Public Service Enterprise (PEG) Posts In-Line Q1 Earnings

Public Service Enterprise Group Inc. PEG, or PSEG, reported first-quarter 2020 adjusted operating earnings of $1.03 per share, which came in line with the Zacks Consensus Estimate. However, the bottom line declined 4.6% on a year-over-year basis.

Including one-time adjustments, the company reported quarterly earnings of 88 cents per share compared with $1.38 in first-quarter 2019.

Total Revenues

Revenues of $2,781 million missed the Zacks Consensus Estimate of $3,237 million by 14.1%. The top-line figure also declined 6.7% from the year-ago quarter’s $2,980 million.

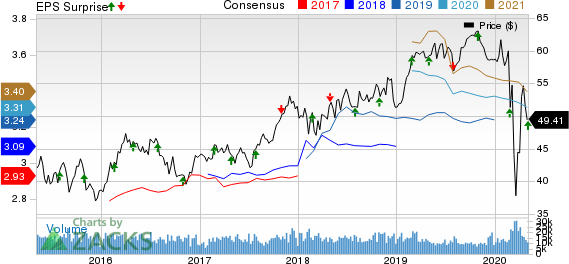

Public Service Enterprise Group Incorporated Price, Consensus and EPS Surprise

Public Service Enterprise Group Incorporated price-consensus-eps-surprise-chart | Public Service Enterprise Group Incorporated Quote

Highlights of the Release

For the first quarter of 2020, the company reported operating income of $797 million, higher than $786 million in the year-ago quarter. Total operating expenses were $1,984 million, down 9.6% from the year-ago quarter.

Interest expenses in the reported quarter were $153 million, compared with $133 million in the first quarter of 2019.

Segment Performance

PSE&G: Segment earnings were $440 million, up from $403 million in the prior-year quarter. PSE&G’s results in the quarter were driven by revenue growth from ongoing capital investment programs as well as growth in transmission rate base.

PSEG Power: Segment adjusted earnings were $85 million compared with $143 million in the prior-year quarter. The downside was due to extremely mild winter weather conditions that caused lower generation output.

PSEG Enterprise/Other: Segment losswas $5 million against earnings of $1 million in the prior-year quarter. The year-over-year downside can be attributed to higher interest and tax expenses.

2020 Guidance

The company reiterated its 2020 guidance. Adjusted earnings are still projected to be $3.30-$3.50 per share. The Zacks Consensus Estimate for earnings is currently pegged at $3.31, lower than the mid-point of the company’s guided range.

PSE&G’s operating earnings are still anticipated to be $1,310-$1,370 million. The company expects PSEG Power operating earnings to be in the range of $345-$435 million.

Zacks Rank

PSEG currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Utility Releases

FirstEnergy Corporation FE delivered first-quarter 2020 operating earnings of 66 cents per share, which beat the Zacks Consensus Estimate of 64 cents by 3.13%.

NextEra Energy NEE reported first-quarter 2020 adjusted earnings of $2.38 per share, which surpassed the Zacks Consensus Estimate of $2.21 by 7.7%.

CMS Energy Corporation CMS reported first-quarter 2020 adjusted EPS of 86 cents, which surpassed the Zacks Consensus Estimate of 77 cents by 11.7%.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FirstEnergy Corporation (FE) : Free Stock Analysis Report

CMS Energy Corporation (CMS) : Free Stock Analysis Report

Public Service Enterprise Group Incorporated (PEG) : Free Stock Analysis Report

NextEra Energy, Inc. (NEE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance