Production Growth to Aid Canadian Natural's (CNQ) Q1 Earnings

Canadian Natural Resources Limited CNQ is set to release first-quarter 2020 results before the opening bell on Thursday, May 7. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of 4 cents per share on revenues of $3.6 billion.

Let’s delve into the factors that might have influenced the Canadian explorer and producer’s performance in the March quarter. But it’s worth taking a look at Canadian Natural’s previous-quarter performance first.

Highlights of Q4 Earnings & Surprise History

In the last reported quarter, the Calgary-based oil and gas giant missed the consensus mark due to lower natural gas price realizations plus higher costs and expenses. Canadian Natural reported adjusted net income per share of 44 cents that underperformed the Zacks Consensus Estimate by 18.5%. The company’s quarterly revenues of $4.5 billion fell 1.7% short of the Zacks Consensus Estimate.

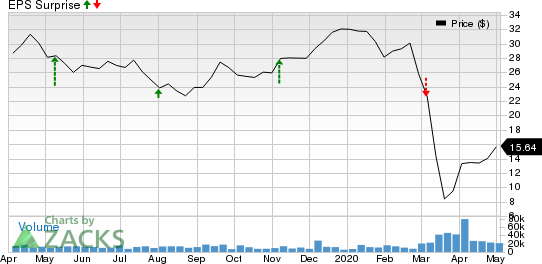

As far as earnings surprises are concerned, Canadian Natural surpassed the Zacks Consensus Estimate on two occasions, missed once and reported in line in the other, with the average positive surprise being 12.3%. This is depicted in the graph below:

Canadian Natural Resources Limited Price and EPS Surprise

Canadian Natural Resources Limited price-eps-surprise | Canadian Natural Resources Limited Quote

Trend in Estimate Revision

The Zacks Consensus Estimate for first-quarter earnings per share remained same over the last seven days. However, the estimated figure indicates a 92.5% drop from the year-ago reported earnings. Meanwhile, the Zacks Consensus Estimate for revenues suggests an 8.5% decline from the prior-year reported figure of $4 billion.

Factors to Consider This Quarter

Canadian Natural Resources has a broad portfolio of low-risk exploration and development projects with a strong international exposure that yields long-term volume growth at above-average rates. In the fourth quarter, the company’s total output of oil and natural gas liquids ("NGL") output (accounting for more than 79% of total volumes) increased 9.7% compared with last year’s corresponding period to 913,782 barrels per day (Bbl/d), a trend that is most likely to have continued in the first quarter because of contribution from the assets acquired from Devon Energy DVN. As a proof of this, the Zacks Consensus Estimate for first-quarter oil and NGL production is pegged at 964,745 Bbl/d, indicating an increase of 23.1% from the year-ago reported figure.

Why a Likely Positive Surprise?

Our proven model predicts an earnings beat for Canadian Natural this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Canadian Natural has an Earnings ESP of +36.36% and a Zacks Rank #3.

Other Stocks to Consider

Canadian Natural is not the only energy company looking up this earnings cycle. Here are some other firms from the space you may want to consider on the basis of our model, which shows that they have the right combination of elements to post an earnings beat this season:

Apache Corporation APA has an Earnings ESP of +1.33% and a Zacks Rank #3. The company is scheduled to release earnings on May 6.

You can see the complete list of today’s Zacks #1 Rank stocks here.

NOW Inc. DNOW has an Earnings ESP of +30.00% and is Zacks #3 Ranked. The company is scheduled to release earnings on May 6.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apache Corporation (APA) : Free Stock Analysis Report

Devon Energy Corporation (DVN) : Free Stock Analysis Report

Canadian Natural Resources Limited (CNQ) : Free Stock Analysis Report

NOW Inc. (DNOW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance