system.

What’s Favoring Raytheon?

The changing dynamics of the military landscape and the rising geopolitical tension make it mandatory for a country to continuously evolve and strengthen its defense structure. To this end, Navy ships form an integral part of any military missions and arm them in their ship warfare affairs.

Notably, Raytheon’s Missile and Defense unit provided naval and undersea solutions including combat and ship electronic and sensing systems, as well as undersea sensing and effects solutions. As a result, with increasing demand for military shipbuilding and associated upgrades in recent times, Raytheon is also witnessing solid contract flow for its naval solutions. The latest contract win is an example of that.

Growth Prospects

Nations are reinforcing their defense capabilities to prevent any war-like situation.

In this context, per a report from Mordor Intelligence, the global shipbuilding market is projected to witness a CAGR of 4.8% during the 2022-2027 period. Such growth trends indicate ample opportunities for Raytheon, as well as other defense primes BAE Systems BAESY, Mitsubishi Heavy Industries MHVYF and Huntington Ingalls HII, which enjoy a significant position in the military shipbuilding space.

BAE Systems designs and manufactures naval ships and submarines as well as state-of-the-art combat systems and equipment. It also offers an array of associated services, including training solutions, maintenance and modernization programs, to support ships and equipment in service worldwide.

The long-term earnings growth rate of BAESY is pegged at 9.3%. Shares of BAE Systems have rallied 21.2% in the past year.

Mitsubishi Heavy Industries manufactures naval surface ships and submarines. The company also provides after-sales service for destroyers and submarines.

The Zacks Consensus Estimate for Mitsubishi’s fiscal 2023 sales indicates growth of 2.7% from the prior-year reported figure. Shares of MHVYF have returned 34.1% value to investors in the past year.

Huntington Ingalls’ business segment, Ingalls, has in-depth experience in manufacturing amphibious assault and expeditionary ships for the U.S. Navy. Being the U.S. Navy's primary surface combatant, the Aegis-equipped Arleigh Burke class (DDG 51) destroyers enjoy solid demand.

The Zacks Consensus Estimate for Huntington Ingalls’ 2022 earnings indicates growth of 13.9% from the prior-year reported figure. Shares of HII have returned 17.1% value to investors in the past year.

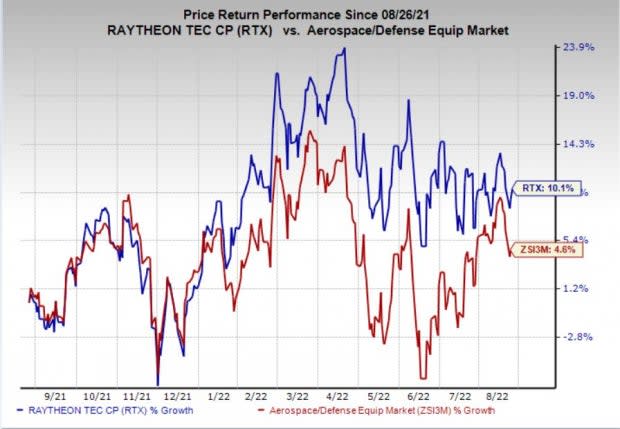

Price Performance

Shares of Raytheon Technologies have rallied 10.1% in the past year compared with the industry’s rise of 4.6%.

Image Source: Zacks Investment Research

Zacks Rank

Raytheon currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bae Systems PLC (BAESY) : Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII) : Free Stock Analysis Report

Mitsubishi Heavy Industries, Ltd. (MHVYF) : Free Stock Analysis Report

Raytheon Technologies Corporation (RTX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance