Q1 Earnings: Can Artificial Intelligence (AI) Sustain Momentum?

The analysts covering Nvidia NVDA are struggling to come up with superlatives to describe the chipmaker’s blockbuster quarterly results. Coming into Nvidia’s May 26th quarterly numbers, many analysts saw some upside to consensus estimates, given the company’s AI leverage. But the stock had already doubled this year before the Wednesday release on those AI hopes.

It is humbling to acknowledge that I thought the stock was ‘priced for perfection’ and was skeptical that Nvidia could do anything in the quarterly numbers that could satisfy those lofty expectations. Keep in mind that we fall in the Nvidia ‘fan club,’ having held the stock in the Zacks Focus List portfolio since May 2019.

The stock’s performance since the quarterly release is in a class of its own, and for good reasons. In the current uncertain macroeconomic environment, Nvidia raised Q2 revenue guidance by more than +50% on the back of robust data-center demand reflecting momentum in generative AI and large language models. Importantly, Nvidia indicated a high degree of visibility in these demand trends over the coming quarters.

There are legitimate questions as to how sustainable this growth trajectory will prove to be and whether Nvidia will be able to protect its first-mover advantage as the competitive landscape heats up over time.

We have all glimpsed the potential of generative AI by playing around with ChatGPT and Google Bard, allowing us to envision this technology’s ability to enhance efficiencies. But it is reasonable to be skeptical of both the trillions of dollars in TAMs that the AI revolution will unleash or the emerging talk of an ‘AI bubble.’

Nvidia is hardly alone in riding the AI wave, with Microsoft MSFT and Alphabet GOOGL already duking it out for primacy. Alphabet’s earlier AI efforts didn’t impress the market much, and many had started thinking that Microsoft may be able to leverage AI to open up Alphabet’s hold on the search market. But Alphabet appears to have found its mojo back, as the stock’s recent performance shows.

The chart below shows the year-to-date performance of Microsoft, Alphabet, and Nvidia.

Image Source: Zacks Investment Research

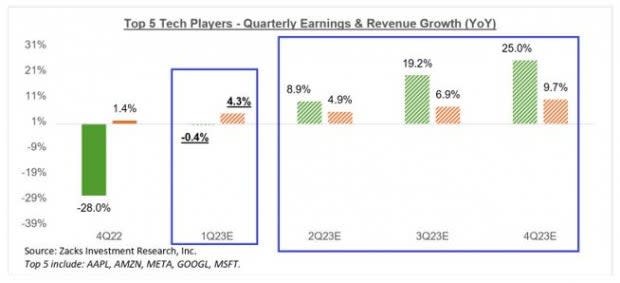

The earnings outlook for the ‘Big 5 Tech Players’ that includes Apple AAPL, Amazon AMZN, and Meta META, in addition to Microsoft and Alphabet, has steadily improved lately. Total Q1 earnings for the group were essentially flat (down -0.4%) on +4.3% higher revenues.

The growth outlook starts improving from the current period (2023 Q2) onwards, with earnings expected to be up +8.9% on +4.9% higher revenues.

The chart below shows the group’s earnings picture on a quarterly basis.

Image Source: Zacks Investment Research

The chart below shows the group’s earnings picture on an annual basis.

Image Source: Zacks Investment Research

Q1 Earnings Season Scorecard

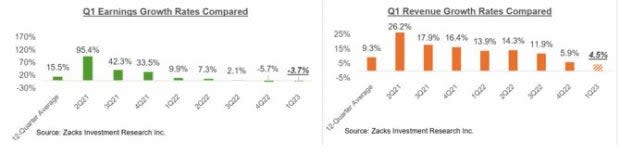

Including all the quarterly reports that came out through Friday, May 26th, we now have Q1 earnings from 486 S&P 500 members, or 97.2% of the index’s total membership. Total earnings for these companies are down -3.7% from the same period last year on +4.5% higher revenues, with 78.2% beating EPS estimates and 75.1% beating revenue estimates.

The proportion of these companies beating both EPS and revenue estimates is 63.2%.

Regular readers of our earnings commentary know that we have been referring to the overall picture emerging from the Q1 earnings season as good enough; not great, but not bad, either.

With this reporting cycle now largely behind us, we can confidently say that corporate earnings aren’t headed towards the ‘cliff’ that market bears warned us of.

The way we see it, the ‘better-than-feared’ view of the Q1 earnings season at this stage may be a bit unfair, given how resilient corporate profitability has turned out to be. But the view isn’t entirely off the mark either.

We have about 100 companies on deck to report results, including 9 S&P 500 members. This week’s docket includes Salesforce.com, Macy’s, Broadcom, Lululemon, Dollar General, and others.

Below, we compare the Q1 results thus far from what we have seen from this same group of companies in other recent periods.

The first set of charts compares the earnings and revenue growth rates for the companies that have reported with what we had seen from the group in other recent quarters.

Image Source: Zacks Investment Research

The comparison charts below put the Q1 EPS and revenue beats percentages in a historical context.

Image Source: Zacks Investment Research

The Earnings Big Picture

To get a sense of what is currently expected, take a look at the chart below that shows current earnings and revenue growth expectations for the S&P 500 index for 2023 Q1 and the following three quarters.

Image Source: Zacks Investment Research

The chart below shows the earnings and revenue growth picture on an annual basis.

Image Source: Zacks Investment Research

For a detailed look at the overall earnings picture, including expectations for the coming periods, please check out our weekly Earnings Trends report >>>> Earnings Outlook Reflects Stability

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Apple Inc. (AAPL) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance