Should Quanzhou Huixin Micro-Credit Co., Ltd. (HKG:1577) Be Part Of Your Income Portfolio?

Is Quanzhou Huixin Micro-Credit Co., Ltd. (HKG:1577) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

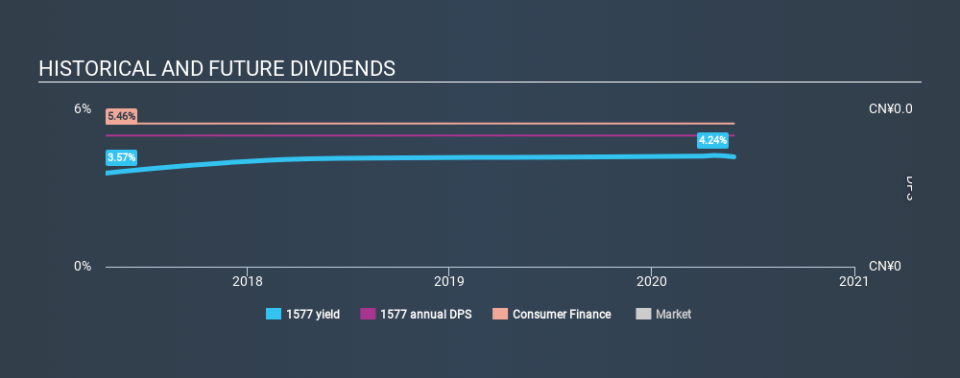

Quanzhou Huixin Micro-Credit pays a 4.2% dividend yield, and has been paying dividends for the past three years. A high yield probably looks enticing, but investors are likely wondering about the short payment history. Some simple research can reduce the risk of buying Quanzhou Huixin Micro-Credit for its dividend - read on to learn more.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, Quanzhou Huixin Micro-Credit paid out 53% of its profit as dividends. This is a fairly normal payout ratio among most businesses. It allows a higher dividend to be paid to shareholders, but does limit the capital retained in the business - which could be good or bad.

We update our data on Quanzhou Huixin Micro-Credit every 24 hours, so you can always get our latest analysis of its financial health, here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. The company has been paying a stable dividend for a few years now, but we'd like to see more evidence of consistency over a longer period. Its most recent annual dividend was CN¥0.05 per share, effectively flat on its first payment three years ago.

Modest dividend growth is good to see, especially with the payments being relatively stable. However, the payment history is relatively short and we wouldn't want to rely on this dividend too much.

Dividend Growth Potential

Dividend payments have been consistent over the past few years, but we should always check if earnings per share (EPS) are growing, as this will help maintain the purchasing power of the dividend. In the last five years, Quanzhou Huixin Micro-Credit's earnings per share have shrunk at approximately 8.4% per annum. A modest decline in earnings per share is not great to see, but it doesn't automatically make a dividend unsustainable. Still, we'd vastly prefer to see EPS growth when researching dividend stocks.

Conclusion

To summarise, shareholders should always check that Quanzhou Huixin Micro-Credit's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Quanzhou Huixin Micro-Credit's payout ratio is within normal bounds. Earnings per share have been falling, and the company has a relatively short dividend history - shorter than we like, anyway. With this information in mind, we think Quanzhou Huixin Micro-Credit may not be an ideal dividend stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 1 warning sign for Quanzhou Huixin Micro-Credit that investors need to be conscious of moving forward.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance