Poverty hits us hard - and not just in the pocket

What determines how productive you are at work? Whether or not you are home schooling is obviously the main answer now. But it’s an important question for normal times and one recent research paper set out to answer by examining the impact of cash payments on the productivity of factory workers in India.

Workers receiving their cash payments earlier worked faster and produced more. This wasn’t because payments made them healthier or more positive. The key effect was to reduce how distracted workers were by financial worries; as a result, they not only produced more but did so with fewer mistakes.

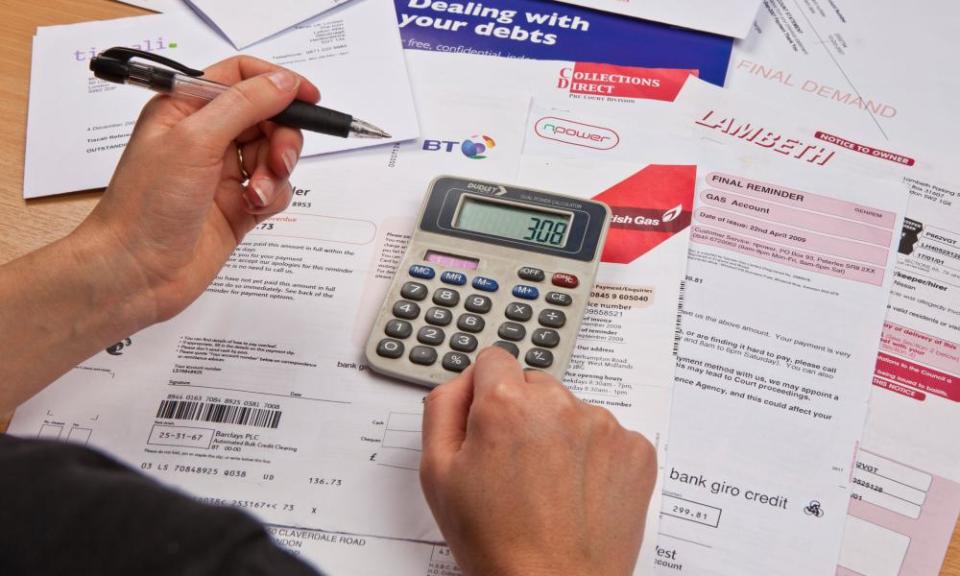

The situation for lower earners in India is very different to that in the UK. But when new data shows that benefit cuts have delivered income falls of 8% for poorer, working-age households it’s hard to believe this hasn’t come with a huge cost in increased anxiety. And those same families have been most likely to take on more debt during Covid, which new research from the Financial Conduct Authority shows carries a price tag beyond the interest: it damages our wellbeing. It suggests falling into debt could cost you £5,500 in “wellbeing terms” (that’s how big a lottery win you’d need to compensate for the happiness fall), particularly because of worries about debt feeling “unmanageable”. When we think about poverty, we need to recognise that it doesn’t just reflect a lack of earnings - it can make it harder to earn or do just about anything.

Torsten Bell is chief executive of the Resolution Foundation. Read more at resolutionfoundation.org

Yahoo Finance

Yahoo Finance