Rainbows and Unicorns: Tamarack Valley Energy Ltd. (TSE:TVE) Analysts Just Became A Lot More Optimistic

Tamarack Valley Energy Ltd. (TSE:TVE) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with analysts modelling a real improvement in business performance. The stock price has risen 5.9% to CA$2.69 over the past week, suggesting investors are becoming more optimistic. It will be interesting to see if this latest upgrade is enough to kickstart further buying interest in the stock.

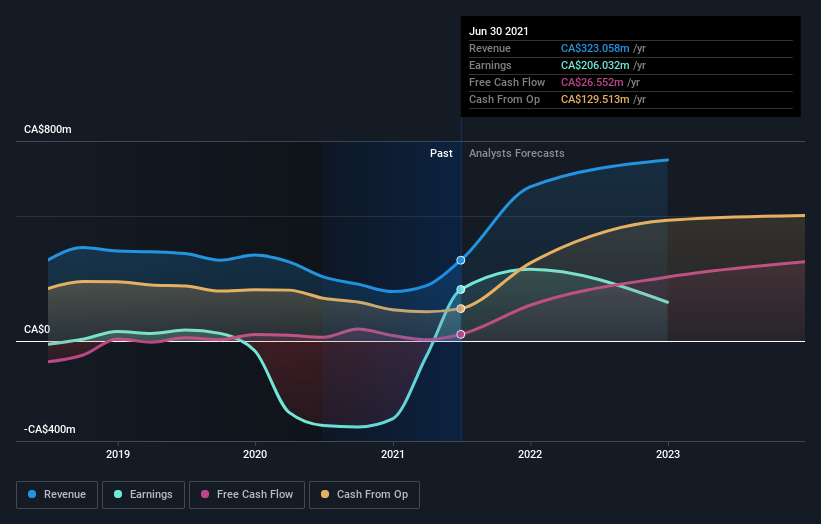

Following the upgrade, the current consensus from Tamarack Valley Energy's twin analysts is for revenues of CA$617m in 2021 which - if met - would reflect a major 91% increase on its sales over the past 12 months. Statutory earnings per share are forecast to be CA$0.80, approximately in line with the last 12 months. Previously, the analysts had been modelling revenues of CA$555m and earnings per share (EPS) of CA$0.29 in 2021. So we can see there's been a pretty clear increase in analyst sentiment in recent times, with both revenues and earnings per share receiving a decent lift in the latest estimates.

View our latest analysis for Tamarack Valley Energy

Although the analysts have upgraded their earnings estimates, there was no change to the consensus price target of CA$4.25, suggesting that the forecast performance does not have a long term impact on the company's valuation. The consensus price target is just an average of individual analyst targets, so - it could be handy to see how wide the range of underlying estimates is. The most optimistic Tamarack Valley Energy analyst has a price target of CA$6.00 per share, while the most pessimistic values it at CA$3.00. This is a fairly broad spread of estimates, suggesting that the analysts are forecasting a wide range of possible outcomes for the business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analysts are definitely expecting Tamarack Valley Energy's growth to accelerate, with the forecast 264% annualised growth to the end of 2021 ranking favourably alongside historical growth of 13% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 6.4% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Tamarack Valley Energy to grow faster than the wider industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. Some investors might be disappointed to see that the price target is unchanged, but we feel that improving fundamentals are usually a positive - assuming these forecasts are met! So Tamarack Valley Energy could be a good candidate for more research.

These earnings upgrades look like a sterling endorsement, but before diving in - you should know that we've spotted 3 potential flag with Tamarack Valley Energy, including major dilution from new stock issuance in the past year. For more information, you can click through to our platform to learn more about this and the 1 other flag we've identified .

We also provide an overview of the Tamarack Valley Energy Board and CEO remuneration and length of tenure at the company, and whether insiders have been buying the stock, here.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

Yahoo Finance

Yahoo Finance