Pound reverses election bump as fears of crash-out Brexit grow

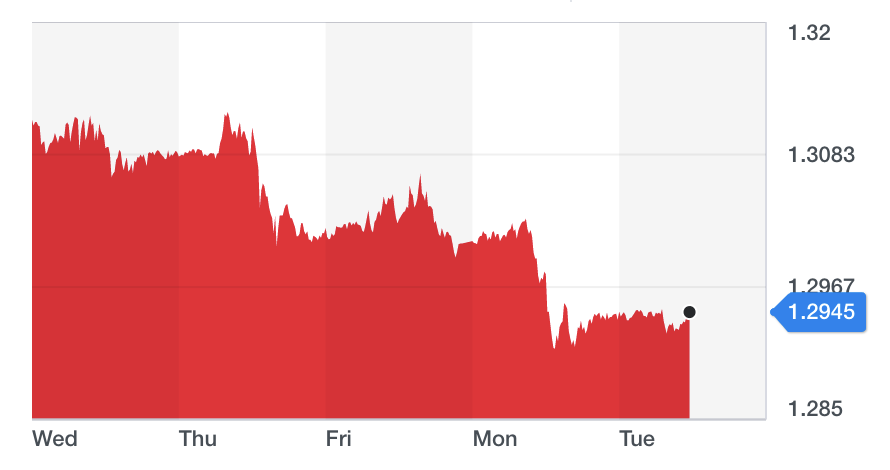

The pound on Tuesday looked set for its sixth straight day of losses, with the currency now having almost completely erased the boost it got from this month’s general election.

The currency fell 2.42% against the dollar (GBPUSD=X) last week — the deepest tumble of 2019 — as traders assessed prime minister Boris Johnson’s rhetoric about a post-Brexit trade deal.

Johnson has signalled that he will not seek an extension to the 11-month post-Brexit transition period, even if that means crashing out without a trade deal at the end of 2020.

The pound had climbed in the weeks prior to the vote, as it became clear that Johnson’s Conservative party would sweep to victory. It continued to surge in the wake of the result, primarily because markets assumed his emphatic election win would give certainty to the Brexit process.

The currency had climbed above the $1.30 mark and even reached $1.34 as the scale of the victory became clear, but has since fallen to just $1.29.

The currency swiftly fell amid reports that Johnson would even make it illegal to extend the transition period in spite of the potential fall-out from leaving the bloc on World Trade Organisation terms.

The currency hovered on Tuesday amid low trading volumes in the run-up to Christmas.

The currency is extraordinarily sensitive to Brexit developments, and nosedived in the wake of the 2016 referendum and has still not recovered.

While much of the focus has been on the 31 January Brexit deadline, once that passes the attention of markets will turn to trade negotiations with the EU.

Analysts suggest that 31 December 2020, considering Johnson’s negotiating position, may end up being more significant.

“This creates a new cliff-edge, which brings no-deal risks to the fore, which will undoubtedly lead to volatility for sterling in 2020, with the upside capped until we get further into the year,” said Neil Wilson, chief market analyst at Markets.com.

READ MORE: Surge in approved UK arms sales to Saudi Arabia and war allies in Yemen

But Wilson said he believed Johnson would indeed negotiate a trade deal in 2020, before the end of the transition period.

“There is no appetite to leave the transition arrangements without some kind of agreement. It may not be perfect, but it will suffice,” he said.

Yahoo Finance

Yahoo Finance