Raytheon (RTX) Wins $79M Deal to Aid ESSM Block 2 Production

Raytheon Technologies Corp.’s RTX business segment, Missiles & Defense, recently won a modification contract involving Evolved Seasparrow Missile (ESSM). The Naval Sea Systems Command, Washington, D.C., has awarded the contract.

Details of the Deal

Valued at $78.7 million, the deal is expected to be completed by March 2025. Per the terms, Raytheon is going to procure additional fiscal 2022 guided missile assemblies for supporting the fiscal 2021-2023 ESSM Block 2 full-rate production requirements.

The majority of the work related to this deal will be executed in Tucson, AZ.

What’s Favoring Raytheon?

Increasing geopolitical tensions across the globe have prompted nations, both developed and developing, to strengthen their defense systems manifold. Following the rapid technological advancements, missile defense has steadily emerged as a key catalyst for the nation’s defense strategy.

With the United States being the world’s largest weapons supplier and Raytheon Technologies a prominent U.S. missile maker, the company has been clinching significant awards for the enhancement of its missile defense systems with the latest technologies and providing its end users complex technical services. The latest contract is one such example.

The U.S. fiscal 2023 defense budget proposal provisioned $24.7 billion for investments in missile defense. This should enable Raytheon Technologies to clinch more contracts related to various missile defense systems and associated services.

Growth Prospects

Per a report by Mordor Intelligence, the global missiles and missile defense systems market is estimated to register a CAGR of more than 8% during the 2022-2031 period. Such massive growth projections indicate solid opportunities for prominent missile manufacturers like Raytheon Technologies along with Northrop Grumman NOC, Lockheed Martin LMT and General Dynamics GD.

Northrop is a prominent developer of missile systems, and counter systems, including strategic deterrents, as well as subsystems and components. In fact, to strengthen its position in the missile market, Northrop acquired Orbital ATK in 2018, which used to be one of the industry leaders in providing missile components across air-, sea- and land-based systems.

Northrop boasts a long-term earnings growth rate of 6.1%. The Zacks Consensus Estimate for NOC’s 2022 sales indicates an improvement of 2.6% from the 2021 reported figure.

Lockheed’s Missiles and Fire Control business unit develops, manufactures, and supports advanced combat missiles and rockets for military customers, including the U.S. Army, Navy, Air Force, Marine Corps, NASA and dozens of foreign allies. Some of its prominent products include the PAC-3 missile as well as the Terminal High Altitude Area Defense missile.

Lockheed boasts a long-term earnings growth rate of 5.7%. The company has a four-quarter average earnings surprise of 63.25%.

General Dynamics’ Ordnance and Tactical Systems is the system integrator of the 2.75-inch Hydra-70 family of rockets. It also produces composite rocket motor cases and launch tubes for tactical and strategic missiles.

General Dynamics boasts a long-term earnings growth rate of 9.8%. The Zacks Consensus Estimate for GD’s 2022 sales indicates an improvement of 2.7% from the 2021 reported figure.

Price Movement

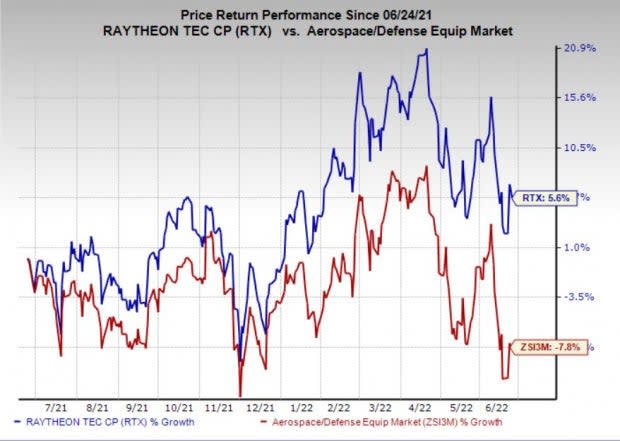

In the past year, Raytheon Technologies’ shares have gained 5.6% against the industry’s 7.8% decline.

Image Source: Zacks Investment Research

Zacks Rank

Raytheon currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance