Proofpoint (PFPT) Q3 Earnings & Revenues Beat Estimates

Proofpoint Inc. PFPT reported third-quarter 2019 non-GAAP earnings of 49 cents per share, which outpaced the Zacks Consensus Estimate of 40 cents. The bottom line also came ahead of the year-ago quarter figure of 40 cents.

Proofpoint generated total revenues of $227.4 million, up 23% year over year. The top line also surpassed the consensus estimate of $225 million.

The top-line growth can be attributed to strong customer wins and a solid progress in the emerging products. Strong demand for its next-generation cloud security and compliance platform, ongoing migration to the cloud, and high renewal rates were other tailwinds.

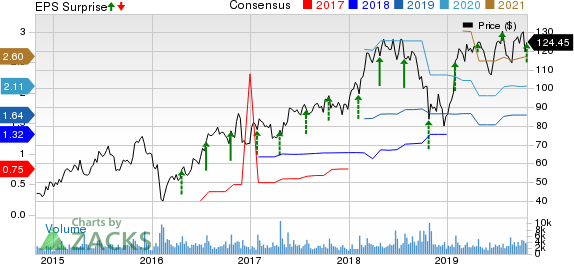

Proofpoint, Inc. Price, Consensus and EPS Surprise

Proofpoint, Inc. price-consensus-eps-surprise-chart | Proofpoint, Inc. Quote

Top-Line Details

Total billings during the quarter jumped 26% year over year to $277.8 million. Also, renewal rates again soared above 90%.

Subscription revenues (98.6% of total revenues) came in at $224.3 million, up 23.6%. Hardware and services revenues (1.4%) grew 14.8% to $3.1 million.

On the basis of solutions, revenues from Advanced Threat (72.2%), which includes Targeted Attack Protection or TAP offering, rose 19% from the year-earlier quarter to $164.2 million. Compliance revenues (27.8%) of $63.2 million surged 36.8%.

Emerging products, which contributed to more than 33% of total new and add-on businesses closed during the quarter, steadily surpassed the company’s remaining product portfolio. This upside was led by robust demand for Email Fraud Defense, Proofpoint Security Awareness Training (PSAT) and Threat Response.

The company added new video-based awareness content to PSAT in the third quarter. Management remains optimistic about the prospects of PSAT, which is expected to drive growth and boost its capabilities in the new segment of the cybersecurity market.

Proofpoint continues to expand abroad by the dint of its international business, which grew 28% year over year and accounted for 20% of its total revenues in the third quarter.

The company won many international deals during the quarter. These are a Global 2000 financial services firm that purchased Protection for 160,000 users, a Global 2000 financial services firm that added Protection and TAP for 18,000 users, a transportation services company that bought P3 bundle for 5,000 users, and a electrical products distributor that purchased Protection, TAP, Threat Response and internal e-mail defense for 16,000 users.

Ecosystem partnerships included a technology partnership with CrowdStrike CRWD, aimed at protecting customers from advanced threats across e-mail and endpoints through cloud-to-cloud APIs established between TAP and CrowdStrike Falcon.

Proofpoint also expanded its technology partnership with identity access management provider Okta OKTA to enhance the capability of customers to protect their users from sophisticated cyber-attacks.

The pipeline in Proofpoint’s digital risk products area remained strong. Increased interest in new archiving features like supervision, eDiscovery and analytics visualization, particularly from firms in regulated industries such as healthcare and financial services and the features are driving demand.

Proofpoint’s archiving pipeline continued to strengthen on the back of its cloud-based delivery model. However, given the complexity of these deals, the company expects that it might take a few quarters for them to mature and contribute to results.

Additionally, archiving deals maturing in the third quarter included a large North American bank, which bought a three-year prepaid subscription for a high amount for 18,000 users; a large Canadian bank that purchased a three-year high-value prepaid subscription for 55,000 users; and a technology company that expanded their subscription for 50,000 users.

Operating Details

Non-GAAP gross profit advanced 25.4% from the year-ago quarter to $181 million. Non-GAAP gross margin improved 200 basis points (bps) to 80%, driven by a strong revenue performance.

Proofpoint’s non-GAAP operating income surged 49.3% to $33.9 million. Non-GAAP operating margin expanded 260 bps to 14.9%.

Balance Sheet & Cash Flow

Proofpoint exited the quarter with cash and cash equivalents and short-term investments of approximately $1.05 billion compared with the previous quarter’s balance of $182.7 million.

The company generated operating cash flow of $68.6 million compared with $43.4 million in the previous quarter. Free cash flow summed $58.6 million compared with $35 million reported in the second quarter of 2019.

Guidance

Encouraged by its strong third-quarter performance, Proofpoint raised full-year 2019 guidance. For 2019, the company expects revenues of $882.3-$884.3 million, up from the previous projection of $878.5-$880.5 million. Billings expectation remains in the range of $1.064-$1.068 billion. Non-GAAP gross margin is projected to be 79%.

Non-GAAP earnings per share are now anticipated in the band of $1.72-$1.75. Previously, the company had projected this metric to be $1.61-$1.64.

Free cash flow is envisioned in the range of $200.5-$202.5 million, up from $196-$198 million expected previously, which includes $8.4 million tax payment associated with the acquisition of Meta Networks.

Capital expenditures are expected to be approximately $38 million for full-year 2019.

For the fourth quarter of 2019, Proofpoint anticipates revenues of $237.5-$239.5 million and billings of $339-$343 million.

Non-GAAP gross margin is estimated to be 79%. Non-GAAP earnings per share are anticipated in the band of 47-50 cents. Free cash flow is estimated in the range of $58.2-$60.2 million.

Capital expenditures of $1 million and depreciation of $9 million are expected to remain overhangs on the margins in the fourth quarter.

Management is optimistic about its progress to increase its total addressable market to more than $13 billion in the coming years.

Zacks Rank & Another Key Pick

The company currently has a Zacks Rank #2 (Buy).

Another top-ranked stock in the broader technology sector is Splunk Inc. SPLK, flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term expected earnings growth rate for Splunk is 31.24%.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Splunk Inc. (SPLK) : Free Stock Analysis Report

Proofpoint, Inc. (PFPT) : Free Stock Analysis Report

CrowdStrike Holdings Inc. (CRWD) : Free Stock Analysis Report

Okta, Inc. (OKTA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance