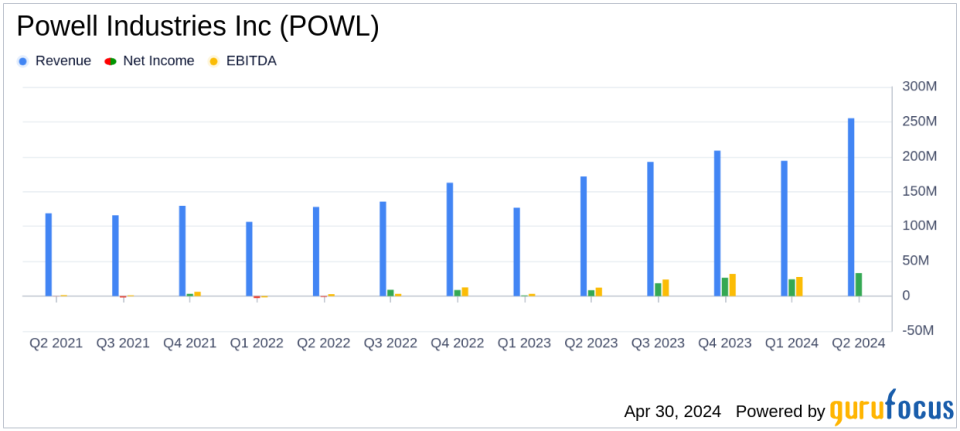

Powell Industries Inc (POWL) Surpasses Analyst Revenue Forecasts with Strong Q2 Performance

Revenue: Reported at $255.1 million, marking a 49% increase from the previous year and surpassing estimates of $201.45 million.

Net Income: Reached $33.5 million, significantly exceeding the estimated $20.29 million.

Earnings Per Share (EPS): Achieved $2.75 per diluted share, surpassing the estimated $1.78.

Gross Margin: Improved to 24.6% of revenue, a 510 basis point increase from the previous year.

Backlog: Remained stable at $1.3 billion, indicating strong future revenue potential.

New Orders: Totaled $235 million, demonstrating robust demand across various markets.

Cash and Short-Term Investments: Increased to $365 million, up from $279 million at the end of the previous fiscal year.

Powell Industries Inc (NASDAQ:POWL), a prominent player in the electrical energy management and distribution sector, released its 8-K filing on April 30, 2024, detailing a robust fiscal performance for the second quarter ended March 31, 2024. The company reported a significant revenue of $255 million, a 49% increase from the previous year, surpassing the analyst's estimate of $201.45 million. Net income also exceeded expectations, reaching $33 million against an estimated $20.29 million, translating to earnings per share of $2.75, well above the forecasted $1.78.

Powell Industries, headquartered in Houston, specializes in custom-engineered solutions for the distribution, control, and monitoring of electrical energy. Serving diverse industrial markets such as oil and gas, petrochemicals, and utilities, Powell continues to be a critical supplier amid evolving energy needs.

Financial and Operational Highlights

The company's impressive revenue growth was primarily driven by a 66% increase in the Oil and Gas sector and a 93% increase in the Petrochemical sector. The Commercial and Other Industrial sector also saw a significant revenue jump of 57%, while the Electric Utility sector grew by 11%. Gross profit soared by 88% to $62.7 million, representing 24.6% of revenue, a notable improvement from the previous year's margin of 19.5%.

New orders for the quarter stood at $235 million, indicating robust demand across Powell's market segments, despite a decrease from the previous year's $508 million, which included two large domestic projects. The company's backlog remains strong at $1.3 billion, reflecting ongoing and future project commitments.

Strategic Insights and Future Outlook

Brett A. Cope, Chairman and CEO of Powell Industries, highlighted the company's successful project execution and volume leverage as key drivers of the improved margins. He also noted the active project landscape across the markets Powell serves, including ongoing energy transition initiatives. Looking ahead, CFO Michael Metcalf expressed confidence in sustaining strong financial performance through fiscal 2024 and into 2025, supported by favorable market dynamics and strategic capacity expansions.

The company's financial stability is further underscored by its substantial cash reserves, with cash and short-term investments totaling $365 million as of March 31, 2024.

Comprehensive Financial Overview

For the six months ended March 31, 2024, Powell Industries achieved a net income of $57.57 million, a significant increase from $9.64 million in the same period last year. This financial strength is reflected in the basic earnings per share, which improved from $0.81 to $4.81.

The balance sheet remains robust with total assets of $849.6 million as of March 31, 2024, compared to $752.2 million as of September 30, 2023. The company's working capital also improved, indicating enhanced operational efficiency and financial health.

Investor and Analyst Communications

Powell Industries has scheduled a conference call for May 1, 2024, to discuss these results and provide more insights into its operations and outlook. This call is accessible both via telephone and online through the company's website, ensuring transparency and engagement with the investment community.

Overall, Powell Industries' second-quarter performance not only demonstrates its resilience and adaptability in a dynamic market environment but also positions it well for sustained growth and profitability. Investors and stakeholders can likely anticipate continued success as the company leverages its strategic initiatives and strong market presence.

Explore the complete 8-K earnings release (here) from Powell Industries Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance