Pound could lose another 4% despite rout

The pound has been battered by political chaos in the UK over the draft Brexit deal — but many city analysts think sterling has further to fall.

Sterling fell over 1% against the dollar and euro on Thursday, suffering its steepest decline in almost a year and a half. The slump came after several UK cabinet ministers resigned over prime minister Theresa May’s draft deal with the EU on Brexit.

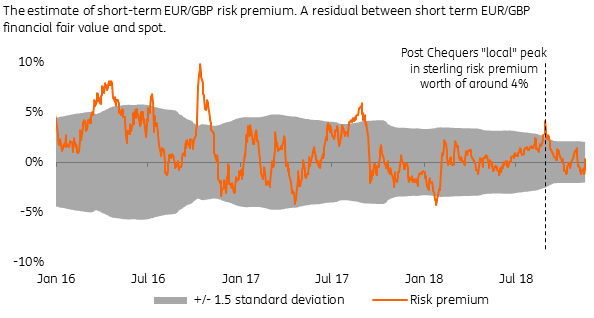

Despite the pound’s collapse, analysts at Dutch bank ING believe investors are overvaluing the pound. Chris Turner, ING’s global head of strategy, and his team said in a note on Thursday that the currency could stand to fall as much as 4% against the dollar and euro.

“For GBP, the question is how much risk premium should be priced in? Is enough priced in already? We would say not,” Turner said.

“Until there is some clarity on a leadership challenge, there is a risk that we end up with a more Brexit-leaning leader. Such an outcome would increase the chances of a No Deal, on the assumption that a new leader would be unlikely to secure any further concessions from Brussels.”

Under ING’s modelling, a fall of 3-4% against both the dollar and euro would better reflect the current risks facing the UK.

“In other words, were the market to price in a more credible leadership challenge, GBP could potentially fall another 3-4% – sending EUR/GBP back towards the 0.91 region and GBP/$ towards new lows for the year near 1.23/24,” Turner wrote. “That’s the risk.”

Other analysts also think the pound has further to fall, although others have been reluctant to predict the level of decline.

Dean Turner, an economist with UBS Wealth Management, and his team said in a note on Thursday: “Ratification of any withdrawal agreement in the UK parliament is likely to prove challenging, and the collateral damage could be immense. This could keep sterling volatile and exposed to downside risk in the near term.”

JPMorgan’s foreign exchange analyst Paul Meggyesi said on Thursday: “We have long argued that the path to a deal was fraught with political risks. Those risks are crystallising today and even assuming that May survives as leader … worse is still to come as parliament seems set to reject the treaty at the first time of asking.”

Morgan Stanley analysts Hans Redeker and David Adams said in a note late on Thursday that while the pound remains “compelling” in the long term, it could go lower in the short term.

“We are watching the 1.2665 August low in GBPUSD closely, and should that fail to hold, 1.2450 may soon follow,” the pair wrote.

Yahoo Finance

Yahoo Finance